European Court of Justice VAT cases 2006-3 - empcom.gov.in

European Court of Justice VAT cases 2006-3 - empcom.gov.in

European Court of Justice VAT cases 2006-3 - empcom.gov.in

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

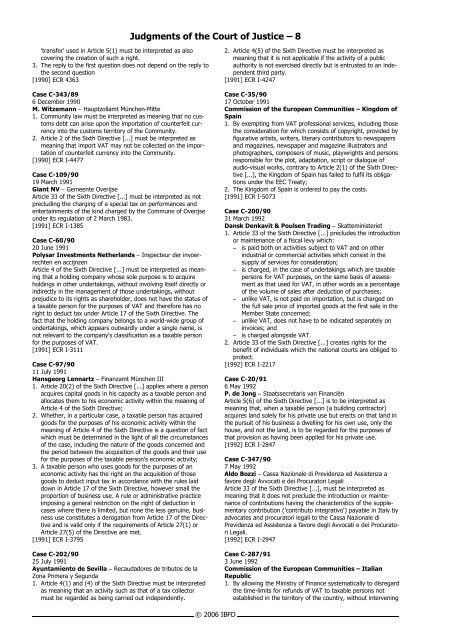

'transfer' used <strong>in</strong> Article 5(1) must be <strong>in</strong>terpreted as also<br />

cover<strong>in</strong>g the creation <strong>of</strong> such a right.<br />

3. The reply to the first question does not depend on the reply to<br />

the second question<br />

[1990] ECR 4363<br />

Case C-343/89<br />

6 December 1990<br />

M. Witzemann S Hauptzollamt München-Mitte<br />

1. Community law must be <strong>in</strong>terpreted as mean<strong>in</strong>g that no customs<br />

debt can arise upon the importation <strong>of</strong> counterfeit currency<br />

<strong>in</strong>to the customs territory <strong>of</strong> the Community.<br />

2. Article 2 <strong>of</strong> the Sixth Directive [...] must be <strong>in</strong>terpreted as<br />

mean<strong>in</strong>g that import <strong>VAT</strong> may not be collected on the importation<br />

<strong>of</strong> counterfeit currency <strong>in</strong>to the Community.<br />

[1990] ECR I-4477<br />

Case C-109/90<br />

19 March 1991<br />

Giant NV S Gemeente Overijse<br />

Article 33 <strong>of</strong> the Sixth Directive [...] must be <strong>in</strong>terpreted as not<br />

preclud<strong>in</strong>g the charg<strong>in</strong>g <strong>of</strong> a special tax on performances and<br />

enterta<strong>in</strong>ments <strong>of</strong> the k<strong>in</strong>d charged by the Commune <strong>of</strong> Overijse<br />

under its regulation <strong>of</strong> 2 March 1983.<br />

[1991] ECR I-1385<br />

Case C-60/90<br />

20 June 1991<br />

Polysar Investments Netherlands S Inspecteur der <strong>in</strong>voerrechten<br />

en accijnzen<br />

Article 4 <strong>of</strong> the Sixth Directive [...] must be <strong>in</strong>terpreted as mean<strong>in</strong>g<br />

that a hold<strong>in</strong>g company whose sole purpose is to acquire<br />

hold<strong>in</strong>gs <strong>in</strong> other undertak<strong>in</strong>gs, without <strong>in</strong>volv<strong>in</strong>g itself directly or<br />

<strong>in</strong>directly <strong>in</strong> the management <strong>of</strong> those undertak<strong>in</strong>gs, without<br />

prejudice to its rights as shareholder, does not have the status <strong>of</strong><br />

a taxable person for the purposes <strong>of</strong> <strong>VAT</strong> and therefore has no<br />

right to deduct tax under Article 17 <strong>of</strong> the Sixth Directive. The<br />

fact that the hold<strong>in</strong>g company belongs to a world-wide group <strong>of</strong><br />

undertak<strong>in</strong>gs, which appears outwardly under a s<strong>in</strong>gle name, is<br />

not relevant to the company's classification as a taxable person<br />

for the purposes <strong>of</strong> <strong>VAT</strong>.<br />

[1991] ECR I-3111<br />

Case C-97/90<br />

11 July 1991<br />

Hansgeorg Lennartz S F<strong>in</strong>anzamt München III<br />

1. Article 20(2) <strong>of</strong> the Sixth Directive [...] applies where a person<br />

acquires capital goods <strong>in</strong> his capacity as a taxable person and<br />

allocates them to his economic activity with<strong>in</strong> the mean<strong>in</strong>g <strong>of</strong><br />

