BVCA Private Equity and Venture Capital ... - BVCA admin

BVCA Private Equity and Venture Capital ... - BVCA admin

BVCA Private Equity and Venture Capital ... - BVCA admin

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

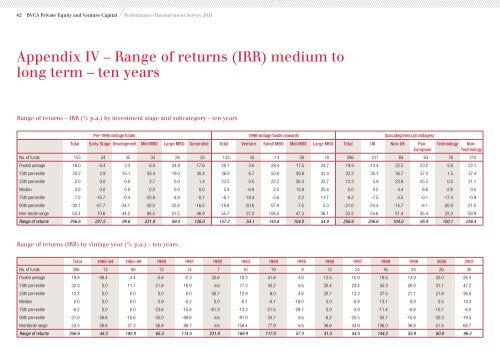

42 <strong>BVCA</strong> <strong>Private</strong> <strong>Equity</strong> <strong>and</strong> <strong>Venture</strong> <strong>Capital</strong> Performance Measurement Survey 2011<br />

Appendix IV – Range of returns (IRR) medium to<br />

long term – ten years<br />

Range of returns – IRR (% p.a.) by investment stage <strong>and</strong> subcategory – ten years<br />

Pre-1996 vintage funds 1996 vintage funds onwards Subcategories (all vintages)<br />

Total Early Stage Development Mid-MBO Large MBO Generalist Total <strong>Venture</strong> Small MBO Mid-MBO Large MBO Total UK Non-UK Pan- Technology Non-<br />

European<br />

Technology<br />

No. of funds 153 24 35 33 26 35 133 43 14 58 18 286 217 69 63 76 210<br />

Pooled average 16.0 -0.4 -3.3 6.0 24.8 17.6 20.1 -3.6 29.4 17.5 24.7 19.9 13.4 22.5 23.2 -3.6 22.1<br />

10th percentile 24.2 2.9 10.1 58.4 19.0 30.4 36.9 6.7 50.0 39.8 41.4 32.3 30.1 36.7 37.3 1.5 37.4<br />

25th percentile 0.0 0.0 0.0 3.7 0.0 1.4 23.5 0.0 22.2 26.3 33.7 12.3 5.9 23.9 25.2 0.0 21.1<br />

Median 0.0 0.0 0.0 0.0 0.0 0.0 5.4 -6.9 2.5 13.8 25.4 0.0 0.0 4.4 8.6 -2.6 0.0<br />

75th percentile -7.0 -16.7 -0.4 -20.9 -4.9 -0.1 -6.1 -18.4 -3.6 3.2 11.7 -6.2 -7.5 -3.5 -0.1 -17.4 -0.9<br />

90th percentile -30.1 -67.7 -34.1 -30.0 -32.6 -16.5 -18.8 -20.6 -57.9 -7.5 5.3 -21.0 -24.4 -14.7 -8.1 -20.9 -21.5<br />

Inter-decile range 54.3 70.6 44.2 88.5 51.5 46.9 55.7 27.2 108.0 47.3 36.1 53.3 54.6 51.4 45.4 22.3 58.9<br />

Range of returns 256.6 227.5 89.6 231.9 99.0 126.0 157.3 54.1 145.6 104.0 54.9 256.6 256.6 104.0 95.9 100.1 256.4<br />

Range of returns (IRR) by vintage year (% p.a.) – ten years<br />

Total 1980-84 1985-89 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001<br />

No. of funds 286 13 68 13 14 7 10 19 9 13 24 16 24 26 30<br />

Pooled average 19.9 -98.4 4.4 -5.8 -2.3 33.6 18.3 41.8 4.8 12.5 10.9 19.5 14.9 20.0 26.3<br />

10th percentile 32.3 0.0 11.7 21.8 18.9 n/a 77.3 43.2 n/a 30.4 23.4 55.3 26.0 31.1 47.2<br />

25th percentile 12.3 0.0 0.0 0.0 0.0 56.7 12.9 8.0 4.8 20.7 12.3 37.5 21.1 21.8 36.0<br />

Median 0.0 0.0 0.0 -3.9 -0.2 0.0 -0.1 -0.1 -19.0 5.0 -0.8 13.1 8.9 0.5 14.3<br />

75th percentile -6.2 0.0 0.0 -23.6 -15.8 -61.3 -13.3 -21.5 -29.7 0.0 -3.9 -11.4 -6.8 -10.7 -6.0<br />

90th percentile -21.0 -26.6 -15.6 -35.0 -69.8 n/a -81.0 -34.7 n/a -6.2 -20.5 -50.7 -10.9 -20.3 -19.5<br />

Interdecile range 53.3 26.6 27.3 56.8 88.7 n/a 158.4 77.9 n/a 36.6 43.9 106.0 36.8 51.5 66.7<br />

Range of returns 256.6 44.3 192.9 65.3 114.5 231.9 169.9 117.0 57.3 41.3 54.5 144.2 55.9 80.8 96.3