BVCA Private Equity and Venture Capital ... - BVCA admin

BVCA Private Equity and Venture Capital ... - BVCA admin

BVCA Private Equity and Venture Capital ... - BVCA admin

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

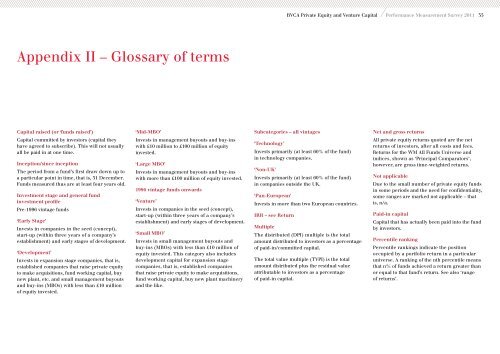

Appendix II – Glossary of terms<br />

<strong>Capital</strong> raised (or ‘funds raised’)<br />

<strong>Capital</strong> committed by investors (capital they<br />

have agreed to subscribe). This will not usually<br />

all be paid in at one time.<br />

Inception/since inception<br />

The period from a fund’s first draw down up to<br />

a particular point in time, that is, 31 December.<br />

Funds measured thus are at least four years old.<br />

Investment stage <strong>and</strong> general fund<br />

investment profile<br />

Pre-1996 vintage funds<br />

‘Early Stage’<br />

Invests in companies in the seed (concept),<br />

start-up (within three years of a company’s<br />

establishment) <strong>and</strong> early stages of development.<br />

‘Development’<br />

Invests in expansion stage companies, that is,<br />

established companies that raise private equity<br />

to make acquisitions, fund working capital, buy<br />

new plant, etc. <strong>and</strong> small management buyouts<br />

<strong>and</strong> buy-ins (MBOs) with less than £10 million<br />

of equity invested.<br />

‘Mid-MBO’<br />

Invests in management buyouts <strong>and</strong> buy-ins<br />

with £10 million to £100 million of equity<br />

invested.<br />

‘Large MBO’<br />

Invests in management buyouts <strong>and</strong> buy-ins<br />

with more than £100 million of equity invested.<br />

1996 vintage funds onwards<br />

‘<strong>Venture</strong>’<br />

Invests in companies in the seed (concept),<br />

start-up (within three years of a company’s<br />

establishment) <strong>and</strong> early stages of development.<br />

‘Small MBO’<br />

Invests in small management buyouts <strong>and</strong><br />

buy-ins (MBOs) with less than £10 million of<br />

equity invested. This category also includes<br />

development capital for expansion stage<br />

companies, that is, established companies<br />

that raise private equity to make acquisitions,<br />

fund working capital, buy new plant machinery<br />

<strong>and</strong> the like.<br />

<strong>BVCA</strong> <strong>Private</strong> <strong>Equity</strong> <strong>and</strong> <strong>Venture</strong> <strong>Capital</strong> Performance Measurement Survey 2011 35<br />

Subcategories – all vintages<br />

‘Technology’<br />

Invests primarily (at least 60% of the fund)<br />

in technology companies.<br />

‘Non-UK’<br />

Invests primarily (at least 60% of the fund)<br />

in companies outside the UK.<br />

‘Pan-European’<br />

Invests in more than two European countries.<br />

IRR – see Return<br />

Multiple<br />

The distributed (DPI) multiple is the total<br />

amount distributed to investors as a percentage<br />

of paid-in/committed capital.<br />

The total value multiple (TVPI) is the total<br />

amount distributed plus the residual value<br />

attributable to investors as a percentage<br />

of paid-in capital.<br />

Net <strong>and</strong> gross returns<br />

All private equity returns quoted are the net<br />

returns of investors, after all costs <strong>and</strong> fees.<br />

Returns for the WM All Funds Universe <strong>and</strong><br />

indices, shown as ‘Principal Comparators’,<br />

however, are gross time-weighted returns.<br />

Not applicable<br />

Due to the small number of private equity funds<br />

in some periods <strong>and</strong> the need for confidentiality,<br />

some ranges are marked not applicable – that<br />

is, n/a.<br />

Paid-in capital<br />

<strong>Capital</strong> that has actually been paid into the fund<br />

by investors.<br />

Percentile ranking<br />

Percentile rankings indicate the position<br />

occupied by a portfolio return in a particular<br />

universe. A ranking of the nth percentile means<br />

that n% of funds achieved a return greater than<br />

or equal to that fund’s return. See also ‘range<br />

of returns’.