Article 4 <strong>of</strong> the Sixth Directive;<br />

2. Whether, <strong>in</strong> a particular case, a taxable person has acquired<br />

goods for the purposes <strong>of</strong> his economic activity with<strong>in</strong> the<br />

mean<strong>in</strong>g <strong>of</strong> Article 4 <strong>of</strong> the Sixth Directive is a question <strong>of</strong> fact<br />

which must be determ<strong>in</strong>ed <strong>in</strong> the light <strong>of</strong> all the circumstances<br />

<strong>of</strong> the case, <strong>in</strong>clud<strong>in</strong>g the nature <strong>of</strong> the goods concerned and<br />

the period between the acquisition <strong>of</strong> the goods and their use<br />

for the purposes <strong>of</strong> the taxable person's economic activity;<br />

3. A taxable person who uses goods for the purposes <strong>of</strong> an<br />

economic activity has the right on the acquisition <strong>of</strong> those<br />

goods to deduct <strong>in</strong>put tax <strong>in</strong> accordance with the rules laid<br />

down <strong>in</strong> Article 17 <strong>of</strong> the Sixth Directive, however small the<br />

proportion <strong>of</strong> bus<strong>in</strong>ess use. A rule or adm<strong>in</strong>istrative practice<br />

impos<strong>in</strong>g a general restriction on the right <strong>of</strong> deduction <strong>in</strong><br />

<strong>cases</strong> where there is limited, but none the less genu<strong>in</strong>e, bus<strong>in</strong>ess<br />

use constitutes a derogation from Article 17 <strong>of</strong> the Directive<br />

and is valid only if the requirements <strong>of</strong> Article 27(1) or<br />

Article 27(5) <strong>of</strong> the Directive are met.<br />

[1991] ECR I-3795<br />

Case C-202/90<br />

25 July 1991<br />

Ayuntamiento de Sevilla S Recaudadores de tributos de la<br />

Zona Primera y Segunda<br />

1. Article 4(1) and (4) <strong>of</strong> the Sixth Directive must be <strong>in</strong>terpreted<br />

as mean<strong>in</strong>g that an activity such as that <strong>of</strong> a tax collector<br />

must be regarded as be<strong>in</strong>g carried out <strong>in</strong>dependently.<br />

Judgments <strong>of</strong> the <strong>Court</strong> <strong>of</strong> <strong>Justice</strong> – 8<br />

© <strong>2006</strong> IBFD<br />

2. Article 4(5) <strong>of</strong> the Sixth Directive must be <strong>in</strong>terpreted as<br />

mean<strong>in</strong>g that it is not applicable if the activity <strong>of</strong> a public<br />

authority is not exercised directly but is entrusted to an <strong>in</strong>dependent<br />

third party.<br />

[1991] ECR I-4247<br />

Case C-35/90<br />

17 October 1991<br />

Commission <strong>of</strong> the <strong>European</strong> Communities – K<strong>in</strong>gdom <strong>of</strong><br />

Spa<strong>in</strong><br />

1. By exempt<strong>in</strong>g from <strong>VAT</strong> pr<strong>of</strong>essional services, <strong>in</strong>clud<strong>in</strong>g those<br />

the consideration for which consists <strong>of</strong> copyright, provided by<br />

figurative artists, writers, literary contributors to newspapers<br />

and magaz<strong>in</strong>es, newspaper and magaz<strong>in</strong>e illustrators and<br />

photographers, composers <strong>of</strong> music, playwrights and persons<br />

responsible for the plot, adaptation, script or dialogue <strong>of</strong><br />

audio-visual works, contrary to Article 2(1) <strong>of</strong> the Sixth Directive<br />

