Debt Analysts' Views of Debt-Equity Conflicts of Interest

Debt Analysts' Views of Debt-Equity Conflicts of Interest

Debt Analysts' Views of Debt-Equity Conflicts of Interest

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

APPENDIX 2 (Continued)<br />

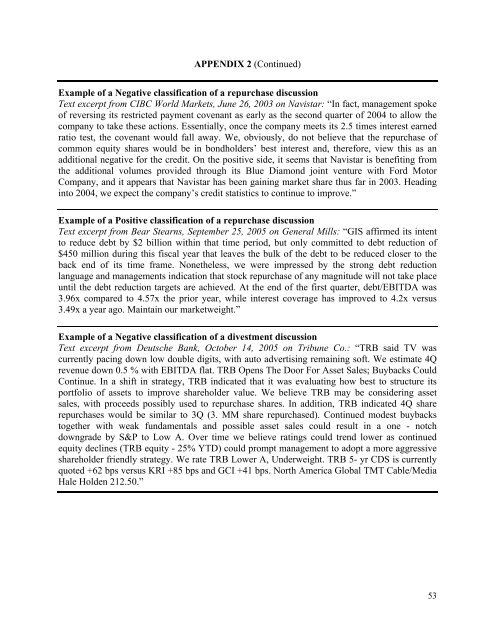

Example <strong>of</strong> a Negative classification <strong>of</strong> a repurchase discussion<br />

Text excerpt from CIBC World Markets, June 26, 2003 on Navistar: “In fact, management spoke<br />

<strong>of</strong> reversing its restricted payment covenant as early as the second quarter <strong>of</strong> 2004 to allow the<br />

company to take these actions. Essentially, once the company meets its 2.5 times interest earned<br />

ratio test, the covenant would fall away. We, obviously, do not believe that the repurchase <strong>of</strong><br />

common equity shares would be in bondholders’ best interest and, therefore, view this as an<br />

additional negative for the credit. On the positive side, it seems that Navistar is benefiting from<br />

the additional volumes provided through its Blue Diamond joint venture with Ford Motor<br />

Company, and it appears that Navistar has been gaining market share thus far in 2003. Heading<br />

into 2004, we expect the company’s credit statistics to continue to improve.”<br />

Example <strong>of</strong> a Positive classification <strong>of</strong> a repurchase discussion<br />

Text excerpt from Bear Stearns, September 25, 2005 on General Mills: “GIS affirmed its intent<br />

to reduce debt by $2 billion within that time period, but only committed to debt reduction <strong>of</strong><br />

$450 million during this fiscal year that leaves the bulk <strong>of</strong> the debt to be reduced closer to the<br />

back end <strong>of</strong> its time frame. Nonetheless, we were impressed by the strong debt reduction<br />

language and managements indication that stock repurchase <strong>of</strong> any magnitude will not take place<br />

until the debt reduction targets are achieved. At the end <strong>of</strong> the first quarter, debt/EBITDA was<br />

3.96x compared to 4.57x the prior year, while interest coverage has improved to 4.2x versus<br />

3.49x a year ago. Maintain our marketweight.”<br />

Example <strong>of</strong> a Negative classification <strong>of</strong> a divestment discussion<br />

Text excerpt from Deutsche Bank, October 14, 2005 on Tribune Co.: “TRB said TV was<br />

currently pacing down low double digits, with auto advertising remaining s<strong>of</strong>t. We estimate 4Q<br />

revenue down 0.5 % with EBITDA flat. TRB Opens The Door For Asset Sales; Buybacks Could<br />

Continue. In a shift in strategy, TRB indicated that it was evaluating how best to structure its<br />

portfolio <strong>of</strong> assets to improve shareholder value. We believe TRB may be considering asset<br />

sales, with proceeds possibly used to repurchase shares. In addition, TRB indicated 4Q share<br />

repurchases would be similar to 3Q (3. MM share repurchased). Continued modest buybacks<br />

together with weak fundamentals and possible asset sales could result in a one - notch<br />

downgrade by S&P to Low A. Over time we believe ratings could trend lower as continued<br />

equity declines (TRB equity - 25% YTD) could prompt management to adopt a more aggressive<br />

shareholder friendly strategy. We rate TRB Lower A, Underweight. TRB 5- yr CDS is currently<br />

quoted +62 bps versus KRI +85 bps and GCI +41 bps. North America Global TMT Cable/Media<br />

Hale Holden 212.50.”<br />

53