Iran Sanctions - Foreign Press Centers

Iran Sanctions - Foreign Press Centers

Iran Sanctions - Foreign Press Centers

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

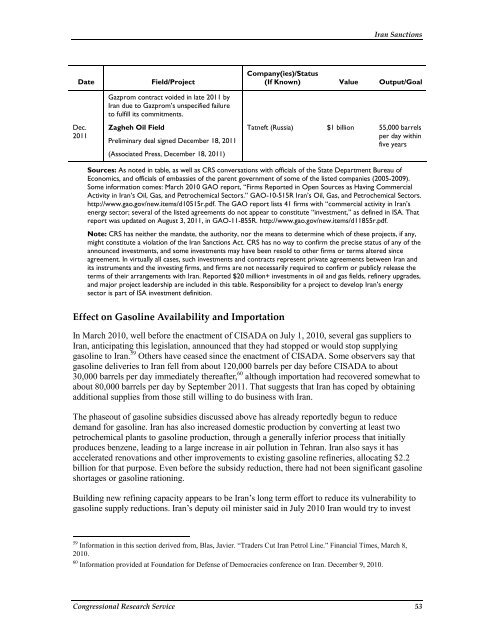

Date Field/Project<br />

Dec.<br />

2011<br />

Gazprom contract voided in late 2011 by<br />

<strong>Iran</strong> due to Gazprom’s unspecified failure<br />

to fulfill its commitments.<br />

Zagheh Oil Field<br />

Preliminary deal signed December 18, 2011<br />

(Associated <strong>Press</strong>, December 18, 2011)<br />

<strong>Iran</strong> <strong>Sanctions</strong><br />

Company(ies)/Status<br />

(If Known) Value Output/Goal<br />

Tatneft (Russia) $1 billion 55,000 barrels<br />

per day within<br />

five years<br />

Sources: As noted in table, as well as CRS conversations with officials of the State Department Bureau of<br />

Economics, and officials of embassies of the parent government of some of the listed companies (2005-2009).<br />

Some information comes: March 2010 GAO report, “Firms Reported in Open Sources as Having Commercial<br />

Activity in <strong>Iran</strong>’s Oil, Gas, and Petrochemical Sectors.” GAO-10-515R <strong>Iran</strong>’s Oil, Gas, and Petrochemical Sectors.<br />

http://www.gao.gov/new.items/d10515r.pdf. The GAO report lists 41 firms with “commercial activity in <strong>Iran</strong>’s<br />

energy sector; several of the listed agreements do not appear to constitute “investment,” as defined in ISA. That<br />

report was updated on August 3, 2011, in GAO-11-855R. http://www.gao.gov/new.items/d11855r.pdf.<br />

Note: CRS has neither the mandate, the authority, nor the means to determine which of these projects, if any,<br />

might constitute a violation of the <strong>Iran</strong> <strong>Sanctions</strong> Act. CRS has no way to confirm the precise status of any of the<br />

announced investments, and some investments may have been resold to other firms or terms altered since<br />

agreement. In virtually all cases, such investments and contracts represent private agreements between <strong>Iran</strong> and<br />

its instruments and the investing firms, and firms are not necessarily required to confirm or publicly release the<br />

terms of their arrangements with <strong>Iran</strong>. Reported $20 million+ investments in oil and gas fields, refinery upgrades,<br />

and major project leadership are included in this table. Responsibility for a project to develop <strong>Iran</strong>’s energy<br />

sector is part of ISA investment definition.<br />

Effect on Gasoline Availability and Importation<br />

In March 2010, well before the enactment of CISADA on July 1, 2010, several gas suppliers to<br />

<strong>Iran</strong>, anticipating this legislation, announced that they had stopped or would stop supplying<br />

gasoline to <strong>Iran</strong>. 59 Others have ceased since the enactment of CISADA. Some observers say that<br />

gasoline deliveries to <strong>Iran</strong> fell from about 120,000 barrels per day before CISADA to about<br />

30,000 barrels per day immediately thereafter, 60 although importation had recovered somewhat to<br />

about 80,000 barrels per day by September 2011. That suggests that <strong>Iran</strong> has coped by obtaining<br />

additional supplies from those still willing to do business with <strong>Iran</strong>.<br />

The phaseout of gasoline subsidies discussed above has already reportedly begun to reduce<br />

demand for gasoline. <strong>Iran</strong> has also increased domestic production by converting at least two<br />

petrochemical plants to gasoline production, through a generally inferior process that initially<br />

produces benzene, leading to a large increase in air pollution in Tehran. <strong>Iran</strong> also says it has<br />

accelerated renovations and other improvements to existing gasoline refineries, allocating $2.2<br />

billion for that purpose. Even before the subsidy reduction, there had not been significant gasoline<br />

shortages or gasoline rationing.<br />

Building new refining capacity appears to be <strong>Iran</strong>’s long term effort to reduce its vulnerability to<br />

gasoline supply reductions. <strong>Iran</strong>’s deputy oil minister said in July 2010 <strong>Iran</strong> would try to invest<br />

59<br />

Information in this section derived from, Blas, Javier. “Traders Cut <strong>Iran</strong> Petrol Line.” Financial Times, March 8,<br />

2010.<br />

60<br />

Information provided at Foundation for Defense of Democracies conference on <strong>Iran</strong>. December 9, 2010.<br />

Congressional Research Service 53