European Court of Justice VAT cases 2006-3 - empcom.gov.in

European Court of Justice VAT cases 2006-3 - empcom.gov.in

European Court of Justice VAT cases 2006-3 - empcom.gov.in

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

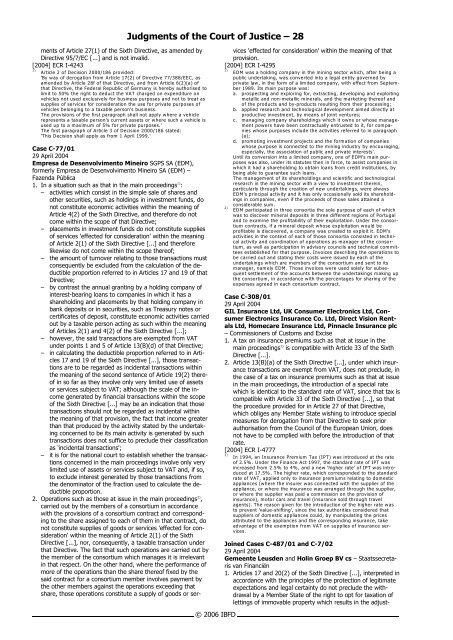

ments <strong>of</strong> Article 27(1) <strong>of</strong> the Sixth Directive, as amended by<br />

Directive 95/7/EC [...] and is not <strong>in</strong>valid.<br />

[2004] ECR I-4243<br />

1)<br />

Article 2 <strong>of</strong> Decision 2000/186 provided:<br />

'By way <strong>of</strong> derogation from Article 17(2) <strong>of</strong> Directive 77/388/EEC, as<br />

amended by Article 28f <strong>of</strong> that Directive, and from Article 6(2)(a) <strong>of</strong><br />

that Directive, the Federal Republic <strong>of</strong> Germany is hereby authorised to<br />

limit to 50% the right to deduct the <strong>VAT</strong> charged on expenditure on<br />

vehicles not used exclusively for bus<strong>in</strong>ess purposes and not to treat as<br />

supplies <strong>of</strong> services for consideration the use for private purposes <strong>of</strong><br />

vehicles belong<strong>in</strong>g to a taxable person's bus<strong>in</strong>ess.<br />

The provisions <strong>of</strong> the first paragraph shall not apply where a vehicle<br />

represents a taxable person's current assets or where such a vehicle is<br />

used up to a maximum <strong>of</strong> 5% for private purposes.'<br />

The first paragraph <strong>of</strong> Article 3 <strong>of</strong> Decision 2000/186 stated:<br />

'This Decision shall apply as from 1 April 1999.'<br />

Case C-77/01<br />

29 April 2004<br />

Empresa de Desenvolvimento M<strong>in</strong>eiro SGPS SA (EDM),<br />

formerly Empresa de Desenvolvimento M<strong>in</strong>eiro SA (EDM) –<br />

Fazenda Pública<br />

1)<br />

1. In a situation such as that <strong>in</strong> the ma<strong>in</strong> proceed<strong>in</strong>gs :<br />

– activities which consist <strong>in</strong> the simple sale <strong>of</strong> shares and<br />

other securities, such as hold<strong>in</strong>gs <strong>in</strong> <strong>in</strong>vestment funds, do<br />

not constitute economic activities with<strong>in</strong> the mean<strong>in</strong>g <strong>of</strong><br />

Article 4(2) <strong>of</strong> the Sixth Directive, and therefore do not<br />

come with<strong>in</strong> the scope <strong>of</strong> that Directive;<br />

– placements <strong>in</strong> <strong>in</strong>vestment funds do not constitute supplies<br />

<strong>of</strong> services 'effected for consideration' with<strong>in</strong> the mean<strong>in</strong>g<br />

<strong>of</strong> Article 2(1) <strong>of</strong> the Sixth Directive [...] and therefore<br />

likewise do not come with<strong>in</strong> the scope there<strong>of</strong>;<br />

– the amount <strong>of</strong> turnover relat<strong>in</strong>g to those transactions must<br />

consequently be excluded from the calculation <strong>of</strong> the deductible<br />

proportion referred to <strong>in</strong> Articles 17 and 19 <strong>of</strong> that<br />

Directive;<br />

– by contrast the annual grant<strong>in</strong>g by a hold<strong>in</strong>g company <strong>of</strong><br />

<strong>in</strong>terest-bear<strong>in</strong>g loans to companies <strong>in</strong> which it has a<br />

sharehold<strong>in</strong>g and placements by that hold<strong>in</strong>g company <strong>in</strong><br />

bank deposits or <strong>in</strong> securities, such as Treasury notes or<br />

certificates <strong>of</strong> deposit, constitute economic activities carried<br />

out by a taxable person act<strong>in</strong>g as such with<strong>in</strong> the mean<strong>in</strong>g<br />

<strong>of</strong> Articles 2(1) and 4(2) <strong>of</strong> the Sixth Directive [...];<br />

– however, the said transactions are exempted from <strong>VAT</strong><br />

under po<strong>in</strong>ts 1 and 5 <strong>of</strong> Article 13(B)(d) <strong>of</strong> that Directive;<br />

– <strong>in</strong> calculat<strong>in</strong>g the deductible proportion referred to <strong>in</strong> Articles<br />

17 and 19 <strong>of</strong> the Sixth Directive [...], those transactions<br />

are to be regarded as <strong>in</strong>cidental transactions with<strong>in</strong><br />

the mean<strong>in</strong>g <strong>of</strong> the second sentence <strong>of</strong> Article 19(2) there<strong>of</strong><br />

<strong>in</strong> so far as they <strong>in</strong>volve only very limited use <strong>of</strong> assets<br />

or services subject to <strong>VAT</strong>; although the scale <strong>of</strong> the <strong>in</strong>come<br />

generated by f<strong>in</strong>ancial transactions with<strong>in</strong> the scope<br />

<strong>of</strong> the Sixth Directive [...] may be an <strong>in</strong>dication that those<br />

transactions should not be regarded as <strong>in</strong>cidental with<strong>in</strong><br />

the mean<strong>in</strong>g <strong>of</strong> that provision, the fact that <strong>in</strong>come greater<br />

than that produced by the activity stated by the undertak<strong>in</strong>g<br />

concerned to be its ma<strong>in</strong> activity is generated by such<br />

transactions does not suffice to preclude their classification<br />

as '<strong>in</strong>cidental transactions';<br />

– it is for the national court to establish whether the transactions<br />

concerned <strong>in</strong> the ma<strong>in</strong> proceed<strong>in</strong>gs <strong>in</strong>volve only very<br />

limited use <strong>of</strong> assets or services subject to <strong>VAT</strong> and, if so,<br />

to exclude <strong>in</strong>terest generated by those transactions from<br />

the denom<strong>in</strong>ator <strong>of</strong> the fraction used to calculate the deductible<br />

proportion.<br />

2)<br />

2. Operations such as those at issue <strong>in</strong> the ma<strong>in</strong> proceed<strong>in</strong>gs ,<br />

carried out by the members <strong>of</strong> a consortium <strong>in</strong> accordance<br />

with the provisions <strong>of</strong> a consortium contract and correspond<strong>in</strong>g<br />

to the share assigned to each <strong>of</strong> them <strong>in</strong> that contract, do<br />

not constitute supplies <strong>of</strong> goods or services 'effected for consideration'<br />

with<strong>in</strong> the mean<strong>in</strong>g <strong>of</strong> Article 2(1) <strong>of</strong> the Sixth<br />

Directive [...], nor, consequently, a taxable transaction under<br />

that Directive. The fact that such operations are carried out by<br />

the member <strong>of</strong> the consortium which manages it is irrelevant<br />

<strong>in</strong> that respect. On the other hand, where the performance <strong>of</strong><br />

more <strong>of</strong> the operations than the share there<strong>of</strong> fixed by the<br />

said contract for a consortium member <strong>in</strong>volves payment by<br />

the other members aga<strong>in</strong>st the operations exceed<strong>in</strong>g that<br />

share, those operations constitute a supply <strong>of</strong> goods or ser-<br />

Judgments <strong>of</strong> the <strong>Court</strong> <strong>of</strong> <strong>Justice</strong> – 28<br />

© <strong>2006</strong> IBFD<br />

vices 'effected for consideration' with<strong>in</strong> the mean<strong>in</strong>g <strong>of</strong> that<br />

provision.<br />

[2004] ECR I-4295<br />

1)<br />

EDM was a hold<strong>in</strong>g company <strong>in</strong> the m<strong>in</strong><strong>in</strong>g sector which, after be<strong>in</strong>g a<br />

public undertak<strong>in</strong>g, was converted <strong>in</strong>to a legal entity <strong>gov</strong>erned by<br />

private law, <strong>in</strong> the form <strong>of</strong> a limited company, with effect from September<br />

1989. Its ma<strong>in</strong> purpose was:<br />

a. prospect<strong>in</strong>g and explor<strong>in</strong>g for, extract<strong>in</strong>g, develop<strong>in</strong>g and exploit<strong>in</strong>g<br />

metallic and non-metallic m<strong>in</strong>erals, and the market<strong>in</strong>g there<strong>of</strong> and<br />

<strong>of</strong> the products and by-products result<strong>in</strong>g from their process<strong>in</strong>g;<br />

b. applied research and technological development aimed directly at<br />

productive <strong>in</strong>vestment, by means <strong>of</strong> jo<strong>in</strong>t ventures;<br />

c. manag<strong>in</strong>g company sharehold<strong>in</strong>gs which it owns or whose management<br />

powers have been contractually entrusted to it, for companies<br />

whose purposes <strong>in</strong>clude the activities referred to <strong>in</strong> paragraph<br />

(a);<br />

d. promot<strong>in</strong>g <strong>in</strong>vestment projects and the formation <strong>of</strong> companies<br />

whose purpose is connected to the m<strong>in</strong><strong>in</strong>g <strong>in</strong>dustry by encourag<strong>in</strong>g,<br />

especially, the association <strong>of</strong> public and private <strong>in</strong>terests'.<br />

Until its conversion <strong>in</strong>to a limited company, one <strong>of</strong> EDM's ma<strong>in</strong> purposes<br />

was also, under its statutes then <strong>in</strong> force, to assist companies <strong>in</strong><br />

which it had a sharehold<strong>in</strong>g to obta<strong>in</strong> loans from credit <strong>in</strong>stitutions, by<br />

be<strong>in</strong>g able to guarantee such loans.<br />

The management <strong>of</strong> its sharehold<strong>in</strong>gs and scientific and technological<br />

research <strong>in</strong> the m<strong>in</strong><strong>in</strong>g sector with a view to <strong>in</strong>vestment there<strong>in</strong>,<br />

particularly through the creation <strong>of</strong> new undertak<strong>in</strong>gs, were always<br />

EDM's pr<strong>in</strong>cipal activity and it has only occasionally sold its sharehold<strong>in</strong>gs<br />

<strong>in</strong> companies, even if the proceeds <strong>of</strong> those sales atta<strong>in</strong>ed a<br />

considerable sum.<br />

2)<br />

EDM participated <strong>in</strong> three consortia the sole purpose <strong>of</strong> each <strong>of</strong> which<br />

was to discover m<strong>in</strong>eral deposits <strong>in</strong> three different regions <strong>of</strong> Portugal<br />

and to exam<strong>in</strong>e the pr<strong>of</strong>itability <strong>of</strong> their exploitation. Under the consortium<br />

contracts, if a m<strong>in</strong>eral deposit whose exploitation would be<br />

pr<strong>of</strong>itable is discovered, a company was created to exploit it. EDM's<br />

activities <strong>in</strong> the context <strong>of</strong> each <strong>of</strong> those consortia consisted <strong>in</strong> technical<br />

activity and coord<strong>in</strong>ation <strong>of</strong> operations as manager <strong>of</strong> the consortium,<br />

as well as participation <strong>in</strong> advisory councils and technical committees<br />

established for that purpose. Invoices describ<strong>in</strong>g the operations to<br />

be carried out and stat<strong>in</strong>g their costs were issued by each <strong>of</strong> the<br />

undertak<strong>in</strong>gs which are members <strong>of</strong> the consortium and sent to its<br />

manager, namely EDM. Those <strong>in</strong>voices were used solely for subsequent<br />

settlement <strong>of</strong> the accounts between the undertak<strong>in</strong>gs mak<strong>in</strong>g up<br />

the consortium, <strong>in</strong> accordance with the percentages for shar<strong>in</strong>g <strong>of</strong> the<br />

expenses agreed <strong>in</strong> each consortium contract.<br />

Case C-308/01<br />

29 April 2004<br />

GIL Insurance Ltd, UK Consumer Electronics Ltd, Consumer<br />

Electronics Insurance Co. Ltd, Direct Vision Rentals<br />

Ltd, Homecare Insurance Ltd, P<strong>in</strong>nacle Insurance plc<br />

– Commissioners <strong>of</strong> Customs and Excise<br />

1. A tax on <strong>in</strong>surance premiums such as that at issue <strong>in</strong> the<br />

1)<br />

ma<strong>in</strong> proceed<strong>in</strong>gs is compatible with Article 33 <strong>of</strong> the Sixth<br />

Directive [...].<br />

2. Article 13(B)(a) <strong>of</strong> the Sixth Directive [...], under which <strong>in</strong>surance<br />

transactions are exempt from <strong>VAT</strong>, does not preclude, <strong>in</strong><br />

the case <strong>of</strong> a tax on <strong>in</strong>surance premiums such as that at issue<br />

<strong>in</strong> the ma<strong>in</strong> proceed<strong>in</strong>gs, the <strong>in</strong>troduction <strong>of</strong> a special rate<br />

which is identical to the standard rate <strong>of</strong> <strong>VAT</strong>, s<strong>in</strong>ce that tax is<br />

compatible with Article 33 <strong>of</strong> the Sixth Directive [...], so that<br />

the procedure provided for <strong>in</strong> Article 27 <strong>of</strong> that Directive,<br />

which obliges any Member State wish<strong>in</strong>g to <strong>in</strong>troduce special<br />

measures for derogation from that Directive to seek prior<br />

authorisation from the Council <strong>of</strong> the <strong>European</strong> Union, does<br />

not have to be complied with before the <strong>in</strong>troduction <strong>of</strong> that<br />

rate.<br />

[2004] ECR I-4777<br />

1)<br />

In 1994, an Insurance Premium Tax (IPT) was <strong>in</strong>troduced at the rate<br />

<strong>of</strong> 2.5%. Under the F<strong>in</strong>ance Act 1997, the standard rate <strong>of</strong> IPT was<br />

<strong>in</strong>creased from 2.5% to 4%, and a new 'higher rate' <strong>of</strong> IPT was <strong>in</strong>troduced<br />

at 17.5%. The higher rate, which corresponded to the standard<br />

rate <strong>of</strong> <strong>VAT</strong>, applied only to <strong>in</strong>surance premiums relat<strong>in</strong>g to domestic<br />

appliances (where the <strong>in</strong>surer was connected with the supplier <strong>of</strong> the<br />

appliance, or where the <strong>in</strong>surance was arranged through the supplier,<br />

or where the supplier was paid a commission on the provision <strong>of</strong><br />

<strong>in</strong>surance), motor cars and travel (<strong>in</strong>surance sold through travel<br />

agents). The reason given for the <strong>in</strong>troduction <strong>of</strong> the higher rate was<br />

to prevent 'value-shift<strong>in</strong>g', s<strong>in</strong>ce the tax authorities considered that<br />

suppliers <strong>of</strong> domestic appliances could, by manipulat<strong>in</strong>g the prices<br />

attributed to the appliances and the correspond<strong>in</strong>g <strong>in</strong>surance, take<br />

advantage <strong>of</strong> the exemption from <strong>VAT</strong> on supplies <strong>of</strong> <strong>in</strong>surance services.<br />

Jo<strong>in</strong>ed Cases C-487/01 and C-7/02<br />

29 April 2004<br />

Gemeente Leusden and Hol<strong>in</strong> Groep BV cs – Staatssecretaris<br />

van F<strong>in</strong>anciën<br />

1. Articles 17 and 20(2) <strong>of</strong> the Sixth Directive [...], <strong>in</strong>terpreted <strong>in</strong><br />

accordance with the pr<strong>in</strong>ciples <strong>of</strong> the protection <strong>of</strong> legitimate<br />

expectations and legal certa<strong>in</strong>ty do not preclude the withdrawal<br />

by a Member State <strong>of</strong> the right to opt for taxation <strong>of</strong><br />

lett<strong>in</strong>gs <strong>of</strong> immovable property which results <strong>in</strong> the adjust-