19.1 Payoff Tables and Decision Trees

19.1 Payoff Tables and Decision Trees

19.1 Payoff Tables and Decision Trees

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

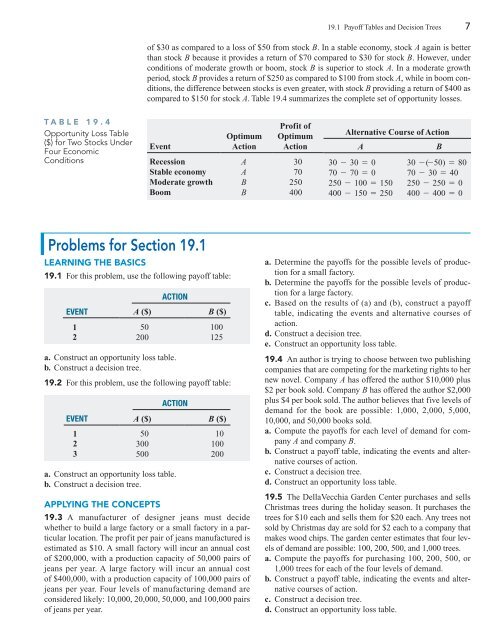

TABLE 19.4<br />

Opportunity Loss Table<br />

($) for Two Stocks Under<br />

Four Economic<br />

Conditions<br />

Problems for Section <strong>19.1</strong><br />

LEARNING THE BASICS<br />

<strong>19.1</strong> For this problem, use the following payoff table:<br />

a. Construct an opportunity loss table.<br />

b. Construct a decision tree.<br />

19.2 For this problem, use the following payoff table:<br />

a. Construct an opportunity loss table.<br />

b. Construct a decision tree.<br />

APPLYING THE CONCEPTS<br />

ACTION<br />

EVENT A ($) B ($)<br />

1 50 100<br />

2 200 125<br />

ACTION<br />

EVENT A ($) B ($)<br />

1 50 10<br />

2 300 100<br />

3 500 200<br />

19.3 A manufacturer of designer jeans must decide<br />

whether to build a large factory or a small factory in a particular<br />

location. The profit per pair of jeans manufactured is<br />

estimated as $10. A small factory will incur an annual cost<br />

of $200,000, with a production capacity of 50,000 pairs of<br />

jeans per year. A large factory will incur an annual cost<br />

of $400,000, with a production capacity of 100,000 pairs of<br />

jeans per year. Four levels of manufacturing dem<strong>and</strong> are<br />

considered likely: 10,000, 20,000, 50,000, <strong>and</strong> 100,000 pairs<br />

of jeans per year.<br />

<strong>19.1</strong> <strong>Payoff</strong> <strong>Tables</strong> <strong>and</strong> <strong>Decision</strong> <strong>Trees</strong> 7<br />

of $30 as compared to a loss of $50 from stock B. In a stable economy, stock A again is better<br />

than stock B because it provides a return of $70 compared to $30 for stock B. However, under<br />

conditions of moderate growth or boom, stock B is superior to stock A. In a moderate growth<br />

period, stock B provides a return of $250 as compared to $100 from stock A, while in boom conditions,<br />

the difference between stocks is even greater, with stock B providing a return of $400 as<br />

compared to $150 for stock A. Table 19.4 summarizes the complete set of opportunity losses.<br />

Event<br />

Optimum<br />

Action<br />

Profit of<br />

Optimum<br />

Action<br />

Alternative Course of Action<br />

A B<br />

Recession A 30 30 - 30 = 0 30 - (-50) = 80<br />

Stable economy A 70 70 - 70 = 0 70 - 30 = 40<br />

Moderate growth B 250 250 - 100 = 150 250 - 250 = 0<br />

Boom B 400 400 - 150 = 250 400 - 400 = 0<br />

a. Determine the payoffs for the possible levels of production<br />

for a small factory.<br />

b. Determine the payoffs for the possible levels of production<br />

for a large factory.<br />

c. Based on the results of (a) <strong>and</strong> (b), construct a payoff<br />

table, indicating the events <strong>and</strong> alternative courses of<br />

action.<br />

d. Construct a decision tree.<br />

e. Construct an opportunity loss table.<br />

19.4 An author is trying to choose between two publishing<br />

companies that are competing for the marketing rights to her<br />

new novel. Company A has offered the author $10,000 plus<br />

$2 per book sold. Company B has offered the author $2,000<br />

plus $4 per book sold. The author believes that five levels of<br />

dem<strong>and</strong> for the book are possible: 1,000, 2,000, 5,000,<br />

10,000, <strong>and</strong> 50,000 books sold.<br />

a. Compute the payoffs for each level of dem<strong>and</strong> for company<br />

A <strong>and</strong> company B.<br />

b. Construct a payoff table, indicating the events <strong>and</strong> alternative<br />

courses of action.<br />

c. Construct a decision tree.<br />

d. Construct an opportunity loss table.<br />

19.5 The DellaVecchia Garden Center purchases <strong>and</strong> sells<br />

Christmas trees during the holiday season. It purchases the<br />

trees for $10 each <strong>and</strong> sells them for $20 each. Any trees not<br />

sold by Christmas day are sold for $2 each to a company that<br />

makes wood chips. The garden center estimates that four levels<br />

of dem<strong>and</strong> are possible: 100, 200, 500, <strong>and</strong> 1,000 trees.<br />

a. Compute the payoffs for purchasing 100, 200, 500, or<br />

1,000 trees for each of the four levels of dem<strong>and</strong>.<br />

b. Construct a payoff table, indicating the events <strong>and</strong> alternative<br />

courses of action.<br />

c. Construct a decision tree.<br />

d. Construct an opportunity loss table.