Stock Valuation

Stock Valuation

Stock Valuation

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

LG5<br />

LG5<br />

CHAPTER 7 <strong>Stock</strong> <strong>Valuation</strong> 297<br />

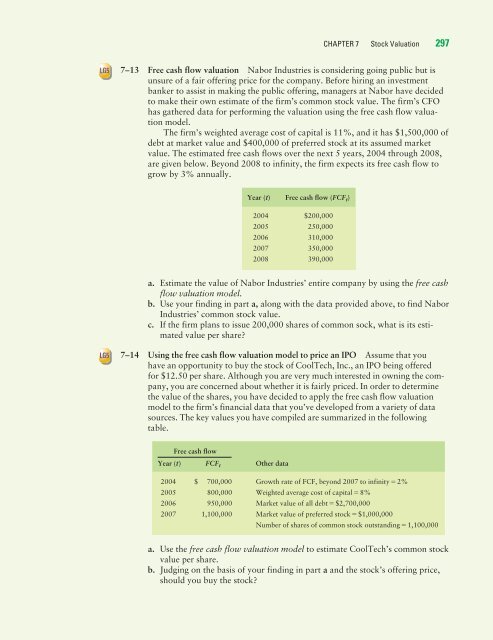

7–13 Free cash flow valuation Nabor Industries is considering going public but is<br />

unsure of a fair offering price for the company. Before hiring an investment<br />

banker to assist in making the public offering, managers at Nabor have decided<br />

to make their own estimate of the firm’s common stock value. The firm’s CFO<br />

has gathered data for performing the valuation using the free cash flow valuation<br />

model.<br />

The firm’s weighted average cost of capital is 11%, and it has $1,500,000 of<br />

debt at market value and $400,000 of preferred stock at its assumed market<br />

value. The estimated free cash flows over the next 5 years, 2004 through 2008,<br />

are given below. Beyond 2008 to infinity, the firm expects its free cash flow to<br />

grow by 3% annually.<br />

a. Estimate the value of Nabor Industries’ entire company by using the free cash<br />

flow valuation model.<br />

b. Use your finding in part a, along with the data provided above, to find Nabor<br />

Industries’ common stock value.<br />

c. If the firm plans to issue 200,000 shares of common sock, what is its estimated<br />

value per share?<br />

7–14 Using the free cash flow valuation model to price an IPO Assume that you<br />

have an opportunity to buy the stock of CoolTech, Inc., an IPO being offered<br />

for $12.50 per share. Although you are very much interested in owning the company,<br />

you are concerned about whether it is fairly priced. In order to determine<br />

the value of the shares, you have decided to apply the free cash flow valuation<br />

model to the firm’s financial data that you’ve developed from a variety of data<br />

sources. The key values you have compiled are summarized in the following<br />

table.<br />

Free cash flow<br />

Year (t) FCFt Other data<br />

Year (t) Free cash flow (FCF t)<br />

2004 $200,000<br />

2005 250,000<br />

2006 310,000<br />

2007 350,000<br />

2008 390,000<br />

2004 $ 700,000 Growth rate of FCF, beyond 2007 to infinity2%<br />

2005 800,000 Weighted average cost of capital8%<br />

2006 950,000 Market value of all debt$2,700,000<br />

2007 1,100,000 Market value of preferred stock$1,000,000<br />

Number of shares of common stock outstanding1,100,000<br />

a. Use the free cash flow valuation model to estimate CoolTech’s common stock<br />

value per share.<br />

b. Judging on the basis of your finding in part a and the stock’s offering price,<br />

should you buy the stock?