European Court of Justice VAT cases 2006-3 - empcom.gov.in

European Court of Justice VAT cases 2006-3 - empcom.gov.in

European Court of Justice VAT cases 2006-3 - empcom.gov.in

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

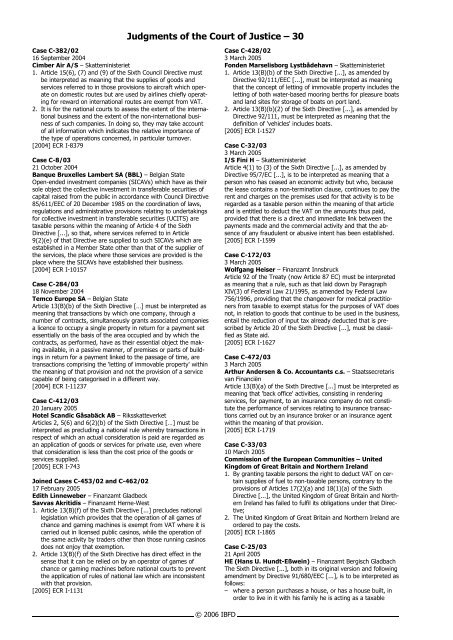

Case C-382/02<br />

16 September 2004<br />

Cimber Air A/S – Skattem<strong>in</strong>isteriet<br />

1. Article 15(6), (7) and (9) <strong>of</strong> the Sixth Council Directive must<br />

be <strong>in</strong>terpreted as mean<strong>in</strong>g that the supplies <strong>of</strong> goods and<br />

services referred to <strong>in</strong> those provisions to aircraft which operate<br />

on domestic routes but are used by airl<strong>in</strong>es chiefly operat<strong>in</strong>g<br />

for reward on <strong>in</strong>ternational routes are exempt from <strong>VAT</strong>.<br />

2. It is for the national courts to assess the extent <strong>of</strong> the <strong>in</strong>ternational<br />

bus<strong>in</strong>ess and the extent <strong>of</strong> the non-<strong>in</strong>ternational bus<strong>in</strong>ess<br />

<strong>of</strong> such companies. In do<strong>in</strong>g so, they may take account<br />

<strong>of</strong> all <strong>in</strong>formation which <strong>in</strong>dicates the relative importance <strong>of</strong><br />

the type <strong>of</strong> operations concerned, <strong>in</strong> particular turnover.<br />

[2004] ECR I-8379<br />

Case C-8/03<br />

21 October 2004<br />

Banque Bruxelles Lambert SA (BBL) – Belgian State<br />

Open-ended <strong>in</strong>vestment companies (SICAVs) which have as their<br />

sole object the collective <strong>in</strong>vestment <strong>in</strong> transferable securities <strong>of</strong><br />

capital raised from the public <strong>in</strong> accordance with Council Directive<br />

85/611/EEC <strong>of</strong> 20 December 1985 on the coord<strong>in</strong>ation <strong>of</strong> laws,<br />

regulations and adm<strong>in</strong>istrative provisions relat<strong>in</strong>g to undertak<strong>in</strong>gs<br />

for collective <strong>in</strong>vestment <strong>in</strong> transferable securities (UCITS) are<br />

taxable persons with<strong>in</strong> the mean<strong>in</strong>g <strong>of</strong> Article 4 <strong>of</strong> the Sixth<br />

Directive [...], so that, where services referred to <strong>in</strong> Article<br />

9(2)(e) <strong>of</strong> that Directive are supplied to such SICAVs which are<br />

established <strong>in</strong> a Member State other than that <strong>of</strong> the supplier <strong>of</strong><br />

the services, the place where those services are provided is the<br />

place where the SICAVs have established their bus<strong>in</strong>ess.<br />

[2004] ECR I-10157<br />

Case C-284/03<br />

18 November 2004<br />

Temco Europe SA – Belgian State<br />

Article 13(B)(b) <strong>of</strong> the Sixth Directive […] must be <strong>in</strong>terpreted as<br />

mean<strong>in</strong>g that transactions by which one company, through a<br />

number <strong>of</strong> contracts, simultaneously grants associated companies<br />

a licence to occupy a s<strong>in</strong>gle property <strong>in</strong> return for a payment set<br />

essentially on the basis <strong>of</strong> the area occupied and by which the<br />

contracts, as performed, have as their essential object the mak<strong>in</strong>g<br />

available, <strong>in</strong> a passive manner, <strong>of</strong> premises or parts <strong>of</strong> build<strong>in</strong>gs<br />

