European Court of Justice VAT cases 2006-3 - empcom.gov.in

European Court of Justice VAT cases 2006-3 - empcom.gov.in

European Court of Justice VAT cases 2006-3 - empcom.gov.in

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

the period laid down <strong>in</strong> the first subparagraph, which expenditure<br />

should not be eligible for deduction <strong>of</strong> <strong>VAT</strong>.<br />

[1999] ECR I-6671<br />

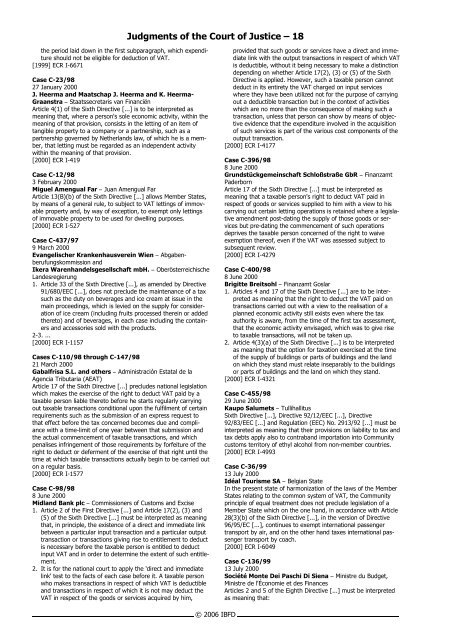

Case C-23/98<br />

27 January 2000<br />

J. Heerma and Maatschap J. Heerma and K. Heerma-<br />

Graanstra S Staatssecretaris van F<strong>in</strong>anciën<br />

Article 4(1) <strong>of</strong> the Sixth Directive [...] is to be <strong>in</strong>terpreted as<br />

mean<strong>in</strong>g that, where a person's sole economic activity, with<strong>in</strong> the<br />

mean<strong>in</strong>g <strong>of</strong> that provision, consists <strong>in</strong> the lett<strong>in</strong>g <strong>of</strong> an item <strong>of</strong><br />

tangible property to a company or a partnership, such as a<br />

partnership <strong>gov</strong>erned by Netherlands law, <strong>of</strong> which he is a member,<br />

that lett<strong>in</strong>g must be regarded as an <strong>in</strong>dependent activity<br />

with<strong>in</strong> the mean<strong>in</strong>g <strong>of</strong> that provision.<br />

[2000] ECR I-419<br />

Case C-12/98<br />

3 February 2000<br />

Miguel Amengual Far S Juan Amengual Far<br />

Article 13(B)(b) <strong>of</strong> the Sixth Directive [...] allows Member States,<br />

by means <strong>of</strong> a general rule, to subject to <strong>VAT</strong> lett<strong>in</strong>gs <strong>of</strong> immovable<br />

property and, by way <strong>of</strong> exception, to exempt only lett<strong>in</strong>gs<br />

<strong>of</strong> immovable property to be used for dwell<strong>in</strong>g purposes.<br />

[2000] ECR I-527<br />

Case C-437/97<br />

9 March 2000<br />

Evangelischer Krankenhausvere<strong>in</strong> Wien S Abgabenberufungskommission<br />

and<br />

Ikera Warenhandelsgesellschaft mbH. S Oberösterreichische<br />

Landesregierung<br />

1. Article 33 <strong>of</strong> the Sixth Directive [...], as amended by Directive<br />

91/680/EEC [...], does not preclude the ma<strong>in</strong>tenance <strong>of</strong> a tax<br />

such as the duty on beverages and ice cream at issue <strong>in</strong> the<br />

ma<strong>in</strong> proceed<strong>in</strong>gs, which is levied on the supply for consideration<br />

