European Court of Justice VAT cases 2006-3 - empcom.gov.in

European Court of Justice VAT cases 2006-3 - empcom.gov.in

European Court of Justice VAT cases 2006-3 - empcom.gov.in

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

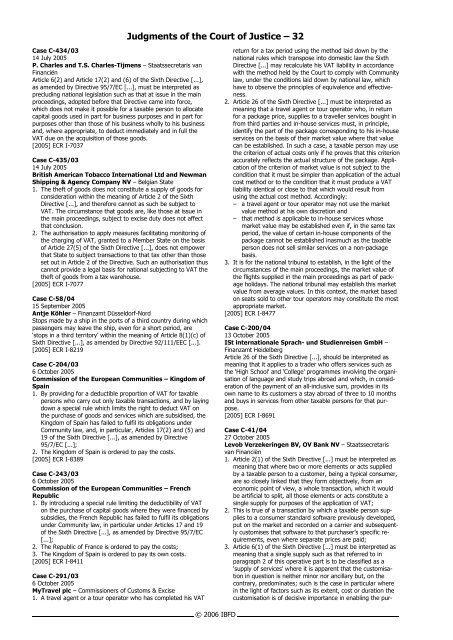

Case C-434/03<br />

14 July 2005<br />

P. Charles and T.S. Charles-Tijmens – Staatssecretaris van<br />

F<strong>in</strong>anciën<br />

Article 6(2) and Article 17(2) and (6) <strong>of</strong> the Sixth Directive [...],<br />

as amended by Directive 95/7/EC [...], must be <strong>in</strong>terpreted as<br />

preclud<strong>in</strong>g national legislation such as that at issue <strong>in</strong> the ma<strong>in</strong><br />

proceed<strong>in</strong>gs, adopted before that Directive came <strong>in</strong>to force,<br />

which does not make it possible for a taxable person to allocate<br />

capital goods used <strong>in</strong> part for bus<strong>in</strong>ess purposes and <strong>in</strong> part for<br />

purposes other than those <strong>of</strong> his bus<strong>in</strong>ess wholly to his bus<strong>in</strong>ess<br />

and, where appropriate, to deduct immediately and <strong>in</strong> full the<br />

<strong>VAT</strong> due on the acquisition <strong>of</strong> those goods.<br />

[2005] ECR I-7037<br />

Case C-435/03<br />

14 July 2005<br />

British American Tobacco International Ltd and Newman<br />

Shipp<strong>in</strong>g & Agency Company NV – Belgian State<br />

1. The theft <strong>of</strong> goods does not constitute a supply <strong>of</strong> goods for<br />

consideration with<strong>in</strong> the mean<strong>in</strong>g <strong>of</strong> Article 2 <strong>of</strong> the Sixth<br />

Directive [...], and therefore cannot as such be subject to<br />

<strong>VAT</strong>. The circumstance that goods are, like those at issue <strong>in</strong><br />

the ma<strong>in</strong> proceed<strong>in</strong>gs, subject to excise duty does not affect<br />

that conclusion.<br />

2. The authorisation to apply measures facilitat<strong>in</strong>g monitor<strong>in</strong>g <strong>of</strong><br />

the charg<strong>in</strong>g <strong>of</strong> <strong>VAT</strong>, granted to a Member State on the basis<br />

<strong>of</strong> Article 27(5) <strong>of</strong> the Sixth Directive [...], does not empower<br />

that State to subject transactions to that tax other than those<br />

set out <strong>in</strong> Article 2 <strong>of</strong> the Directive. Such an authorisation thus<br />

cannot provide a legal basis for national subject<strong>in</strong>g to <strong>VAT</strong> the<br />

theft <strong>of</strong> goods from a tax warehouse.<br />

[2005] ECR I-7077<br />

Case C-58/04<br />

15 September 2005<br />

Antje Köhler – F<strong>in</strong>anzamt Düsseldorf-Nord<br />

Stops made by a ship <strong>in</strong> the ports <strong>of</strong> a third country dur<strong>in</strong>g which<br />

passengers may leave the ship, even for a short period, are<br />

‘stops <strong>in</strong> a third territory’ with<strong>in</strong> the mean<strong>in</strong>g <strong>of</strong> Article 8(1)(c) <strong>of</strong><br />

