IB Econ Study Guide Internationals - Sunny Hills High School

IB Econ Study Guide Internationals - Sunny Hills High School

IB Econ Study Guide Internationals - Sunny Hills High School

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Exchange rates<br />

The exchange rate of a currency is defined as the price (the value) of a cunency expressed<br />

in terms of another currency. For example, in December 2007, the euro3 exchange rate was<br />

$1.45. one needed 1.45 US dollars to purchase one euro.<br />

Foreign exchange<br />

A foreign exchange market is a market in which<br />

currencies are exchanged for other currencies. An<br />

example is the market where euros and dollars are traded.<br />

This is a 24-hour, 365 days a year world market that is<br />

a good example of a perfectly competitive market: the<br />

'good' is homogeneous as it makes no difference whether<br />

a dollar is bought in Frankfurt or singapore or London;<br />

there are very many buyers and sellers of currencies (all<br />

major world banks participate, non-financial corporations<br />

as well financial corporations such as pension funds,<br />

insurance companies, hedge funds, etc.) with no player<br />

being large enough to influence the market price of a<br />

Floating, fixed and<br />

A currency is traded in a floating (or flexible) exchange<br />

rate system if market forces alone without any<br />

government or central bank intervention determine its<br />

value. The dollar, the euro and the British pound all float<br />

against each other.<br />

A fixed exchange rate system refers to the case where<br />

the exchange rate is set and maintained at some level by<br />

the government (or the central bank) of a country China<br />

maintained its currency, the yuan (officially the renminbi<br />

Appreciation and<br />

currency; no entry barriers into the market exist as any<br />

new bank or corporate financial<br />

or non-financial major can enter and participale, and<br />

this market comes closest to perfect information as any<br />

new piece of information is available to all participants<br />

in real time.<br />

A distinctive characteristic of this market is that all buyers<br />

are at the same time sellers also and vice versa. Also, if<br />

the price of currency A expressed in terms of currency<br />

B is e then the price of currency B expressed in terms of<br />

currency A is (1/e).<br />

or RMB), fixed against the dollar between 1994 and 21<br />

July 2005 at RMB 8.28 per dollar.<br />

. A managed exchange rate system is one where there<br />

is no pre-announced level but either the exchange rate is<br />

allowed to float within some uooer and lower bound or a<br />

system in which authorities intervene when they consider<br />

the direction or the speed of adjuslment of the currency<br />

as undesirable. Since July 2005 the renminbi has been in a<br />

managed float with reference to a basket of currencies.<br />

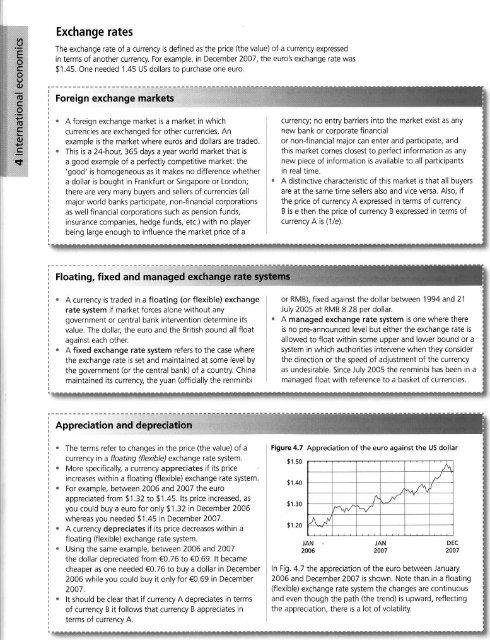

The terms refer to changes in the price (the value) of a Figure 4.7 Appreciation of the euro against the US dollar<br />

currency in a //oatlng (flexible) exchange rate system.<br />

More specifically, a currency appreciates il iIs price<br />

$1.50<br />

increases within a floating (flexible) exchange rate system.<br />

For example, between 2006 and 2007 the euro<br />

$1.40<br />

appreciated from $1 .32 to $1.45. lts price increased, as<br />

you could buy a euro for only $1.32 in December 2006<br />

$1.30<br />

whereas you needed $1.45 in December 2007.<br />

A currency depreciates if its price decreases within a<br />

$1.20<br />

floating (flexible) exchange rate system.<br />

Using the same example, between 2006 and 2007<br />

the dollar depreciated from €0.76 to €0.69. lt became<br />

IAN<br />

2006<br />

IAN<br />

2007<br />

DEC<br />

2007<br />

cheaper as one needed €0.76 to buy a dollar in December ln Fig. 4.7 ihe appreciation of the euro between January<br />

2006 while you could buy it only for €0.69 in December 2006 and December 2007 is shown. Note than in a floating<br />

2007 .<br />

(flexible) exchange rate system the changes are continuous<br />

It should be clear that if currency A depreciates in terms and even though the path (1he trend) is upward, reflecting<br />

of currency B it follows that currency B appreciates in<br />

terms of currency A.<br />

the appreciation, there is a lot of volatility.