Debt Analysts' Views of Debt-Equity Conflicts of Interest

Debt Analysts' Views of Debt-Equity Conflicts of Interest

Debt Analysts' Views of Debt-Equity Conflicts of Interest

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

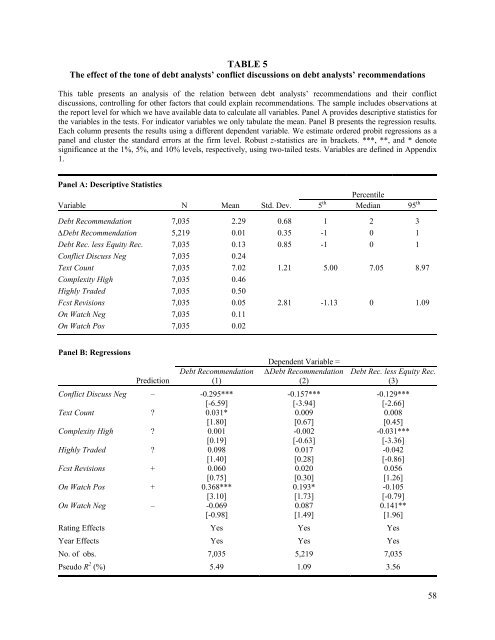

TABLE 5<br />

The effect <strong>of</strong> the tone <strong>of</strong> debt analysts’ conflict discussions on debt analysts’ recommendations<br />

This table presents an analysis <strong>of</strong> the relation between debt analysts’ recommendations and their conflict<br />

discussions, controlling for other factors that could explain recommendations. The sample includes observations at<br />

the report level for which we have available data to calculate all variables. Panel A provides descriptive statistics for<br />

the variables in the tests. For indicator variables we only tabulate the mean. Panel B presents the regression results.<br />

Each column presents the results using a different dependent variable. We estimate ordered probit regressions as a<br />

panel and cluster the standard errors at the firm level. Robust z-statistics are in brackets. ***, **, and * denote<br />

significance at the 1%, 5%, and 10% levels, respectively, using two-tailed tests. Variables are defined in Appendix<br />

1.<br />

Panel A: Descriptive Statistics<br />

Variable N Mean Std. Dev. 5<br />

Percentile<br />

th Median 95 th<br />

<strong>Debt</strong> Recommendation 7,035 2.29 0.68 1 2 3<br />

∆<strong>Debt</strong> Recommendation 5,219 0.01 0.35 -1 0 1<br />

<strong>Debt</strong> Rec. less <strong>Equity</strong> Rec. 7,035 0.13 0.85 -1 0 1<br />

Conflict Discuss Neg 7,035 0.24<br />

Text Count 7,035 7.02 1.21 5.00 7.05 8.97<br />

Complexity High 7,035 0.46<br />

Highly Traded 7,035 0.50<br />

Fcst Revisions 7,035 0.05 2.81 -1.13 0 1.09<br />

On Watch Neg 7,035 0.11<br />

On Watch Pos 7,035 0.02<br />

Panel B: Regressions<br />

Dependent Variable =<br />

<strong>Debt</strong> Recommendation ∆<strong>Debt</strong> Recommendation <strong>Debt</strong> Rec. less <strong>Equity</strong> Rec.<br />

Prediction (1) (2) (3)<br />

Conflict Discuss Neg – -0.295*** -0.157*** -0.129***<br />

[-6.59] [-3.94] [-2.66]<br />

Text Count ? 0.031* 0.009 0.008<br />

[1.80] [0.67] [0.45]<br />

Complexity High ? 0.001 -0.002 -0.031***<br />

[0.19] [-0.63] [-3.36]<br />

Highly Traded ? 0.098 0.017 -0.042<br />

[1.40] [0.28] [-0.86]<br />

Fcst Revisions + 0.060 0.020 0.056<br />

[0.75] [0.30] [1.26]<br />

On Watch Pos + 0.368*** 0.193* -0.105<br />

[3.10] [1.73] [-0.79]<br />

On Watch Neg – -0.069 0.087 0.141**<br />

[-0.98] [1.49] [1.96]<br />

Rating Effects Yes Yes Yes<br />

Year Effects Yes Yes Yes<br />

No. <strong>of</strong> obs. 7,035 5,219 7,035<br />

Pseudo R 2 (%) 5.49 1.09 3.56<br />

58