Iran Sanctions - Foreign Press Centers

Iran Sanctions - Foreign Press Centers

Iran Sanctions - Foreign Press Centers

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Iran</strong> <strong>Sanctions</strong><br />

“backfilling” are few, to date. Most of the companies that might backfill abandoned projects are<br />

perceived as not being as technically capable as those that have withdrawn from <strong>Iran</strong>.<br />

To try to mitigate the trend in <strong>Iran</strong> has been that the “backfill” is being conducted by domestic<br />

companies, particularly those controlled or linked to the Revolutionary Guard (IRGC). Deals with<br />

Polish and Russian firms fell apart in late 2011, and their projects reportedly were taken over by<br />

domestic <strong>Iran</strong>ian firms. Still, backfill by <strong>Iran</strong>ian firms has potential pitfalls because foreign firms<br />

are reluctant to partner with IRGC firms, which are increasingly targeted by international<br />

sanctions. In July 2010, after the enactment of Resolution 1929 and CISADA, the Revolutionary<br />

Guard’s main construction affiliate, Khatem ol-Anbiya, announced it had withdrawn from<br />

developing Phases 15 and 16 of South Pars—a project worth $2 billion. 58 Khatem ol-Anbiya took<br />

over that project in 2006 when Norway’s Kvaerner pulled out of it.<br />

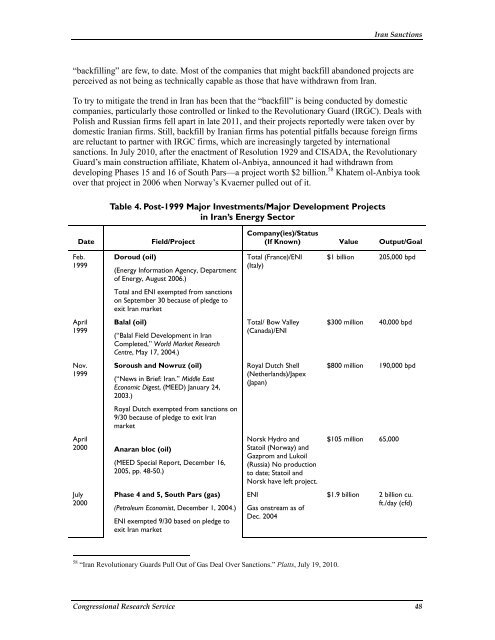

Table 4. Post-1999 Major Investments/Major Development Projects<br />

in <strong>Iran</strong>’s Energy Sector<br />

Date Field/Project<br />

Feb.<br />

1999<br />

April<br />

1999<br />

Nov.<br />

1999<br />

Doroud (oil)<br />

(Energy Information Agency, Department<br />

of Energy, August 2006.)<br />

Total and ENI exempted from sanctions<br />

on September 30 because of pledge to<br />

exit <strong>Iran</strong> market<br />

Balal (oil)<br />

(“Balal Field Development in <strong>Iran</strong><br />

Completed,” World Market Research<br />

Centre, May 17, 2004.)<br />

Soroush and Nowruz (oil)<br />

(“News in Brief: <strong>Iran</strong>.” Middle East<br />

Economic Digest, (MEED) January 24,<br />

2003.)<br />

Royal Dutch exempted from sanctions on<br />

9/30 because of pledge to exit <strong>Iran</strong><br />

market<br />

April<br />

2000 Anaran bloc (oil)<br />

(MEED Special Report, December 16,<br />

2005, pp. 48-50.)<br />

July<br />

2000<br />

Phase 4 and 5, South Pars (gas)<br />

(Petroleum Economist, December 1, 2004.)<br />

ENI exempted 9/30 based on pledge to<br />

exit <strong>Iran</strong> market<br />

Company(ies)/Status<br />

(If Known) Value Output/Goal<br />

Total (France)/ENI<br />

(Italy)<br />

Total/ Bow Valley<br />

(Canada)/ENI<br />

Royal Dutch Shell<br />

(Netherlands)/Japex<br />

(Japan)<br />

Norsk Hydro and<br />

Statoil (Norway) and<br />

Gazprom and Lukoil<br />

(Russia) No production<br />

to date; Statoil and<br />

Norsk have left project.<br />

ENI<br />

Gas onstream as of<br />

Dec. 2004<br />

58 “<strong>Iran</strong> Revolutionary Guards Pull Out of Gas Deal Over <strong>Sanctions</strong>.” Platts, July 19, 2010.<br />

$1 billion 205,000 bpd<br />

$300 million 40,000 bpd<br />

$800 million 190,000 bpd<br />

$105 million 65,000<br />

$1.9 billion 2 billion cu.<br />

ft./day (cfd)<br />

Congressional Research Service 48