Stock Valuation

Stock Valuation

Stock Valuation

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

292 PART 2 Important Financial Concepts<br />

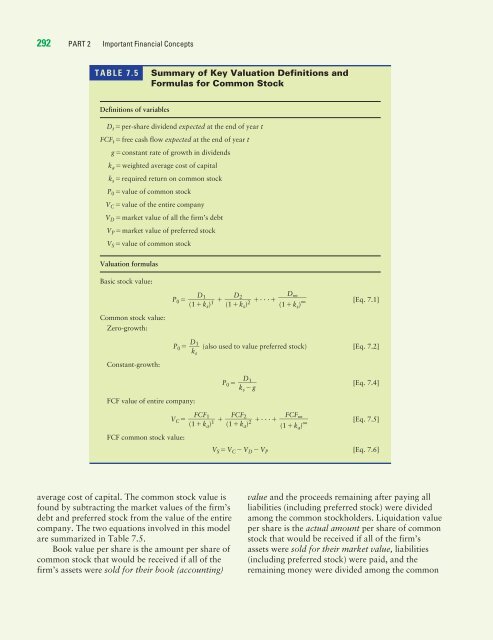

TABLE 7.5 Summary of Key <strong>Valuation</strong> Definitions and<br />

Formulas for Common <strong>Stock</strong><br />

Definitions of variables<br />

Dtper-share dividend expected at the end of year t<br />

FCFtfree cash flow expected at the end of year t<br />

gconstant rate of growth in dividends<br />

kaweighted average cost of capital<br />

ksrequired return on common stock<br />

P0value of common stock<br />

VCvalue of the entire company<br />

VDmarket value of all the firm’s debt<br />

VPmarket value of preferred stock<br />

VSvalue of common stock<br />

<strong>Valuation</strong> formulas<br />

Basic stock value:<br />

Common stock value:<br />

Zero-growth:<br />

P0 . . . D<br />

∞<br />

[Eq. 7.1]<br />

(1 ks) ∞<br />

D2<br />

<br />

(1 ks) 2<br />

D1<br />

<br />

(1 ks) 1<br />

P0 (also used to value preferred stock) [Eq. 7.2]<br />

Constant-growth:<br />

P0 [Eq. 7.4]<br />

FCF value of entire company:<br />

VC . . . FCF<br />

∞<br />

[Eq. 7.5]<br />

(1 ka)<br />

FCF common stock value:<br />

VSV CV DV P<br />

[Eq. 7.6]<br />

∞<br />

FCF2<br />

<br />

(1 ka) 2<br />

FCF1<br />

<br />

(1 ka) 1<br />

D1<br />

<br />

ks<br />

D1 <br />

ksg<br />

average cost of capital. The common stock value is<br />

found by subtracting the market values of the firm’s<br />

debt and preferred stock from the value of the entire<br />

company. The two equations involved in this model<br />

are summarized in Table 7.5.<br />

Book value per share is the amount per share of<br />

common stock that would be received if all of the<br />

firm’s assets were sold for their book (accounting)<br />

value and the proceeds remaining after paying all<br />

liabilities (including preferred stock) were divided<br />

among the common stockholders. Liquidation value<br />

per share is the actual amount per share of common<br />

stock that would be received if all of the firm’s<br />

assets were sold for their market value, liabilities<br />

(including preferred stock) were paid, and the<br />

remaining money were divided among the common