Stock Valuation

Stock Valuation

Stock Valuation

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

288 PART 2 Important Financial Concepts<br />

LG6<br />

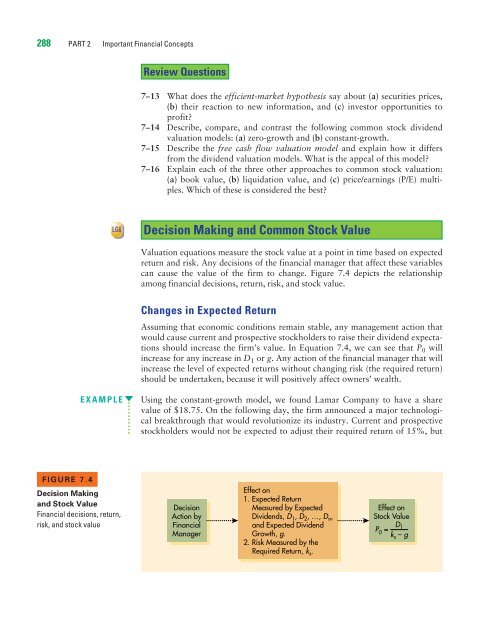

FIGURE 7.4<br />

Decision Making<br />

and <strong>Stock</strong> Value<br />

Financial decisions, return,<br />

risk, and stock value<br />

Review Questions<br />

7–13 What does the efficient-market hypothesis say about (a) securities prices,<br />

(b) their reaction to new information, and (c) investor opportunities to<br />

profit?<br />

7–14 Describe, compare, and contrast the following common stock dividend<br />

valuation models: (a) zero-growth and (b) constant-growth.<br />

7–15 Describe the free cash flow valuation model and explain how it differs<br />

from the dividend valuation models. What is the appeal of this model?<br />

7–16 Explain each of the three other approaches to common stock valuation:<br />

(a) book value, (b) liquidation value, and (c) price/earnings (P/E) multiples.<br />

Which of these is considered the best?<br />

Decision Making and Common <strong>Stock</strong> Value<br />

<strong>Valuation</strong> equations measure the stock value at a point in time based on expected<br />

return and risk. Any decisions of the financial manager that affect these variables<br />

can cause the value of the firm to change. Figure 7.4 depicts the relationship<br />

among financial decisions, return, risk, and stock value.<br />

Changes in Expected Return<br />

Assuming that economic conditions remain stable, any management action that<br />

would cause current and prospective stockholders to raise their dividend expectations<br />

should increase the firm’s value. In Equation 7.4, we can see that P 0 will<br />

increase for any increase in D 1 or g. Any action of the financial manager that will<br />

increase the level of expected returns without changing risk (the required return)<br />

should be undertaken, because it will positively affect owners’ wealth.<br />

EXAMPLE Using the constant-growth model, we found Lamar Company to have a share<br />

value of $18.75. On the following day, the firm announced a major technological<br />

breakthrough that would revolutionize its industry. Current and prospective<br />

stockholders would not be expected to adjust their required return of 15%, but<br />

Decision<br />

Action by<br />

Financial<br />

Manager<br />

Effect on<br />

1. Expected Return<br />

Measured by Expected<br />

Dividends, D 1, D 2, …, D n,<br />

and Expected Dividend<br />

Growth, g.<br />

2. Risk Measured by the<br />

Required Return, k s.<br />

Effect on<br />

<strong>Stock</strong> Value<br />

D1 P0 =<br />

ks – g