IB Econ Study Guide Internationals - Sunny Hills High School

IB Econ Study Guide Internationals - Sunny Hills High School

IB Econ Study Guide Internationals - Sunny Hills High School

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The terms strictly refer to offlc,a/ changes in the price (the<br />

value) of a currency in a f,ixed exchange rate system.<br />

More specifically, a currency devalues if its official price<br />

decreases within a fixed exchange rate system. A currency<br />

revalues if its official Drice increases within a fixed<br />

exchanoe rate svstem.<br />

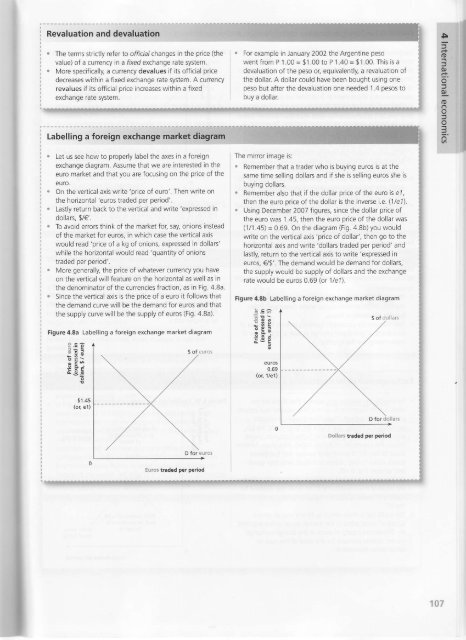

Let us see how to properly label ihe axes in a foreign<br />

exchange diagram. Assume that we are interested in the<br />

euro market and that you are focusing on the price of the<br />

euro.<br />

on the vertical axis write 'price of euro'. Then write on<br />

the horizontal 'euros traded oer oeriod'.<br />

Lastly return back to the vertical and write 'expressed in<br />

dollars, $/€'.<br />

To avoid errors think of the market for. say, onions instead<br />

of the market for euros, in which case the vertical axis<br />

would read 'price of a kg of onions, expressed in dollars'<br />

while the horizontal would read 'quantity of onions<br />

traded Der oeriod'.<br />

l\4ore generally, the price of whatever currency you have<br />

on the vertical will {eature on the horizontal as well as in<br />

the denominator of the currencies fraction, as in Fig. 4.8a.<br />

Since the vertical axis is the price of a euro it follows that<br />

the demand curve will be the demand for euros and that<br />

the supply curve will be the supply of euros (Fig, 4,8a).<br />

Figure 4.8a Labelling a foreign exchange market diagram<br />

:*d<br />

.E Sc<br />

a -9 -g E<br />

$1.4s<br />

(or, el)<br />

Euros traded per period<br />

. For example in January 2002 the Argentine peso<br />

went from P 1.00 = $1.00 to P 1.40 = $1.00. This is a<br />

devaluation of the peso or, equivalently, a revaluation of<br />

the dollar A dollar could have been bought using one<br />

peso but after the devaluation one needed 1.4 pesos to<br />

buy a dollar.<br />

The mirror image is:<br />

Remember that a trader who is buying euros is at the<br />

same time selling dollars and if she is selling euros she is<br />

buying dollars.<br />

Remember also that if the dollar price of the euro is e/,<br />

then the euro price of the dollar is the inverse i.e. (1/e7).<br />

Using December 2007 figures, since the dollar price of<br />

the euro was 1.45, then the euro price of the dollar was<br />

(1/1 .45) = o.69. On the diagram (Fig. 4.8b) you would<br />

write on the vertical axis 'price of dollar', then go to the<br />

horizontal axis and write 'dollars traded oer Deriod' and<br />

lastly, return to the vertical axis to write 'expressed in<br />

euros, €/$'. The demand would be demand for dollars,<br />

the supply would be supply of dollars and the exchange<br />

rate would be euros 0.69 (or]/e7).<br />

Figure 4.8b Labelling a foreign exchange market diagram<br />

ir-<br />

:fe<br />

ogf,<br />

#sp<br />

euros<br />

0.69<br />

{o[ 1/e1)<br />

s ol dolla15<br />

Dollars traded p€r poriod