[...], the K<strong>in</strong>gdom <strong>of</strong> Spa<strong>in</strong> has failed to fulfil its obligations<br />

under the EEC Treaty;<br />

2. The K<strong>in</strong>gdom <strong>of</strong> Spa<strong>in</strong> is ordered to pay the costs.<br />

[1991] ECR I-5073<br />

Case C-200/90<br />

31 March 1992<br />

Dansk Denkavit & Poulsen Trad<strong>in</strong>g S Skattem<strong>in</strong>isteriet<br />

1. Article 33 <strong>of</strong> the Sixth Directive [...] precludes the <strong>in</strong>troduction<br />

or ma<strong>in</strong>tenance <strong>of</strong> a fiscal levy which:<br />

S is paid both on activities subject to <strong>VAT</strong> and on other<br />

<strong>in</strong>dustrial or commercial activities which consist <strong>in</strong> the<br />

supply <strong>of</strong> services for consideration;<br />

S is charged, <strong>in</strong> the case <strong>of</strong> undertak<strong>in</strong>gs which are taxable<br />

persons for <strong>VAT</strong> purposes, on the same basis <strong>of</strong> assessment<br />

as that used for <strong>VAT</strong>, <strong>in</strong> other words as a percentage<br />

<strong>of</strong> the volume <strong>of</strong> sales after deduction <strong>of</strong> purchases;<br />

S unlike <strong>VAT</strong>, is not paid on importation, but is charged on<br />

the full sale price <strong>of</strong> imported goods at the first sale <strong>in</strong> the<br />

Member State concerned;<br />

S unlike <strong>VAT</strong>, does not have to be <strong>in</strong>dicated separately on<br />

<strong>in</strong>voices; and<br />

S is charged alongside <strong>VAT</strong>.<br />

2. Article 33 <strong>of</strong> the Sixth Directive [...] creates rights for the<br />

benefit <strong>of</strong> <strong>in</strong>dividuals which the national courts are obliged to<br />

protect.<br />

[1992] ECR I-2217<br />

Case C-20/91<br />

6 May 1992<br />

P. de Jong S Staatssecretaris van F<strong>in</strong>anciën<br />

Article 5(6) <strong>of</strong> the Sixth Directive [...] is to be <strong>in</strong>terpreted as<br />

mean<strong>in</strong>g that, when a taxable person (a build<strong>in</strong>g contractor)<br />

acquires land solely for his private use but erects on that land <strong>in</strong><br />

the pursuit <strong>of</strong> his bus<strong>in</strong>ess a dwell<strong>in</strong>g for his own use, only the<br />

house, and not the land, is to be regarded for the purposes <strong>of</strong><br />

that provision as hav<strong>in</strong>g been applied for his private use.<br />

[1992] ECR I-2847<br />

Case C-347/90<br />

7 May 1992<br />

Aldo Bozzi S Cassa Nazionale di Previdenza ed Assistenza a<br />

favore degli Avvocati e dei Procuratori Legali<br />

Article 33 <strong>of</strong> the Sixth Directive [...], must be <strong>in</strong>terpreted as<br />

mean<strong>in</strong>g that it does not preclude the <strong>in</strong>troduction or ma<strong>in</strong>tenance<br />

<strong>of</strong> contributions hav<strong>in</strong>g the characteristics <strong>of</strong> the supplementary<br />

contribution ('contributo <strong>in</strong>tegrativo') payable <strong>in</strong> Italy by<br />

advocates and procuratori legali to the Cassa Nazionale di<br />

Previdenza ed Assistenza a favore degli Avvocati e dei Procuratori<br />

Legali.<br />

[1992] ECR I-2947<br />

Case C-287/91<br />

3 June 1992<br />

Commission <strong>of</strong> the <strong>European</strong> Communities – Italian<br />

Republic<br />

1. By allow<strong>in</strong>g the M<strong>in</strong>istry <strong>of</strong> F<strong>in</strong>ance systematically to disregard<br />

the time-limits for refunds <strong>of</strong> <strong>VAT</strong> to taxable persons not<br />

established <strong>in</strong> the territory <strong>of</strong> the country, without <strong>in</strong>terven<strong>in</strong>g