IB Econ Study Guide Internationals - Sunny Hills High School

IB Econ Study Guide Internationals - Sunny Hills High School

IB Econ Study Guide Internationals - Sunny Hills High School

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Why do exchange rates<br />

Factors that may affect trade flows: changes in relative<br />

inflation rates<br />

. lf inflation in a country accelerates it means that prices in<br />

that country are rising on average fasler than they dld. As<br />

a result its products will become less and less competitive<br />

aDroao.<br />

. lts exports will decrease and so will the demand for its<br />

currency in foreign exchange markets. ln addition, foreign<br />

products (imports) will now seem relatively more attractive<br />

to domestic househo ds. lmport spending will tend to rise<br />

and thus supply of iG currency in foreign exchange markets<br />

(as they will need more dollars to pay for these imports).<br />

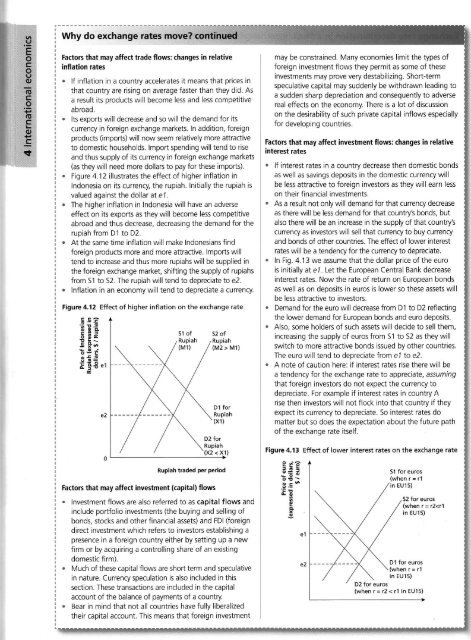

. Figure 4.12 illustrates the effect of higher inflation in<br />

lndonesia on its currency, the rupiah. Initially the rupiah is<br />

valued against the dollar at e7.<br />

. The higher inflation in Indonesia will have an adverse<br />

effect on its exports as they will become less competitive<br />

abroad and thus decrease. decreasing the demand for the<br />

rupiah from D1 to D2.<br />

. At the same time inflation will make Indonesians find<br />

foreign products more and more attradive. lmporls will<br />

tend to increase and thus more rupiahs wlll be supplied in<br />

the foreign exchange market, shifting the supply of rupiahs<br />

from 51 to 52. The rupiah wlll tend to depreciate to e2.<br />

. Inflatlon in an economy will tend to depreciate a currency.<br />

Figure 4.12 Effect of higher inflation on the exchange rate<br />

-E FE<br />

may be constrained. Many economies limit the types of<br />

foreign investment flows they permit as some of these<br />

investments may prove very destabilizing. Short-term<br />

speculative capital may suddenly be withdrawn leading to<br />

a sudden sharp depreciation and consequently to adverse<br />

real effects on the economy. There rs a lot of discussion<br />

on the desirability of such private capital inflows especially<br />

for developing countries.<br />

Factors that may affect investment tlows: changes in relative<br />

interest lates<br />

. lf interest rates in a country decrease then domestic bonds<br />

as well as savings deposits in the domestic currency will<br />

be less attractive to foreign investors as they will earn less<br />

on their financial investments.<br />

. As a result not only will demand for that currency decrease<br />

as there will be less demand for that country's bonds, but<br />

also there will be an increase in the supply of that countryS<br />

currency as investors will sell that currency to buy currency<br />

and bonds of other countries. The effect of lower interest<br />

rates will be a tendenry for the currency to depreciate.<br />

. In Fig. 4.13 we assume that the dollar price of the euro<br />

is inilially at e 7. Let the European Central Bank decrease<br />

interest rates. Now the rate of return on European bonds<br />

as well as on deposits in euros is lower so these assets will<br />

be less attractive to investors.<br />

. Demand for the euro will decrease from D1 to D2 reflecting<br />

the lower demand for European bonds and euro deposits.<br />

. Also, some holders of such assets will decide to sell them,<br />

: .6<br />

E99'<br />

!4E"'<br />

51 of<br />

(M1)<br />

Rupiah<br />

(M2 > M1)<br />

increasing the supply of euros from s1 to s2 as they will<br />

switch to more attract ve bonds issued by other countries.<br />

The euro will tend to depreciate from e/ to e2.<br />

. A note of caution here: if interest rates rise there will be<br />

a tendency for the exchange rate to appreciate, assum,hg<br />

that foreign inveslors do not exoect the cLrrency to<br />

depreciate. For example if interest rates in country A<br />

rise then investors will not flock into that country if they<br />

expect its currency to depreciate. 50 interest rates do<br />

matter but so does the expectation about the future path<br />

of the exchange rate itself.<br />

(x2 <<br />

Rupiah traded Per Period<br />

Factors that may affect investment (capital) flows<br />

. lnvestment flows are also referred to as capital flows and<br />

lnclude porffolio investments (the buying and selling of<br />

bonds, stocks and other financial assets) and FDI (foreign<br />

direct jnvestment which refers to investors establishing a<br />

presence in a foreign country eilher by setting up a new<br />

firm or by acqulring a controlling share of an existing<br />

domestic firm).<br />

. l\y'uch of these capital flows are shorl term and specuiative<br />

in nature. Currency speculation is also included in this<br />

section. These transactions are included ln the capital<br />

account of the balance of payments of a country<br />

. Bear in mind that not all countries have fully liberalized<br />

their capital account. Thrs means that foreign investment<br />

Figure 4.13 Effect of lower interest rates on the exchange rate<br />

EE<br />

E<br />

g<br />

Sl for euros<br />

52 for euros<br />

in EUl s)<br />

D1 for euros<br />

in EU15)<br />

D2 Jor euros<br />

(when r = 12 < rl in EU15)