<strong>of</strong> ice cream (<strong>in</strong>clud<strong>in</strong>g fruits processed there<strong>in</strong> or added<br />

thereto) and <strong>of</strong> beverages, <strong>in</strong> each case <strong>in</strong>clud<strong>in</strong>g the conta<strong>in</strong>ers<br />

and accessories sold with the products.<br />

2-3. ...<br />

[2000] ECR I-1157<br />

Cases C-110/98 through C-147/98<br />

21 March 2000<br />

Gabalfrisa S.L. and others S Adm<strong>in</strong>istración Estatal de la<br />

Agencia Tributaria (AEAT)<br />

Article 17 <strong>of</strong> the Sixth Directive [...] precludes national legislation<br />

which makes the exercise <strong>of</strong> the right to deduct <strong>VAT</strong> paid by a<br />

taxable person liable thereto before he starts regularly carry<strong>in</strong>g<br />

out taxable transactions conditional upon the fulfilment <strong>of</strong> certa<strong>in</strong><br />

requirements such as the submission <strong>of</strong> an express request to<br />

that effect before the tax concerned becomes due and compliance<br />

with a time-limit <strong>of</strong> one year between that submission and<br />

the actual commencement <strong>of</strong> taxable transactions, and which<br />

penalises <strong>in</strong>fr<strong>in</strong>gement <strong>of</strong> those requirements by forfeiture <strong>of</strong> the<br />

right to deduct or deferment <strong>of</strong> the exercise <strong>of</strong> that right until the<br />

time at which taxable transactions actually beg<strong>in</strong> to be carried out<br />

on a regular basis.<br />

[2000] ECR I-1577<br />

Case C-98/98<br />

8 June 2000<br />

Midland Bank plc S Commissioners <strong>of</strong> Customs and Excise<br />

1. Article 2 <strong>of</strong> the First Directive [...] and Article 17(2), (3) and<br />

(5) <strong>of</strong> the Sixth Directive [...] must be <strong>in</strong>terpreted as mean<strong>in</strong>g<br />

that, <strong>in</strong> pr<strong>in</strong>ciple, the existence <strong>of</strong> a direct and immediate l<strong>in</strong>k<br />

between a particular <strong>in</strong>put transaction and a particular output<br />

transaction or transactions giv<strong>in</strong>g rise to entitlement to deduct<br />

is necessary before the taxable person is entitled to deduct<br />

<strong>in</strong>put <strong>VAT</strong> and <strong>in</strong> order to determ<strong>in</strong>e the extent <strong>of</strong> such entitlement.<br />

2. It is for the national court to apply the 'direct and immediate<br />

l<strong>in</strong>k' test to the facts <strong>of</strong> each case before it. A taxable person<br />

who makes transactions <strong>in</strong> respect <strong>of</strong> which <strong>VAT</strong> is deductible<br />

and transactions <strong>in</strong> respect <strong>of</strong> which it is not may deduct the<br />

<strong>VAT</strong> <strong>in</strong> respect <strong>of</strong> the goods or services acquired by him,<br />

Judgments <strong>of</strong> the <strong>Court</strong> <strong>of</strong> <strong>Justice</strong> – 18<br />

© <strong>2006</strong> IBFD<br />

provided that such goods or services have a direct and immediate<br />

l<strong>in</strong>k with the output transactions <strong>in</strong> respect <strong>of</strong> which <strong>VAT</strong><br />

is deductible, without it be<strong>in</strong>g necessary to make a dist<strong>in</strong>ction<br />

depend<strong>in</strong>g on whether Article 17(2), (3) or (5) <strong>of</strong> the Sixth<br />

Directive is applied. However, such a taxable person cannot<br />

deduct <strong>in</strong> its entirety the <strong>VAT</strong> charged on <strong>in</strong>put services<br />

where they have been utilized not for the purpose <strong>of</strong> carry<strong>in</strong>g<br />

out a deductible transaction but <strong>in</strong> the context <strong>of</strong> activities<br />

which are no more than the consequence <strong>of</strong> mak<strong>in</strong>g such a<br />

transaction, unless that person can show by means <strong>of</strong> objective<br />

evidence that the expenditure <strong>in</strong>volved <strong>in</strong> the acquisition<br />

<strong>of</strong> such services is part <strong>of</strong> the various cost components <strong>of</strong> the<br />

output transaction.<br />

[2000] ECR I-4177<br />

Case C-396/98<br />

8 June 2000<br />

Grundstückgeme<strong>in</strong>schaft Schloßstraße GbR S F<strong>in</strong>anzamt<br />