<strong>in</strong> return for a payment l<strong>in</strong>ked to the passage <strong>of</strong> time, are<br />

transactions compris<strong>in</strong>g the 'lett<strong>in</strong>g <strong>of</strong> immovable property' with<strong>in</strong><br />

the mean<strong>in</strong>g <strong>of</strong> that provision and not the provision <strong>of</strong> a service<br />

capable <strong>of</strong> be<strong>in</strong>g categorised <strong>in</strong> a different way.<br />

[2004] ECR I-11237<br />

Case C-412/03<br />

20 January 2005<br />

Hotel Scandic Gåsabäck AB – Riksskatteverket<br />

Articles 2, 5(6) and 6(2)(b) <strong>of</strong> the Sixth Directive […] must be<br />

<strong>in</strong>terpreted as preclud<strong>in</strong>g a national rule whereby transactions <strong>in</strong><br />

respect <strong>of</strong> which an actual consideration is paid are regarded as<br />

an application <strong>of</strong> goods or services for private use, even where<br />

that consideration is less than the cost price <strong>of</strong> the goods or<br />

services supplied.<br />

[2005] ECR I-743<br />

Jo<strong>in</strong>ed Cases C-453/02 and C-462/02<br />

17 February 2005<br />

Edith L<strong>in</strong>neweber – F<strong>in</strong>anzamt Gladbeck<br />

Savvas Akritidis – F<strong>in</strong>anzamt Herne-West<br />

1. Article 13(B)(f) <strong>of</strong> the Sixth Directive [...] precludes national<br />

legislation which provides that the operation <strong>of</strong> all games <strong>of</strong><br />

chance and gam<strong>in</strong>g mach<strong>in</strong>es is exempt from <strong>VAT</strong> where it is<br />

carried out <strong>in</strong> licensed public cas<strong>in</strong>os, while the operation <strong>of</strong><br />

the same activity by traders other than those runn<strong>in</strong>g cas<strong>in</strong>os<br />

does not enjoy that exemption.<br />

2. Article 13(B)(f) <strong>of</strong> the Sixth Directive has direct effect <strong>in</strong> the<br />

sense that it can be relied on by an operator <strong>of</strong> games <strong>of</strong><br />

chance or gam<strong>in</strong>g mach<strong>in</strong>es before national courts to prevent<br />

the application <strong>of</strong> rules <strong>of</strong> national law which are <strong>in</strong>consistent<br />

with that provision.<br />

[2005] ECR I-1131<br />

Judgments <strong>of</strong> the <strong>Court</strong> <strong>of</strong> <strong>Justice</strong> – 30<br />

© <strong>2006</strong> IBFD<br />

Case C-428/02<br />

3 March 2005<br />

Fonden Marselisborg Lystbådehavn – Skattem<strong>in</strong>isteriet<br />

1. Article 13(B)(b) <strong>of</strong> the Sixth Directive [...], as amended by<br />

Directive 92/111/EEC [...], must be <strong>in</strong>terpreted as mean<strong>in</strong>g<br />

that the concept <strong>of</strong> lett<strong>in</strong>g <strong>of</strong> immovable property <strong>in</strong>cludes the<br />

lett<strong>in</strong>g <strong>of</strong> both water-based moor<strong>in</strong>g berths for pleasure boats<br />

and land sites for storage <strong>of</strong> boats on port land.<br />

2. Article 13(B)(b)(2) <strong>of</strong> the Sixth Directive [...], as amended by<br />

Directive 92/111, must be <strong>in</strong>terpreted as mean<strong>in</strong>g that the<br />

def<strong>in</strong>ition <strong>of</strong> 'vehicles' <strong>in</strong>cludes boats.<br />

[2005] ECR I-1527<br />

Case C-32/03<br />

3 March 2005<br />

I/S F<strong>in</strong>i H – Skattem<strong>in</strong>isteriet<br />

Article 4(1) to (3) <strong>of</strong> the Sixth Directive [...], as amended by<br />

