ANNUAL REPORT 2011 A.S. CRÉATION TAPETEN AG

ANNUAL REPORT 2011 A.S. CRÉATION TAPETEN AG

ANNUAL REPORT 2011 A.S. CRÉATION TAPETEN AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

CONSOLIDATED FINANCIAL STATEMENTS ACCORDING TO IFRS<br />

92<br />

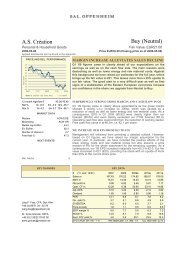

Deferred tax liabilities break down as follows:<br />

31.12.11 31.12.10<br />

€ '000 € '000<br />

Differences between the tax balance sheet<br />

and the commercial balance sheet –1,180 –1,290<br />

Adjustments of individual financial statements to IFRS 5,365 6,081<br />

Consolidation processes 2,525 2,991<br />

6,710 7,782<br />

Deferred taxes refer to the following balance sheet items:<br />

31.12.11 31.12.10<br />

Deferred Deferred Deferred Deferred<br />

tax tax tax tax<br />

assets liabilities assets liabilities<br />

€ ’000 € ’000 € ’000 € ’000<br />

Tangible fixed assets 10 8,563 0 9,129<br />

Intangible fixed assets 68 393 0 585<br />

Inventories 127 0 106 0<br />

Trade receivables and other assets 90 177 0 305<br />

Provisions for pensions 895 0 784 0<br />

Other provisions 18 0 18 0<br />

Other liabilities 1,475 4 1,549 0<br />

Tax losses carried forward 521 0 337 0<br />

3,204 9,137 2,794 10,019<br />

Set-off* –2,427 –2,427 –2,237 –2,237<br />

777 6,710 557 7,782<br />

* According to IAS 12, deferred tax assets and deferred tax liabilities should, under certain conditions, be offset if they relate to<br />

income taxes levied by the same taxation authority.