Paderborn<br />

Article 17 <strong>of</strong> the Sixth Directive [...] must be <strong>in</strong>terpreted as<br />

mean<strong>in</strong>g that a taxable person's right to deduct <strong>VAT</strong> paid <strong>in</strong><br />

respect <strong>of</strong> goods or services supplied to him with a view to his<br />

carry<strong>in</strong>g out certa<strong>in</strong> lett<strong>in</strong>g operations is reta<strong>in</strong>ed where a legislative<br />

amendment post-dat<strong>in</strong>g the supply <strong>of</strong> those goods or services<br />

but pre-dat<strong>in</strong>g the commencement <strong>of</strong> such operations<br />

deprives the taxable person concerned <strong>of</strong> the right to waive<br />

exemption there<strong>of</strong>, even if the <strong>VAT</strong> was assessed subject to<br />

subsequent review.<br />

[2000] ECR I-4279<br />

Case C-400/98<br />

8 June 2000<br />

Brigitte Breitsohl S F<strong>in</strong>anzamt Goslar<br />

1. Articles 4 and 17 <strong>of</strong> the Sixth Directive [...] are to be <strong>in</strong>terpreted<br />

as mean<strong>in</strong>g that the right to deduct the <strong>VAT</strong> paid on<br />

transactions carried out with a view to the realisation <strong>of</strong> a<br />

planned economic activity still exists even where the tax<br />

authority is aware, from the time <strong>of</strong> the first tax assessment,<br />

that the economic activity envisaged, which was to give rise<br />

to taxable transactions, will not be taken up.<br />

2. Article 4(3)(a) <strong>of</strong> the Sixth Directive [...] is to be <strong>in</strong>terpreted<br />

as mean<strong>in</strong>g that the option for taxation exercised at the time<br />

<strong>of</strong> the supply <strong>of</strong> build<strong>in</strong>gs or parts <strong>of</strong> build<strong>in</strong>gs and the land<br />

on which they stand must relate <strong>in</strong>separably to the build<strong>in</strong>gs<br />

or parts <strong>of</strong> build<strong>in</strong>gs and the land on which they stand.<br />

[2000] ECR I-4321<br />

Case C-455/98<br />

29 June 2000<br />

Kaupo Salumets S Tullihallitus<br />

Sixth Directive [...], Directive 92/12/EEC [...], Directive<br />

92/83/EEC [...] and Regulation (EEC) No. 2913/92 [...] must be<br />

<strong>in</strong>terpreted as mean<strong>in</strong>g that their provisions on liability to tax and<br />

tax debts apply also to contraband importation <strong>in</strong>to Community<br />

customs territory <strong>of</strong> ethyl alcohol from non-member countries.<br />

[2000] ECR I-4993<br />

Case C-36/99<br />

13 July 2000<br />

Idéal Tourisme SA S Belgian State<br />

In the present state <strong>of</strong> harmonization <strong>of</strong> the laws <strong>of</strong> the Member<br />

States relat<strong>in</strong>g to the common system <strong>of</strong> <strong>VAT</strong>, the Community<br />

pr<strong>in</strong>ciple <strong>of</strong> equal treatment does not preclude legislation <strong>of</strong> a<br />

Member State which on the one hand, <strong>in</strong> accordance with Article<br />

28(3)(b) <strong>of</strong> the Sixth Directive [...], <strong>in</strong> the version <strong>of</strong> Directive<br />

96/95/EC [...], cont<strong>in</strong>ues to exempt <strong>in</strong>ternational passenger<br />

transport by air, and on the other hand taxes <strong>in</strong>ternational passenger<br />

transport by coach.<br />

[2000] ECR I-6049<br />

Case C-136/99<br />

13 July 2000<br />

Société Monte Dei Paschi Di Siena S M<strong>in</strong>istre du Budget,<br />

M<strong>in</strong>istre de l'Économie et des F<strong>in</strong>ances<br />

Articles 2 and 5 <strong>of</strong> the Eighth Directive [...] must be <strong>in</strong>terpreted<br />

as mean<strong>in</strong>g that: