European Court of Justice VAT cases 2006-3 - empcom.gov.in

European Court of Justice VAT cases 2006-3 - empcom.gov.in

European Court of Justice VAT cases 2006-3 - empcom.gov.in

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

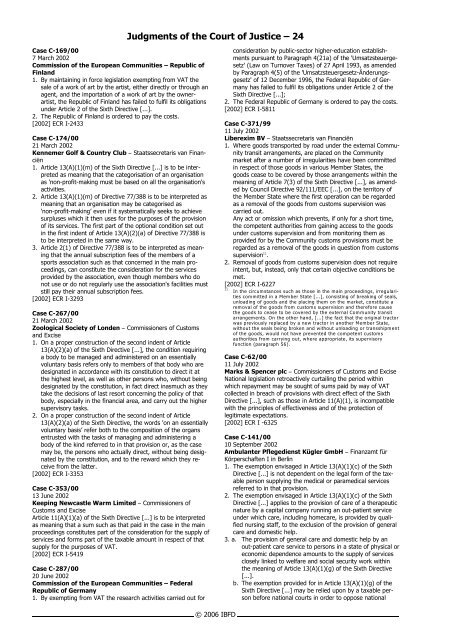

Case C-169/00<br />

7 March 2002<br />

Commission <strong>of</strong> the <strong>European</strong> Communities – Republic <strong>of</strong><br />

F<strong>in</strong>land<br />

1. By ma<strong>in</strong>ta<strong>in</strong><strong>in</strong>g <strong>in</strong> force legislation exempt<strong>in</strong>g from <strong>VAT</strong> the<br />

sale <strong>of</strong> a work <strong>of</strong> art by the artist, either directly or through an<br />

agent, and the importation <strong>of</strong> a work <strong>of</strong> art by the ownerartist,<br />

the Republic <strong>of</strong> F<strong>in</strong>land has failed to fulfil its obligations<br />

under Article 2 <strong>of</strong> the Sixth Directive [...].<br />

2. The Republic <strong>of</strong> F<strong>in</strong>land is ordered to pay the costs.<br />

[2002] ECR I-2433<br />

Case C-174/00<br />

21 March 2002<br />

Kennemer Golf & Country Club S Staatssecretaris van F<strong>in</strong>anciën<br />

1. Article 13(A)(1)(m) <strong>of</strong> the Sixth Directive [...] is to be <strong>in</strong>terpreted<br />

as mean<strong>in</strong>g that the categorisation <strong>of</strong> an organisation<br />

as 'non-pr<strong>of</strong>it-mak<strong>in</strong>g must be based on all the organisation's<br />

activities.<br />

2. Article 13(A)(1)(m) <strong>of</strong> Directive 77/388 is to be <strong>in</strong>terpreted as<br />

mean<strong>in</strong>g that an organisation may be categorised as<br />

'non-pr<strong>of</strong>it-mak<strong>in</strong>g’ even if it systematically seeks to achieve<br />

surpluses which it then uses for the purposes <strong>of</strong> the provision<br />

<strong>of</strong> its services. The first part <strong>of</strong> the optional condition set out<br />

<strong>in</strong> the first <strong>in</strong>dent <strong>of</strong> Article 13(A)(2)(a) <strong>of</strong> Directive 77/388 is<br />

to be <strong>in</strong>terpreted <strong>in</strong> the same way.<br />

3. Article 2(1) <strong>of</strong> Directive 77/388 is to be <strong>in</strong>terpreted as mean<strong>in</strong>g<br />

that the annual subscription fees <strong>of</strong> the members <strong>of</strong> a<br />

sports association such as that concerned <strong>in</strong> the ma<strong>in</strong> proceed<strong>in</strong>gs,<br />

can constitute the consideration for the services<br />

provided by the association, even though members who do<br />

not use or do not regularly use the association's facilities must<br />

still pay their annual subscription fees.<br />

[2002] ECR I-3293<br />

Case C-267/00<br />

21 March 2002<br />

Zoological Society <strong>of</strong> Londen S Commissioners <strong>of</strong> Customs<br />

and Excise<br />

1. On a proper construction <strong>of</strong> the second <strong>in</strong>dent <strong>of</strong> Article<br />

13(A)(2)(a) <strong>of</strong> the Sixth Directive [...], the condition requir<strong>in</strong>g<br />

a body to be managed and adm<strong>in</strong>istered on an essentially<br />

voluntary basis refers only to members <strong>of</strong> that body who are<br />

designated <strong>in</strong> accordance with its constitution to direct it at<br />

the highest level, as well as other persons who, without be<strong>in</strong>g<br />

designated by the constitution, <strong>in</strong> fact direct <strong>in</strong>asmuch as they<br />

take the decisions <strong>of</strong> last resort concern<strong>in</strong>g the policy <strong>of</strong> that<br />

body, especially <strong>in</strong> the f<strong>in</strong>ancial area, and carry out the higher<br />

supervisory tasks.<br />

2. On a proper construction <strong>of</strong> the second <strong>in</strong>dent <strong>of</strong> Article<br />

13(A)(2)(a) <strong>of</strong> the Sixth Directive, the words 'on an essentially<br />

voluntary basis’ refer both to the composition <strong>of</strong> the organs<br />

entrusted with the tasks <strong>of</strong> manag<strong>in</strong>g and adm<strong>in</strong>ister<strong>in</strong>g a<br />

body <strong>of</strong> the k<strong>in</strong>d referred to <strong>in</strong> that provision or, as the case<br />

may be, the persons who actually direct, without be<strong>in</strong>g designated<br />

by the constitution, and to the reward which they receive<br />

from the latter.<br />

[2002] ECR I-3353<br />

Case C-353/00<br />

13 June 2002<br />

Keep<strong>in</strong>g Newcastle Warm Limited S Commissioners <strong>of</strong><br />

Customs and Excise<br />

Article 11(A)(1)(a) <strong>of</strong> the Sixth Directive [...] is to be <strong>in</strong>terpreted<br />

as mean<strong>in</strong>g that a sum such as that paid <strong>in</strong> the case <strong>in</strong> the ma<strong>in</strong><br />

proceed<strong>in</strong>gs constitutes part <strong>of</strong> the consideration for the supply <strong>of</strong><br />

services and forms part <strong>of</strong> the taxable amount <strong>in</strong> respect <strong>of</strong> that<br />

supply for the purposes <strong>of</strong> <strong>VAT</strong>.<br />

[2002] ECR I-5419<br />

Case C-287/00<br />

20 June 2002<br />

Commission <strong>of</strong> the <strong>European</strong> Communities – Federal<br />

Republic <strong>of</strong> Germany<br />

1. By exempt<strong>in</strong>g from <strong>VAT</strong> the research activities carried out for<br />

Judgments <strong>of</strong> the <strong>Court</strong> <strong>of</strong> <strong>Justice</strong> – 24<br />

© <strong>2006</strong> IBFD<br />

consideration by public-sector higher-education establishments<br />

pursuant to Paragraph 4(21a) <strong>of</strong> the 'Umsatzsteuergesetz'<br />

(Law on Turnover Taxes) <strong>of</strong> 27 April 1993, as amended<br />

by Paragraph 4(5) <strong>of</strong> the 'Umsatzsteuergesetz-Änderungsgesetz'<br />

<strong>of</strong> 12 December 1996, the Federal Republic <strong>of</strong> Germany<br />

has failed to fulfil its obligations under Article 2 <strong>of</strong> the<br />

Sixth Directive [...];<br />

2. The Federal Republic <strong>of</strong> Germany is ordered to pay the costs.<br />

[2002] ECR I-5811<br />

Case C-371/99<br />

11 July 2002<br />

Liberexim BV S Staatssecretaris van F<strong>in</strong>anciën<br />

1. Where goods transported by road under the external Community<br />

transit arrangements, are placed on the Community<br />

market after a number <strong>of</strong> irregularities have been committed<br />

<strong>in</strong> respect <strong>of</strong> those goods <strong>in</strong> various Member States, the<br />

goods cease to be covered by those arrangements with<strong>in</strong> the<br />

mean<strong>in</strong>g <strong>of</strong> Article 7(3) <strong>of</strong> the Sixth Directive [...], as amended<br />

by Council Directive 92/111/EEC [...], on the territory <strong>of</strong><br />

the Member State where the first operation can be regarded<br />

as a removal <strong>of</strong> the goods from customs supervision was<br />

carried out.<br />

Any act or omission which prevents, if only for a short time,<br />

the competent authorities from ga<strong>in</strong><strong>in</strong>g access to the goods<br />

under customs supervision and from monitor<strong>in</strong>g them as<br />

provided for by the Community customs provisions must be<br />

regarded as a removal <strong>of</strong> the goods <strong>in</strong> question from customs<br />

1)<br />

supervision .<br />

2. Removal <strong>of</strong> goods from customs supervision does not require<br />

<strong>in</strong>tent, but, <strong>in</strong>stead, only that certa<strong>in</strong> objective conditions be<br />

met.<br />

[2002] ECR I-6227<br />

1)<br />

In the circumstances such as those <strong>in</strong> the ma<strong>in</strong> proceed<strong>in</strong>gs, irregularities<br />

committed <strong>in</strong> a Member State [...], consist<strong>in</strong>g <strong>of</strong> break<strong>in</strong>g <strong>of</strong> seals,<br />

unload<strong>in</strong>g <strong>of</strong> goods and the plac<strong>in</strong>g them on the market, constitute a<br />

removal <strong>of</strong> the goods from customs supervision and therefore cause<br />

the goods to cease to be covered by the external Community transit<br />

arrangements. On the other hand, [...] the fact that the orig<strong>in</strong>al tractor<br />

was previously replaced by a new tractor <strong>in</strong> another Member State,<br />

without the seals be<strong>in</strong>g broken and without unload<strong>in</strong>g or transshipment<br />

<strong>of</strong> the goods, would not have prevented the competent customs<br />

authorities from carry<strong>in</strong>g out, where appropriate, its supervisory<br />

function (paragraph 56).<br />

Case C-62/00<br />

11 July 2002<br />

Marks & Spencer plc S Commissioners <strong>of</strong> Customs and Excise<br />

National legislation retroactively curtail<strong>in</strong>g the period with<strong>in</strong><br />

which repayment may be sought <strong>of</strong> sums paid by way <strong>of</strong> <strong>VAT</strong><br />

collected <strong>in</strong> breach <strong>of</strong> provisions with direct effect <strong>of</strong> the Sixth<br />

Directive [...], such as those <strong>in</strong> Article 11(A)(1), is <strong>in</strong>compatible<br />

with the pr<strong>in</strong>ciples <strong>of</strong> effectiveness and <strong>of</strong> the protection <strong>of</strong><br />

legitimate expectations.<br />

[2002] ECR I -6325<br />

Case C-141/00<br />

10 September 2002<br />

Ambulanter Pflegedienst Kügler GmbH S F<strong>in</strong>anzamt für<br />

Körperschaften I <strong>in</strong> Berl<strong>in</strong><br />

1. The exemption envisaged <strong>in</strong> Article 13(A)(1)(c) <strong>of</strong> the Sixth<br />

Directive [...] is not dependent on the legal form <strong>of</strong> the taxable<br />

person supply<strong>in</strong>g the medical or paramedical services<br />

referred to <strong>in</strong> that provision.<br />

2. The exemption envisaged <strong>in</strong> Article 13(A)(1)(c) <strong>of</strong> the Sixth<br />

Directive [...] applies to the provision <strong>of</strong> care <strong>of</strong> a therapeutic<br />

nature by a capital company runn<strong>in</strong>g an out-patient service<br />

under which care, <strong>in</strong>clud<strong>in</strong>g homecare, is provided by qualified<br />

nurs<strong>in</strong>g staff, to the exclusion <strong>of</strong> the provision <strong>of</strong> general<br />

care and domestic help.<br />

3. a. The provision <strong>of</strong> general care and domestic help by an<br />

out-patient care service to persons <strong>in</strong> a state <strong>of</strong> physical or<br />

economic dependence amounts to the supply <strong>of</strong> services<br />

closely l<strong>in</strong>ked to welfare and social security work with<strong>in</strong><br />

the mean<strong>in</strong>g <strong>of</strong> Article 13(A)(1)(g) <strong>of</strong> the Sixth Directive<br />

[...].<br />

b. The exemption provided for <strong>in</strong> Article 13(A)(1)(g) <strong>of</strong> the<br />

Sixth Directive [...] may be relied upon by a taxable person<br />

before national courts <strong>in</strong> order to oppose national