IB Econ Study Guide Internationals - Sunny Hills High School

IB Econ Study Guide Internationals - Sunny Hills High School

IB Econ Study Guide Internationals - Sunny Hills High School

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Forms of protectionism<br />

Protectionism can take various forms. The most common forms are: tariffs, quotas, voluntary<br />

export restraints, subsidies, regulatory barriers (product standards), as well as a host of<br />

other measures such as antidumping duties, exchange controls, non-automatic import<br />

authorization (import licences), etc. Bear in mind that non-tariff barriers include those barriers<br />

that do not directly affect the price of the good.<br />

Tariffs<br />

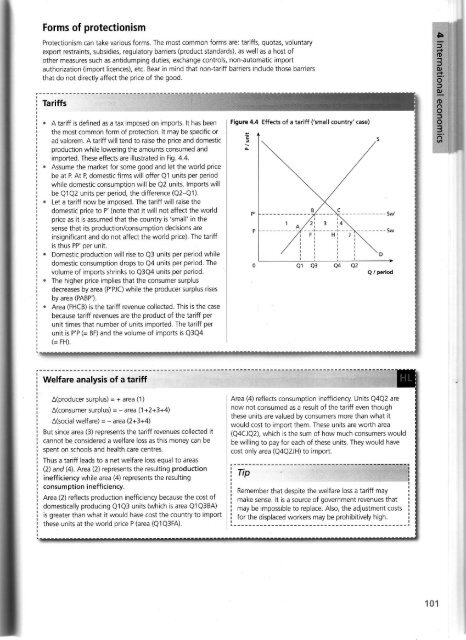

A tariff is defined as a tax imposed on imports. lt has been<br />

the most common form of protection. lt may be specific or<br />

ad valorem. A tariff will tend to raise the price and domestic<br />

production while lowering ihe amounts consumed and<br />

imported. These effects are illustrated in Fig.4.4.<br />

Assume the market for some good and let the world price<br />

be at P At B domestic firms will offer Q1 units per period<br />

while domestic consumption will be Q2 units. lmports will<br />

be Q'1Q2 units per period, the difference (Q2-Q1).<br />

Let a tariff now be imposed. The tariff will raise the<br />

domestic price to P' (note that it will not affect the world<br />

price as it is assumed that the country is'small' in the<br />

sense that its production/consumption decisions are<br />

insignificant and do not affect the world price). The tariff<br />

is thus PP' per unit.<br />

Domestic production will rise to Q3 units per period while<br />

domestic consumption drops to Q4 units per period. The<br />

volume of lmports shrinks to Q3Q4 units per period.<br />

The higher price implies that the consumer surplus<br />

decreases by area (P'PJC)while the producer surplus rises<br />

by area (PABP').<br />

Area (FHCB) is the tariff revenue collected. This is the case<br />

because tariff revenues are the product of the tariff per<br />

unit times that number of units imported. The tariff per<br />

unit is P'P (= BF) and the volume of imports is Q3Q4<br />

(= FH).<br />

Welfare analysis of a tariff<br />

A(producer surplus) = + area (1)<br />

A(consumer surplus) = - area (1+2+3+4)<br />

A(social welfare) = - area (2+3+4)<br />

But since area (3) represents the tariff revenues collected it<br />

cannot be considered a welfare loss as this money can be<br />

spent on schools and health care centres.<br />

Thus a tariff leads to a net welfare loss equal to areas<br />

(2) and (4). Nea (2) represents the resulting produdion<br />

inefficiency while area (4) represents the resulting<br />

consumption ineff iciency.<br />

Area (2) reflects production inefficiency because the cost of<br />

domestically producing Q1Q3 units (which is area Q1Q38A)<br />

is greater than what it would have cost the country to import<br />

these units at the world price P (area (Q1Q3FA).<br />

Figure 4,4 Effeds of a tariff ('small<br />

country'case)<br />

c ------------Sw'<br />

Q / period<br />

Area (4) reflects consumption inefficiency. Units Q4Q2 are<br />

now not consumed as a result of the tariff even though<br />

these units are valued by consumers more than what it<br />

would cost to import them. These units are worth area<br />

(Q4CJQ2), which is the sum of how much consumers would<br />

be willing to pay for each of these units. They would have<br />

cost only area (Q4Q2JH)to import.<br />

: Remember that despite the welfare toss a tariff may i<br />

I make sense. lt is a source of government revenues that i<br />

i may be impossible to replace. Also, the adjustment costs :<br />

i forthedisplacedworkersmaybeprohibitivelyhigh. i<br />

101