ANNUAL REPORT 2011 A.S. CRÉATION TAPETEN AG

ANNUAL REPORT 2011 A.S. CRÉATION TAPETEN AG

ANNUAL REPORT 2011 A.S. CRÉATION TAPETEN AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

GROUP MAN<strong>AG</strong>EMENT <strong>REPORT</strong><br />

44<br />

adjustment of the discount factor from 5.0% to<br />

4.9% led to interest expenses of € 0.1 million.<br />

As the Russian joint venture, A.S. & Palitra,<br />

continued to build up a production facility in<br />

Russia, the related start-up losses increased.<br />

The start-up losses attributable to A.S. Création<br />

amounted to € -0.2 million (2010: € -0.1 million)<br />

and are included in the financial result as loss<br />

from investments accounted for at equity.<br />

The operating result and the financial result<br />

led to earnings before taxes of € 7.3 million,<br />

down 40.7% on the previous year’s € 12.4<br />

million. Due to the increase in the imputed<br />

tax ratio from 32.0% in 2010 to 36.5% in<br />

the past fiscal year, net profit declined more<br />

strongly than earnings before taxes, namely<br />

by 44.6% from € 8.4 million in 2010 to € 4.6<br />

million in <strong>2011</strong>. The higher imputed tax ratio<br />

is primarily attributable to two factors. First,<br />

the pro-rated loss for the year of the joint<br />

venture, A.S. & Palitra, which is recognised in<br />

the financial result in the income statement<br />

(and hence in earnings before taxes), does not<br />

lead to reduced consolidated tax expenses.<br />

Second, the tax audit carried out at A.S. Création<br />

Tapeten <strong>AG</strong> in <strong>2011</strong> for the fiscal years from<br />

2006 to 2009 resulted in tax payments for<br />

prior years, which increased the imputed tax<br />

ratio for the fiscal year.<br />

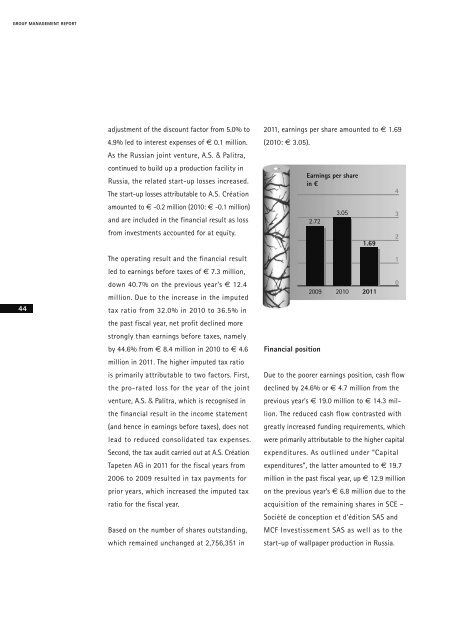

Based on the number of shares outstanding,<br />

which remained unchanged at 2,756,351 in<br />

<strong>2011</strong>, earnings per share amounted to € 1.69<br />

(2010: € 3.05).<br />

Financial position<br />

Earnings per share<br />

in €<br />

2.72<br />

2009<br />

3.05<br />

2010<br />

1.69<br />

<strong>2011</strong><br />

Due to the poorer earnings position, cash flow<br />

declined by 24.6% or € 4.7 million from the<br />

previous year’s € 19.0 million to € 14.3 million.<br />

The reduced cash flow contrasted with<br />

greatly increased funding requirements, which<br />

were primarily attributable to the higher capital<br />

expenditures. As outlined under “Capital<br />

expenditures”, the latter amounted to € 19.7<br />

million in the past fiscal year, up € 12.9 million<br />

on the previous year’s € 6.8 million due to the<br />

acquisition of the remaining shares in SCE –<br />

Société de conception et d’édition SAS and<br />

MCF Investissement SAS as well as to the<br />

start-up of wallpaper production in Russia.<br />

4<br />

3<br />

2<br />

1<br />

0