ANNUAL REPORT 2011 A.S. CRÉATION TAPETEN AG

ANNUAL REPORT 2011 A.S. CRÉATION TAPETEN AG

ANNUAL REPORT 2011 A.S. CRÉATION TAPETEN AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

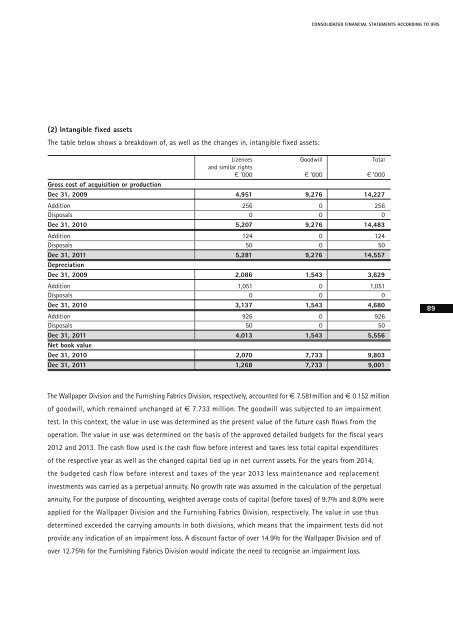

(2) Intangible fixed assets<br />

The table below shows a breakdown of, as well as the changes in, intangible fixed assets:<br />

CONSOLIDATED FINANCIAL STATEMENTS ACCORDING TO IFRS<br />

Lizences<br />

and similar rights<br />

Goodwill Total<br />

¤ ’000 ¤ ’000 ¤ ’000<br />

Gross cost of acquisition or production<br />

Dec 31, 2009 4,951 9,276 14,227<br />

Addition 256 0 256<br />

Disposals 0 0 0<br />

Dec 31, 2010 5,207 9,276 14,483<br />

Addition 124 0 124<br />

Disposals 50 0 50<br />

Dec 31, <strong>2011</strong><br />

Depreciation<br />

5,281 9,276 14,557<br />

Dec 31, 2009 2,086 1,543 3,629<br />

Addition 1,051 0 1,051<br />

Disposals 0 0 0<br />

Dec 31, 2010 3,137 1,543 4,680<br />

Addition 926 0 926<br />

Disposals 50 0 50<br />

Dec 31, <strong>2011</strong><br />

Net book value<br />

4,013 1,543 5,556<br />

Dec 31, 2010 2,070 7,733 9,803<br />

Dec 31, <strong>2011</strong> 1,268 7,733 9,001<br />

The Wallpaper Division and the Furnishing Fabrics Division, respectively, accounted for € 7.581million and € 0.152 million<br />

of goodwill, which remained unchanged at € 7.733 million. The goodwill was subjected to an impairment<br />

test. In this context, the value in use was determined as the present value of the future cash fl ows from the<br />

operation. The value in use was determined on the basis of the approved detailed budgets for the fi scal years<br />

2012 and 2013. The cash fl ow used is the cash fl ow before interest and taxes less total capital expenditures<br />

of the respective year as well as the changed capital tied up in net current assets. For the years from 2014,<br />

the budgeted cash flow before interest and taxes of the year 2013 less maintenance and replacement<br />

investments was carried as a perpetual annuity. No growth rate was assumed in the calculation of the perpetual<br />

annuity. For the purpose of discounting, weighted average costs of capital (before taxes) of 9.7% and 8.0% were<br />

applied for the Wallpaper Division and the Furnishing Fabrics Division, respectively. The value in use thus<br />

determined exceeded the carrying amounts in both divisions, which means that the impairment tests did not<br />

provide any indication of an impairment loss. A discount factor of over 14.9% for the Wallpaper Division and of<br />

over 12.75% for the Furnishing Fabrics Division would indicate the need to recognise an impairment loss.<br />

89