19.1 Payoff Tables and Decision Trees

19.1 Payoff Tables and Decision Trees

19.1 Payoff Tables and Decision Trees

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

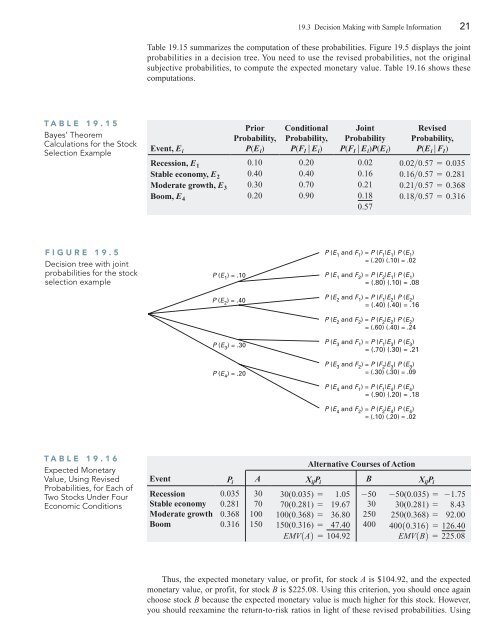

TABLE <strong>19.1</strong>5<br />

Bayes’ Theorem<br />

Calculations for the Stock<br />

Selection Example<br />

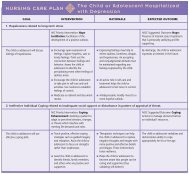

FIGURE 19.5<br />

<strong>Decision</strong> tree with joint<br />

probabilities for the stock<br />

selection example<br />

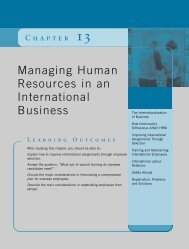

TABLE <strong>19.1</strong>6<br />

Expected Monetary<br />

Value, Using Revised<br />

Probabilities, for Each of<br />

Two Stocks Under Four<br />

Economic Conditions<br />

P (E 1 ) = .10<br />

P (E 2 ) = .40<br />

P (E 3 ) = .30<br />

P (E 4 ) = .20<br />

19.3 <strong>Decision</strong> Making with Sample Information 21<br />

Table <strong>19.1</strong>5 summarizes the computation of these probabilities. Figure 19.5 displays the joint<br />

probabilities in a decision tree. You need to use the revised probabilities, not the original<br />

subjective probabilities, to compute the expected monetary value. Table <strong>19.1</strong>6 shows these<br />

computations.<br />

Event, E i<br />

Prior<br />

Probability,<br />

P(E i)<br />

Conditional<br />

Probability,<br />

P(F 1|E i)<br />

Joint<br />

Probability<br />

P(F 1|E i)P(E i)<br />

P (E 1 <strong>and</strong> F 1 ) = P (F 1 |E 1 ) P (E 1 )<br />

= (.20) (.10) = .02<br />

P (E 1 <strong>and</strong> F 2 ) = P (F 2 |E 1 ) P (E 1 )<br />

= (.80) (.10) = .08<br />

P (E 2 <strong>and</strong> F 1 ) = P (F 1 |E 2 ) P (E 2 )<br />

= (.40) (.40) = .16<br />

P (E 2 <strong>and</strong> F 2 ) = P (F 2 |E 2 ) P (E 2 )<br />

= (.60) (.40) = .24<br />

P (E 3 <strong>and</strong> F 1 ) = P (F 1 |E 3 ) P (E 3 )<br />

= (.70) (.30) = .21<br />

P (E 3 <strong>and</strong> F 2 ) = P (F 2 |E 3 ) P (E 3 )<br />

= (.30) (.30) = .09<br />

P (E 4 <strong>and</strong> F 1 ) = P (F 1 |E 4 ) P (E 4 )<br />

= (.90) (.20) = .18<br />

P (E 4 <strong>and</strong> F 2 ) = P (F 2 |E 4 ) P (E 4 )<br />

= (.10) (.20) = .02<br />

Revised<br />

Probability,<br />

P(E i|F 1)<br />

Recession, E 1 0.10 0.20 0.02 0.02>0.57 = 0.035<br />

Stable economy, E 2 0.40 0.40 0.16 0.16>0.57 = 0.281<br />

Moderate growth, E 3 0.30 0.70 0.21 0.21>0.57 = 0.368<br />

Boom, E 4 0.20 0.90 0.18 0.18>0.57 = 0.316<br />

0.57<br />

Alternative Courses of Action<br />

Event Pi A XijPi B XijPi Recession 0.035 30 30(0.035) = 1.05 -50 -50(0.035) = -1.75<br />

Stable economy 0.281 70 70(0.281) = 19.67 30 30(0.281) = 8.43<br />

Moderate growth 0.368 100 100(0.368) = 36.80 250 250(0.368) = 92.00<br />

Boom 0.316 150 150(0.316) = 47.40 400 40010.3162 = 126.40<br />

EMV1A2 = 104.92 EMV1B2 = 225.08<br />

Thus, the expected monetary value, or profit, for stock A is $104.92, <strong>and</strong> the expected<br />

monetary value, or profit, for stock B is $225.08. Using this criterion, you should once again<br />

choose stock B because the expected monetary value is much higher for this stock. However,<br />

you should reexamine the return-to-risk ratios in light of these revised probabilities. Using