ANNUAL REPORT 2011 A.S. CRÉATION TAPETEN AG

ANNUAL REPORT 2011 A.S. CRÉATION TAPETEN AG

ANNUAL REPORT 2011 A.S. CRÉATION TAPETEN AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

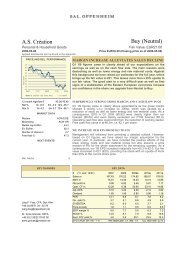

with effect from March 1, <strong>2011</strong>. In spite<br />

of these measures, the gross profit margin<br />

(quotient of gross profit and total output)<br />

declined by 2.7 percentage points from<br />

48.5% in the previous year to 45.8% in<br />

<strong>2011</strong>. In relation to the increased total<br />

output of € 193.5 million, the decline in<br />

the margin means that € 5.2 million less<br />

in earnings was available to cover other<br />

expenses. The comparison with earnings<br />

before interest and taxes of € 9.6 million<br />

illustrates the strong negative impact of<br />

the increased commodity and energy prices<br />

on the company’s bottom line.<br />

• Increased personnel expenses<br />

As explained under “Employees”, staff<br />

productivity did not improve materially in<br />

the fiscal year <strong>2011</strong> due to the increase<br />

in the company’s headcount. Sales per<br />

employee amounted to € 0.242 million<br />

in the fiscal year, compared to € 0.239 in<br />

the previous year. Accordingly, A.S. Création<br />

was unable to offset the collective pay<br />

rise; as a result, personnel expenses as a<br />

percentage of total output deteriorated<br />

moderately from 21.1% in the previous<br />

year to 21.3% in <strong>2011</strong>.<br />

• Adverse trend in other operating<br />

expenses<br />

The increased utilisation of the company’s<br />

production capacity led to an improved<br />

cost situation, as the fixed costs were spread<br />

over a higher total output. However, this<br />

contrasted with higher marketing and<br />

sales costs and increased expenses in<br />

conjunction with the first-time deliveries<br />

to the new DIY customers. Moreover,<br />

higher freight rates and a trend towards<br />

customers ordering smaller quantities per<br />

order led to a disproportionate increase<br />

in transport costs. As a result, other<br />

operating expenses as a percentage of total<br />

output deteriorated from the previous<br />

year’s 14.6% to 14.8%.<br />

As the rise in commodity and energy prices in<br />

<strong>2011</strong> could not be offset by increases in the<br />

company’s own prices and internal productivity<br />

improvements, earnings before interest and<br />

taxes declined, as mentioned above, by 33.0%<br />

from € 14.3 million in the previous year to<br />

€ 9.6 million in <strong>2011</strong>.<br />

The financial result also had an adverse impact<br />

on the bottom line and deteriorated from<br />

€ -2.0 million in the previous year to € -2.3<br />

million in <strong>2011</strong>. As in the previous year, the<br />

discount factor used for the actuarial calculation<br />

of the pension provisions had to be adjusted<br />

to reflect the developments in the capital<br />

market and was reduced from 4.9% to 4.6%.<br />

This led to an actuarial increase in pension provisions<br />

by € 0.3 million, which was recognised<br />

as interest expense. In the fiscal year 2010, the<br />

GROUP MAN<strong>AG</strong>EMENT <strong>REPORT</strong><br />

43