IB Econ Study Guide Internationals - Sunny Hills High School

IB Econ Study Guide Internationals - Sunny Hills High School

IB Econ Study Guide Internationals - Sunny Hills High School

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

108<br />

Demand for foreign<br />

lmagine the world consisting of only two countries, Japan<br />

and Australia. The Japanese currency is the yen (JPY) and<br />

the Australian currency is the Australian dollar (AUD). In this<br />

simplified setup the question is: who demands Australian<br />

dollars in the foreign exchange market? The answer is a<br />

lapanese entity (household or firm) which does not have<br />

Australian dollars but needs them.<br />

Why would a Japanese entity need Australian dollars? Some<br />

basic reasons include:<br />

A Japanese company planning to purchase Australian<br />

wool or iron ore (export of a good).<br />

A Japanese couple planning to visit Uluru in central<br />

Australia where the second largest monolith in the world<br />

is located (export of a service - tourism).<br />

A resident of Japan wishing to make a savings deposit in<br />

Australian dollars or to buy Australian government bonds<br />

(an investment into Australia).<br />

A resident of Japan wishing to buy shares in an Australian<br />

mining company (an investment into Australia).<br />

. A Japanese company establishing a presence in Australia<br />

(an investment into Australia).<br />

More generally, any foreigner wishing to buy Australian<br />

goods and services or to make investments in Australia will<br />

need to buy Australian dollars. The first two reasons are<br />

related to international trade flows whereas the rest are<br />

related to international investment flows.<br />

In summary<br />

. The demand and supply of currencies in foreign exchange<br />

markets reflect internationaltrade flows and crossborder<br />

investment flows.<br />

. The demand for a country's currency reflects the value of<br />

its exports of goods and services as well as the inflow of<br />

investments into the country<br />

Exchange rate<br />

To simplify the analysis letl assume that there are no<br />

cross-border investments so that only exports and imports<br />

of goods and servrces (trade f,ows) create a reed to<br />

exchange currencies. We'll take the example of the Us<br />

and the EU15 (the 15 countries in the European Union<br />

before the expansion on 1 May 2004). Americans demand<br />

euros to buy EU15 goods and services and Europeans<br />

supply euros to buy (dollars and thus) American goods<br />

and services (Fig. 4.1 0).<br />

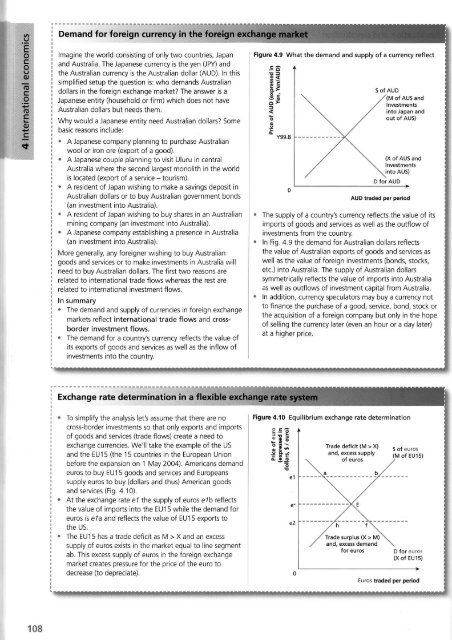

At the exchange raie e7 the supply of euros e/b reflects<br />

the value of imports into the FU15 while the demand for<br />

euros is e7a and reflects the value of EU15 exports to<br />

the US.<br />

The EU15 has a trade deficit as M > X and an excess<br />

supply of euros exists in the market equal to line segment<br />

ab. This excess supply of euros ln the foreign exchange<br />

market creates pressure for the price of the euro to<br />

.la.ra>