Debt Analysts' Views of Debt-Equity Conflicts of Interest

Debt Analysts' Views of Debt-Equity Conflicts of Interest

Debt Analysts' Views of Debt-Equity Conflicts of Interest

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

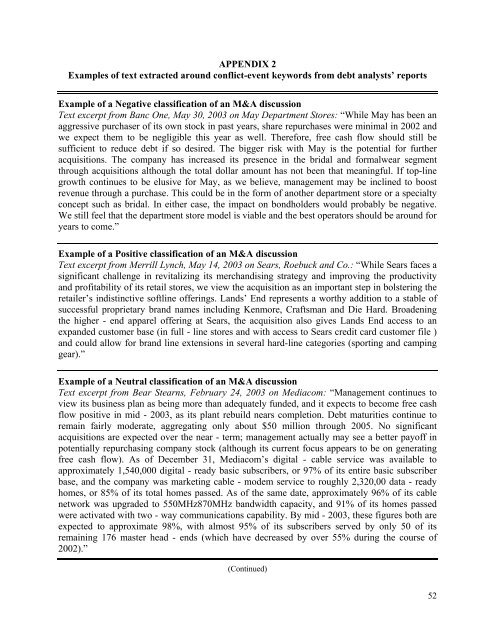

APPENDIX 2<br />

Examples <strong>of</strong> text extracted around conflict-event keywords from debt analysts’ reports<br />

Example <strong>of</strong> a Negative classification <strong>of</strong> an M&A discussion<br />

Text excerpt from Banc One, May 30, 2003 on May Department Stores: “While May has been an<br />

aggressive purchaser <strong>of</strong> its own stock in past years, share repurchases were minimal in 2002 and<br />

we expect them to be negligible this year as well. Therefore, free cash flow should still be<br />

sufficient to reduce debt if so desired. The bigger risk with May is the potential for further<br />

acquisitions. The company has increased its presence in the bridal and formalwear segment<br />

through acquisitions although the total dollar amount has not been that meaningful. If top-line<br />

growth continues to be elusive for May, as we believe, management may be inclined to boost<br />

revenue through a purchase. This could be in the form <strong>of</strong> another department store or a specialty<br />

concept such as bridal. In either case, the impact on bondholders would probably be negative.<br />

We still feel that the department store model is viable and the best operators should be around for<br />

years to come.”<br />

Example <strong>of</strong> a Positive classification <strong>of</strong> an M&A discussion<br />

Text excerpt from Merrill Lynch, May 14, 2003 on Sears, Roebuck and Co.: “While Sears faces a<br />

significant challenge in revitalizing its merchandising strategy and improving the productivity<br />

and pr<strong>of</strong>itability <strong>of</strong> its retail stores, we view the acquisition as an important step in bolstering the<br />

retailer’s indistinctive s<strong>of</strong>tline <strong>of</strong>ferings. Lands’ End represents a worthy addition to a stable <strong>of</strong><br />

successful proprietary brand names including Kenmore, Craftsman and Die Hard. Broadening<br />

the higher - end apparel <strong>of</strong>fering at Sears, the acquisition also gives Lands End access to an<br />

expanded customer base (in full - line stores and with access to Sears credit card customer file )<br />

and could allow for brand line extensions in several hard-line categories (sporting and camping<br />

gear).”<br />

Example <strong>of</strong> a Neutral classification <strong>of</strong> an M&A discussion<br />

Text excerpt from Bear Stearns, February 24, 2003 on Mediacom: “Management continues to<br />

view its business plan as being more than adequately funded, and it expects to become free cash<br />

flow positive in mid - 2003, as its plant rebuild nears completion. <strong>Debt</strong> maturities continue to<br />

remain fairly moderate, aggregating only about $50 million through 2005. No significant<br />

acquisitions are expected over the near - term; management actually may see a better pay<strong>of</strong>f in<br />

potentially repurchasing company stock (although its current focus appears to be on generating<br />

free cash flow). As <strong>of</strong> December 31, Mediacom’s digital - cable service was available to<br />

approximately 1,540,000 digital - ready basic subscribers, or 97% <strong>of</strong> its entire basic subscriber<br />

base, and the company was marketing cable - modem service to roughly 2,320,00 data - ready<br />

homes, or 85% <strong>of</strong> its total homes passed. As <strong>of</strong> the same date, approximately 96% <strong>of</strong> its cable<br />

network was upgraded to 550MHz870MHz bandwidth capacity, and 91% <strong>of</strong> its homes passed<br />

were activated with two - way communications capability. By mid - 2003, these figures both are<br />

expected to approximate 98%, with almost 95% <strong>of</strong> its subscribers served by only 50 <strong>of</strong> its<br />

remaining 176 master head - ends (which have decreased by over 55% during the course <strong>of</strong><br />

2002).”<br />

(Continued)<br />

52