ANNUAL REPORT 2011 A.S. CRÉATION TAPETEN AG

ANNUAL REPORT 2011 A.S. CRÉATION TAPETEN AG

ANNUAL REPORT 2011 A.S. CRÉATION TAPETEN AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

CONSOLIDATED FINANCIAL STATEMENTS ACCORDING TO IFRS<br />

106<br />

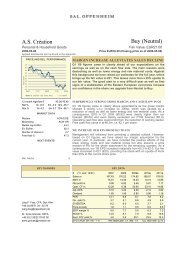

A breakdown of key figures by segments is provided below:<br />

Wallpaper Division Fabrics Division Consolidation Group<br />

<strong>2011</strong> 2010 <strong>2011</strong> 2010 <strong>2011</strong> 2010 <strong>2011</strong> 2010<br />

€ ’000 € ’000 € ’000 € ’000 € ’000 € ’000 € ’000 € ’000<br />

External sales 180,046 172,572 12,216 12,031 0 0 192,262 184,603<br />

Intra-Group sales 226 81 456 544 –682 –625 0 0<br />

Total sales 180,272 172,653 12,672 12,575 –682 –625 192,262 184,603<br />

EBITDA1 19,067 24,092 450 730 2 0 19,519 24,822<br />

EBITDA-margin 10.6% 14.0% 3.6% 5.8% 10.2% 13.4%<br />

EBIT2 9,280 13,728 305 590 2 0 9,587 14,318<br />

EBIT-margin 5.1% 8.0% 2.4% 4.7% 5.0% 7.8%<br />

Interest income<br />

Results from investments<br />

381 281 2 3 –200 –207 183 77<br />

accounted for at equity –226 –89 0 0 0 0 –226 –89<br />

Interest expenses 2,127 1,878 291 284 –200 –207 2,218 1,955<br />

Earnings before taxes 7,308 12,043 15 309 2 0 7,325 12,352<br />

Return on sales (before taxes) 4.1% 7.0% 0.1% 2.5% 3.8% 6.7%<br />

Income taxes 2,673 3,897 2 60 0 0 2,675 3,957<br />

Capital expenditures3 19,482 6,636 185 190 0 0 19,667 6,826<br />

Depreciation 9,787 10,364 146 140 0 0 9,933 10,504<br />

Cash-flow 14,172 18,601 164 426 2 0 14,338 19,027<br />

Segment assets4 144,963 141,417 7,156 7,009 –177 –261 151,942 148,165<br />

thereof non-current assets (64,396) (61,107) (1,262) (1,233) (0) (0) (65,658) (62,340)<br />

Segment liabilities5 19,712 28,043 1,666 1,272 –177 –260 21,201 29,055<br />

Employees (average) 726 706 70 66 0 0 796 772<br />

A breakdown of Group sales by geographical areas is provided in the notes on sales (see No. 17 above).<br />

1 EBITDA is the common international abbreviation of earnings before interest, taxes, depreciation and amortisation.<br />

2 EBIT is the common international abbreviation of earnings before interest and taxes. It is equivalent to the segment<br />

result.<br />

3 Capital expenditures correspond with the item which is shown in the consolidated cash flow statement.<br />

4 Segment assets are the total assets of the segment less interest-bearing intercompany loans, cash and cash equivalents,<br />

deferred tax assets and income tax receivables.<br />

5 Segment liabilities are the total liabilities less shareholders’ equity, pension provisions, tax liabilities, deferred tax<br />

liabilities and financial liabilities.