BVCA Private Equity and Venture Capital ... - BVCA admin

BVCA Private Equity and Venture Capital ... - BVCA admin

BVCA Private Equity and Venture Capital ... - BVCA admin

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>BVCA</strong> <strong>Private</strong> <strong>Equity</strong> <strong>and</strong> <strong>Venture</strong> <strong>Capital</strong> Performance Measurement Survey 2011 37<br />

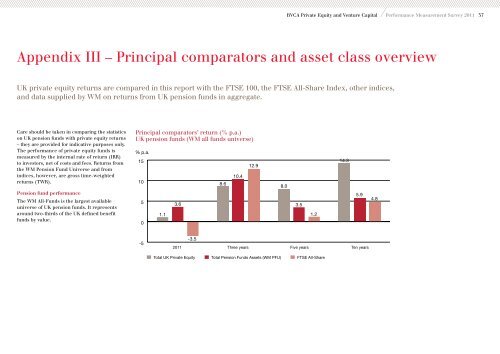

Appendix III – Principal comparators <strong>and</strong> asset class overview<br />

UK private equity returns are compared in this report with the FTSE 100, the FTSE All-Share Index, other indices,<br />

<strong>and</strong> data supplied by WM on returns from UK pension funds in aggregate.<br />

Care should be taken in comparing the statistics<br />

on UK pension funds with private equity returns<br />

– they are provided for indicative purposes only.<br />

The performance of private equity funds is<br />

measured by the internal rate of return (IRR)<br />

to investors, net of costs <strong>and</strong> fees. Returns from<br />

the WM Pension Fund Universe <strong>and</strong> from<br />

indices, however, are gross time-weighted<br />

returns (TWR).<br />

Pension fund performance<br />

The WM All-Funds is the largest available<br />

universe of UK pension funds. It represents<br />

around two-thirds of the UK defined benefit<br />

funds by value.<br />

Principal comparators’ return (% p.a.)<br />

UK pension funds (WM all funds universe)<br />

% p.a.<br />

15<br />

10<br />

5<br />

0<br />

-5<br />

1.1<br />

3.6<br />

2011<br />

-3.5<br />

8.6<br />

10.4<br />

12.9<br />

Three years Five years Ten years<br />

Total UK <strong>Private</strong> <strong>Equity</strong> Total Pension Funds Assets (WM PFU) FTSE All-Share<br />

8.0<br />

3.5<br />

1.2<br />

14.3<br />

5.9<br />

4.8