BVCA Private Equity and Venture Capital ... - BVCA admin

BVCA Private Equity and Venture Capital ... - BVCA admin

BVCA Private Equity and Venture Capital ... - BVCA admin

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

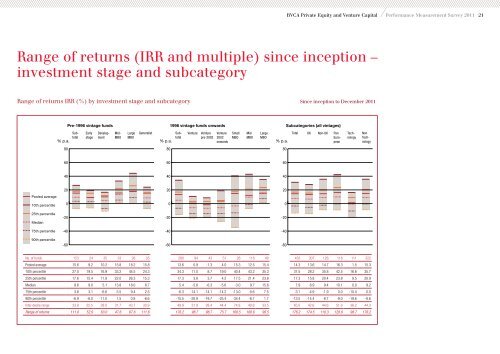

Range of returns (IRR <strong>and</strong> multiple) since inception –<br />

investment stage <strong>and</strong> subcategory<br />

Range of returns IRR (%) by investment stage <strong>and</strong> subcategory Since inception to December 2011<br />

Pooled average<br />

10th percentile<br />

25th percentile<br />

Median<br />

75th percentile<br />

90th percentile<br />

% p.a.<br />

80<br />

60<br />

40<br />

20<br />

0<br />

-20<br />

-40<br />

-60<br />

Pre-1996 vintage funds<br />

Subtotal<br />

Early<br />

stage<br />

Development<br />

Mid-<br />

MBO<br />

Large<br />

MBO<br />

Generalist<br />

% p.a.<br />

80<br />

60<br />

40<br />

20<br />

0<br />

-20<br />

-40<br />

-60<br />

1996 vintage funds onwards<br />

Subtotal<br />

<strong>Venture</strong><br />

No. of funds 153 24 35 33 26 35 280 94 43 51 28 118 40 433 307 126 118 111 322<br />

Pooled average 15.6 9.2 10.2 15.8 18.2 15.8 13.6 0.9 -1.3 4.0 15.3 12.5 15.4 14.3 13.6 14.7 16.3 1.5 15.3<br />

10th percentile 27.0 19.5 16.9 33.2 44.5 24.3 34.3 11.0 8.7 19.0 40.4 43.2 35.3 31.5 28.2 35.8 42.5 16.6 35.7<br />

25th percentile 17.6 15.4 11.9 22.0 26.3 15.3 17.3 3.8 3.7 4.2 17.5 21.4 23.8 17.3 15.8 20.4 23.8 9.5 20.9<br />

Median 9.6 9.0 5.1 13.8 18.0 8.7 5.4 -5.6 -6.3 -5.6 -3.0 9.7 15.6 7.9 6.9 9.4 10.1 0.0 9.2<br />

75th percentile 3.8 3.1 -6.6 5.5 9.4 2.5 -6.3 -14.1 -14.1 -14.2 -13.0 -0.6 7.5 -3.1 -4.9 -1.9 0.0 -10.4 0.0<br />

90th percentile -6.9 -6.0 -11.0 1.5 0.8 -6.6 -15.5 -20.9 -19.7 -25.4 -34.4 -6.7 1.7 -13.5 -14.4 -8.7 -9.0 -19.6 -8.6<br />

Inter-decile range 33.8 25.5 28.0 31.7 43.7 30.9 49.9 31.9 28.4 44.4 74.8 49.8 33.5 45.0 42.6 44.6 51.6 36.2 44.3<br />

Range of returns 111.6 52.9 63.0 47.6 67.6 111.6 176.2 98.7 98.7 75.7 168.5 108.6 96.5 176.2 174.5 110.3 120.9 98.7 176.2<br />

<strong>Venture</strong><br />

pre-2002<br />

<strong>Venture</strong><br />

2002<br />

onwards<br />

Small<br />

MBO<br />

Mid<br />

MBO<br />

Large<br />

MBO<br />

% p.a.<br />

80<br />

60<br />

40<br />

20<br />

0<br />

-20<br />

-40<br />

-60<br />

<strong>BVCA</strong> <strong>Private</strong> <strong>Equity</strong> <strong>and</strong> <strong>Venture</strong> <strong>Capital</strong> Performance Measurement Survey 2011 21<br />

Subcategories (all vintages)<br />

Total<br />

UK<br />

Non-UK Pan<br />

European<br />

Technology<br />

Non<br />

Technology