Directive 95/7/EC [...], is to be <strong>in</strong>terpreted as mean<strong>in</strong>g that a<br />

person who has ceased an economic activity but who, because<br />

the lease conta<strong>in</strong>s a non-term<strong>in</strong>ation clause, cont<strong>in</strong>ues to pay the<br />

rent and charges on the premises used for that activity is to be<br />

regarded as a taxable person with<strong>in</strong> the mean<strong>in</strong>g <strong>of</strong> that article<br />

and is entitled to deduct the <strong>VAT</strong> on the amounts thus paid,<br />

provided that there is a direct and immediate l<strong>in</strong>k between the<br />

payments made and the commercial activity and that the absence<br />

<strong>of</strong> any fraudulent or abusive <strong>in</strong>tent has been established.<br />

[2005] ECR I-1599<br />

Case C-172/03<br />

3 March 2005<br />

Wolfgang Heiser – F<strong>in</strong>anzamt Innsbruck<br />

Article 92 <strong>of</strong> the Treaty (now Article 87 EC) must be <strong>in</strong>terpreted<br />

as mean<strong>in</strong>g that a rule, such as that laid down by Paragraph<br />

XIV(3) <strong>of</strong> Federal Law 21/1995, as amended by Federal Law<br />

756/1996, provid<strong>in</strong>g that the changeover for medical practitioners<br />

from taxable to exempt status for the purposes <strong>of</strong> <strong>VAT</strong> does<br />

not, <strong>in</strong> relation to goods that cont<strong>in</strong>ue to be used <strong>in</strong> the bus<strong>in</strong>ess,<br />

entail the reduction <strong>of</strong> <strong>in</strong>put tax already deducted that is prescribed<br />

by Article 20 <strong>of</strong> the Sixth Directive [...], must be classified<br />

as State aid.<br />

[2005] ECR I-1627<br />

Case C-472/03<br />

3 March 2005<br />

Arthur Andersen & Co. Accountants c.s. – Staatssecretaris<br />

van F<strong>in</strong>anciën<br />

Article 13(B)(a) <strong>of</strong> the Sixth Directive [...] must be <strong>in</strong>terpreted as<br />

mean<strong>in</strong>g that 'back <strong>of</strong>fice' activities, consist<strong>in</strong>g <strong>in</strong> render<strong>in</strong>g<br />

services, for payment, to an <strong>in</strong>surance company do not constitute<br />

the performance <strong>of</strong> services relat<strong>in</strong>g to <strong>in</strong>surance transactions<br />

carried out by an <strong>in</strong>surance broker or an <strong>in</strong>surance agent<br />

with<strong>in</strong> the mean<strong>in</strong>g <strong>of</strong> that provision.<br />

[2005] ECR I-1719<br />

Case C-33/03<br />

10 March 2005<br />

Commission <strong>of</strong> the <strong>European</strong> Communities – United<br />

K<strong>in</strong>gdom <strong>of</strong> Great Brita<strong>in</strong> and Northern Ireland<br />

1. By grant<strong>in</strong>g taxable persons the right to deduct <strong>VAT</strong> on certa<strong>in</strong><br />

supplies <strong>of</strong> fuel to non-taxable persons, contrary to the<br />

provisions <strong>of</strong> Articles 17(2)(a) and 18(1)(a) <strong>of</strong> the Sixth<br />

Directive [...], the United K<strong>in</strong>gdom <strong>of</strong> Great Brita<strong>in</strong> and Northern<br />

Ireland has failed to fulfil its obligations under that Directive;<br />

2. The United K<strong>in</strong>gdom <strong>of</strong> Great Brita<strong>in</strong> and Northern Ireland are<br />

ordered to pay the costs.<br />

[2005] ECR I-1865<br />

Case C-25/03<br />

21 April 2005<br />

HE (Hans U. Hundt-Eßwe<strong>in</strong>) – F<strong>in</strong>anzamt Bergisch Gladbach<br />

The Sixth Directive [...], both <strong>in</strong> its orig<strong>in</strong>al version and follow<strong>in</strong>g<br />

amendment by Directive 91/680/EEC [...], is to be <strong>in</strong>terpreted as<br />

follows:<br />

– where a person purchases a house, or has a house built, <strong>in</strong><br />

order to live <strong>in</strong> it with his family he is act<strong>in</strong>g as a taxable