Sixth Directive [...], as amended by Directive 92/111/EEC [...].<br />

[2005] ECR I-8219<br />

Case C-204/03<br />

6 October 2005<br />

Commission <strong>of</strong> the <strong>European</strong> Communities – K<strong>in</strong>gdom <strong>of</strong><br />

Spa<strong>in</strong><br />

1. By provid<strong>in</strong>g for a deductible proportion <strong>of</strong> <strong>VAT</strong> for taxable<br />

persons who carry out only taxable transactions, and by lay<strong>in</strong>g<br />

down a special rule which limits the right to deduct <strong>VAT</strong> on<br />

the purchase <strong>of</strong> goods and services which are subsidised, the<br />

K<strong>in</strong>gdom <strong>of</strong> Spa<strong>in</strong> has failed to fulfil its obligations under<br />

Community law, and, <strong>in</strong> particular, Articles 17(2) and (5) and<br />

19 <strong>of</strong> the Sixth Directive [...], as amended by Directive<br />

95/7/EC [...];<br />

2. The K<strong>in</strong>gdom <strong>of</strong> Spa<strong>in</strong> is ordered to pay the costs.<br />

[2005] ECR I-8389<br />

Case C-243/03<br />

6 October 2005<br />

Commission <strong>of</strong> the <strong>European</strong> Communities – French<br />

Republic<br />

1. By <strong>in</strong>troduc<strong>in</strong>g a special rule limit<strong>in</strong>g the deductibility <strong>of</strong> <strong>VAT</strong><br />

on the purchase <strong>of</strong> capital goods where they were f<strong>in</strong>anced by<br />

subsidies, the French Republic has failed to fulfil its obligations<br />

under Community law, <strong>in</strong> particular under Articles 17 and 19<br />

<strong>of</strong> the Sixth Directive [...], as amended by Directive 95/7/EC<br />

[...];<br />

2. The Republic <strong>of</strong> France is ordered to pay the costs;<br />

3. The K<strong>in</strong>gdom <strong>of</strong> Spa<strong>in</strong> is ordered to pay its own costs.<br />

[2005] ECR I-8411<br />

Case C-291/03<br />

6 October 2005<br />

MyTravel plc – Commissioners <strong>of</strong> Customs & Excise<br />

1. A travel agent or a tour operator who has completed his <strong>VAT</strong><br />

Judgments <strong>of</strong> the <strong>Court</strong> <strong>of</strong> <strong>Justice</strong> – 32<br />

© <strong>2006</strong> IBFD<br />

return for a tax period us<strong>in</strong>g the method laid down by the<br />

national rules which transpose <strong>in</strong>to domestic law the Sixth<br />

Directive [...] may recalculate his <strong>VAT</strong> liability <strong>in</strong> accordance<br />

with the method held by the <strong>Court</strong> to comply with Community<br />

law, under the conditions laid down by national law, which<br />

have to observe the pr<strong>in</strong>ciples <strong>of</strong> equivalence and effectiveness.<br />

2. Article 26 <strong>of</strong> the Sixth Directive [...] must be <strong>in</strong>terpreted as<br />

mean<strong>in</strong>g that a travel agent or tour operator who, <strong>in</strong> return<br />

for a package price, supplies to a traveller services bought <strong>in</strong><br />

from third parties and <strong>in</strong>-house services must, <strong>in</strong> pr<strong>in</strong>ciple,<br />

identify the part <strong>of</strong> the package correspond<strong>in</strong>g to his <strong>in</strong>-house<br />

services on the basis <strong>of</strong> their market value where that value<br />

can be established. In such a case, a taxable person may use<br />

the criterion <strong>of</strong> actual costs only if he proves that this criterion<br />

accurately reflects the actual structure <strong>of</strong> the package. Application<br />

<strong>of</strong> the criterion <strong>of</strong> market value is not subject to the<br />

condition that it must be simpler than application <strong>of</strong> the actual<br />

cost method or to the condition that it must produce a <strong>VAT</strong><br />

liability identical or close to that which would result from<br />

us<strong>in</strong>g the actual cost method. Accord<strong>in</strong>gly:<br />

– a travel agent or tour operator may not use the market<br />

value method at his own discretion and<br />

– that method is applicable to <strong>in</strong>-house services whose<br />

market value may be established even if, <strong>in</strong> the same tax<br />

period, the value <strong>of</strong> certa<strong>in</strong> <strong>in</strong>-house components <strong>of</strong> the<br />

package cannot be established <strong>in</strong>asmuch as the taxable<br />

person does not sell similar services on a non-package<br />

basis.<br />

3. It is for the national tribunal to establish, <strong>in</strong> the light <strong>of</strong> the<br />

circumstances <strong>of</strong> the ma<strong>in</strong> proceed<strong>in</strong>gs, the market value <strong>of</strong><br />

the flights supplied <strong>in</strong> the ma<strong>in</strong> proceed<strong>in</strong>gs as part <strong>of</strong> package<br />

holidays. The national tribunal may establish this market<br />

value from average values. In this context, the market based<br />

on seats sold to other tour operators may constitute the most<br />

appropriate market.<br />

[2005] ECR I-8477<br />

Case C-200/04<br />

13 October 2005<br />

ISt <strong>in</strong>ternationale Sprach- und Studienreisen GmbH –<br />

F<strong>in</strong>anzamt Heidelberg<br />

Article 26 <strong>of</strong> the Sixth Directive [...], should be <strong>in</strong>terpreted as<br />

mean<strong>in</strong>g that it applies to a trader who <strong>of</strong>fers services such as<br />

the 'High School' and 'College' programmes <strong>in</strong>volv<strong>in</strong>g the organisation<br />

<strong>of</strong> language and study trips abroad and which, <strong>in</strong> consideration<br />

<strong>of</strong> the payment <strong>of</strong> an all-<strong>in</strong>clusive sum, provides <strong>in</strong> its<br />

own name to its customers a stay abroad <strong>of</strong> three to 10 months<br />

and buys <strong>in</strong> services from other taxable persons for that purpose.<br />

[2005] ECR I-8691<br />

Case C-41/04<br />

27 October 2005<br />

Levob Verzeker<strong>in</strong>gen BV, OV Bank NV – Staatssecretaris<br />

van F<strong>in</strong>anciën<br />

1. Article 2(1) <strong>of</strong> the Sixth Directive [...] must be <strong>in</strong>terpreted as<br />

mean<strong>in</strong>g that where two or more elements or acts supplied<br />

by a taxable person to a customer, be<strong>in</strong>g a typical consumer,<br />

are so closely l<strong>in</strong>ked that they form objectively, from an<br />

economic po<strong>in</strong>t <strong>of</strong> view, a whole transaction, which it would<br />

be artificial to split, all those elements or acts constitute a<br />

s<strong>in</strong>gle supply for purposes <strong>of</strong> the application <strong>of</strong> <strong>VAT</strong>;<br />

2. This is true <strong>of</strong> a transaction by which a taxable person supplies<br />

to a consumer standard s<strong>of</strong>tware previously developed,<br />

put on the market and recorded on a carrier and subsequently<br />

customises that s<strong>of</strong>tware to that purchaser’s specific requirements,<br />

even where separate prices are paid;<br />

3. Article 6(1) <strong>of</strong> the Sixth Directive [...] must be <strong>in</strong>terpreted as<br />

mean<strong>in</strong>g that a s<strong>in</strong>gle supply such as that referred to <strong>in</strong><br />

paragraph 2 <strong>of</strong> this operative part is to be classified as a<br />

'supply <strong>of</strong> services' where it is apparent that the customisation<br />

<strong>in</strong> question is neither m<strong>in</strong>or nor ancillary but, on the<br />

contrary, predom<strong>in</strong>ates; such is the case <strong>in</strong> particular where<br />

<strong>in</strong> the light <strong>of</strong> factors such as its extent, cost or duration the<br />

customisation is <strong>of</strong> decisive importance <strong>in</strong> enabl<strong>in</strong>g the pur-