ANNUAL REPORT 2011 A.S. CRÉATION TAPETEN AG

ANNUAL REPORT 2011 A.S. CRÉATION TAPETEN AG

ANNUAL REPORT 2011 A.S. CRÉATION TAPETEN AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

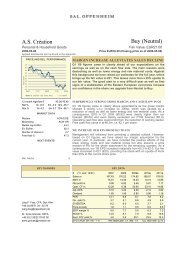

Cash-flow in € m<br />

17.6<br />

19.0<br />

2009 2010<br />

14.3<br />

<strong>2011</strong><br />

Fortunately, A.S. Création was able to release<br />

capital tied up in current assets in the past<br />

fiscal year. Given that a major portion of the<br />

assets of A.S. Création is tied up in inventories<br />

and trade receivables, the company has traditionally<br />

kept a close eye on these items. The<br />

analysis of the underlying figures shows that<br />

the capital tie-up in relation to sales revenues<br />

improved on balance in <strong>2011</strong>. The imputed<br />

receivables collection period declined markedly<br />

from 70 days in the previous year to 65 days<br />

in fiscal <strong>2011</strong>, while the imputed inventory<br />

turnover remained unchanged from the previous<br />

year at 4.2 times per year.<br />

In spite of these positive factors, A.S. Création’s<br />

internal financing capability was insufficient<br />

to finance the exceptionally high capital<br />

expenditures of the year <strong>2011</strong>. Accordingly, net<br />

financial liabilities (difference between interestbearing<br />

financial liabilities and cash and cash<br />

20<br />

15<br />

10<br />

5<br />

0<br />

equivalents) increased from € 16.3 million on<br />

December 31, 2010 by € 13.1 million to € 29.4<br />

million on the balance sheet date. As € 8.4<br />

million of this increase related to the use of<br />

cash and cash equivalents, the interest-bearing<br />

financial liabilities of A.S. Création rose by only<br />

€ 4.7 million in the course of <strong>2011</strong> to € 31.8<br />

million on December 31, <strong>2011</strong> (2010: € 27.1<br />

million). The increase in net financial liabilities<br />

had already been anticipated in the Group’s<br />

budget for <strong>2011</strong>.<br />

A.S. Création’s conservative financing policy,<br />

which is characterised by long-term debt at<br />

fixed interest rates as well as by repayments<br />

during the term of the loans, has proven its<br />

worth especially in the financial crisis. Unlike<br />

other companies, A.S. Création did not face a<br />

reduction in credit lines or had to renegotiate<br />

the conditions of its existing loans. Only where<br />

unused credit lines appeared to be too high<br />

were they reduced in agreement with the<br />

lending banks. The Group has a very robust and<br />

sound financial structure, which is reflected in<br />

the following balance sheet figures:<br />

• Based on equity capital of € 89.6 million<br />

as of December 31, <strong>2011</strong> (2010: € 88.8<br />

million), the equity ratio reached a high<br />

level of 56.9% (2010: 54.9%).<br />

• Equity capital and long-term debt capital<br />

are more than sufficient to finance non-<br />

GROUP MAN<strong>AG</strong>EMENT <strong>REPORT</strong><br />

45