Stock Valuation

Stock Valuation

Stock Valuation

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

296 PART 2 Important Financial Concepts<br />

LG4<br />

LG4<br />

LG4<br />

LG4<br />

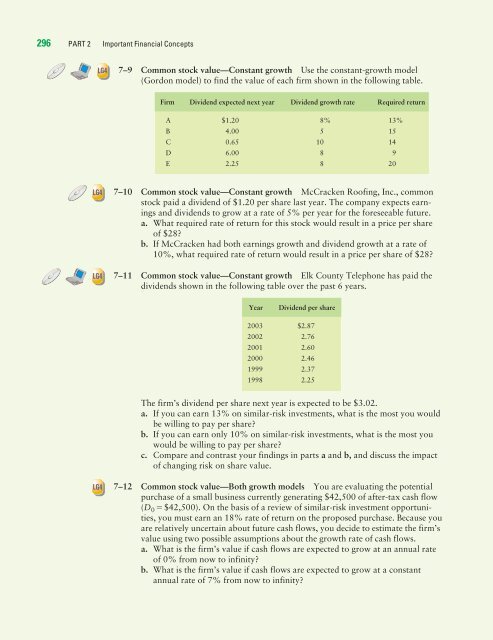

7–9 Common stock value—Constant growth Use the constant-growth model<br />

(Gordon model) to find the value of each firm shown in the following table.<br />

Firm Dividend expected next year Dividend growth rate Required return<br />

A $1.20 8% 13%<br />

B 4.00 5 15<br />

C 0.65 10 14<br />

D 6.00 8 9<br />

E 2.25 8 20<br />

7–10 Common stock value—Constant growth McCracken Roofing, Inc., common<br />

stock paid a dividend of $1.20 per share last year. The company expects earnings<br />

and dividends to grow at a rate of 5% per year for the foreseeable future.<br />

a. What required rate of return for this stock would result in a price per share<br />

of $28?<br />

b. If McCracken had both earnings growth and dividend growth at a rate of<br />

10%, what required rate of return would result in a price per share of $28?<br />

7–11 Common stock value—Constant growth Elk County Telephone has paid the<br />

dividends shown in the following table over the past 6 years.<br />

Year Dividend per share<br />

2003 $2.87<br />

2002 2.76<br />

2001 2.60<br />

2000 2.46<br />

1999 2.37<br />

1998 2.25<br />

The firm’s dividend per share next year is expected to be $3.02.<br />

a. If you can earn 13% on similar-risk investments, what is the most you would<br />

be willing to pay per share?<br />

b. If you can earn only 10% on similar-risk investments, what is the most you<br />

would be willing to pay per share?<br />

c. Compare and contrast your findings in parts a and b, and discuss the impact<br />

of changing risk on share value.<br />

7–12 Common stock value—Both growth models You are evaluating the potential<br />

purchase of a small business currently generating $42,500 of after-tax cash flow<br />

(D 0$42,500). On the basis of a review of similar-risk investment opportunities,<br />

you must earn an 18% rate of return on the proposed purchase. Because you<br />

are relatively uncertain about future cash flows, you decide to estimate the firm’s<br />

value using two possible assumptions about the growth rate of cash flows.<br />

a. What is the firm’s value if cash flows are expected to grow at an annual rate<br />

of 0% from now to infinity?<br />

b. What is the firm’s value if cash flows are expected to grow at a constant<br />

annual rate of 7% from now to infinity?