ANNUAL REPORT 2011 A.S. CRÉATION TAPETEN AG

ANNUAL REPORT 2011 A.S. CRÉATION TAPETEN AG

ANNUAL REPORT 2011 A.S. CRÉATION TAPETEN AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

GROUP MAN<strong>AG</strong>EMENT <strong>REPORT</strong><br />

46<br />

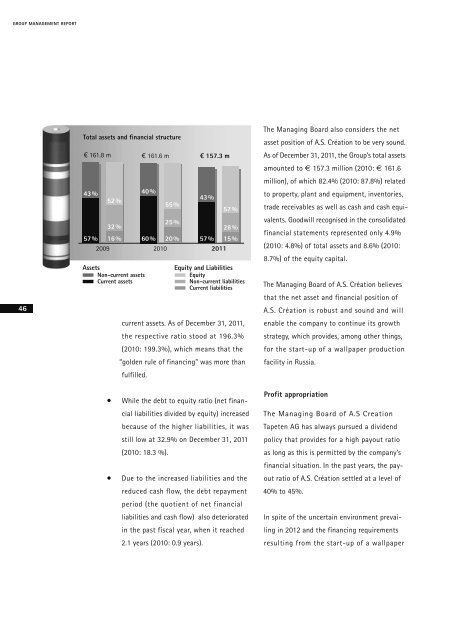

Total assets and financial structure<br />

€ 161.8 m<br />

43%<br />

52%<br />

32%<br />

57% 16% 60% 20%<br />

2009 2010<br />

Assets<br />

Non-current assets<br />

Current assets<br />

€ 161.6 m<br />

40%<br />

55%<br />

25%<br />

€ 157.3 m<br />

43%<br />

57%<br />

28%<br />

57% 15%<br />

<strong>2011</strong><br />

Equity and Liabilities<br />

Equity<br />

Non-current liabilities<br />

Current liabilities<br />

current assets. As of December 31, <strong>2011</strong>,<br />

the respective ratio stood at 196.3%<br />

(2010: 199.3%), which means that the<br />

“golden rule of financing" was more than<br />

fulfilled.<br />

• While the debt to equity ratio (net financial<br />

liabilities divided by equity) increased<br />

because of the higher liabilities, it was<br />

still low at 32.9% on December 31, <strong>2011</strong><br />

(2010: 18.3 %).<br />

• Due to the increased liabilities and the<br />

reduced cash flow, the debt repayment<br />

period (the quotient of net financial<br />

liabilities and cash flow) also deteriorated<br />

in the past fiscal year, when it reached<br />

2.1 years (2010: 0.9 years).<br />

The Managing Board also considers the net<br />

asset position of A.S. Création to be very sound.<br />

As of December 31, <strong>2011</strong>, the Group’s total assets<br />

amounted to € 157.3 million (2010: € 161.6<br />

million), of which 82.4% (2010: 87.8%) related<br />

to property, plant and equipment, inventories,<br />

trade receivables as well as cash and cash equivalents.<br />

Goodwill recognised in the consolidated<br />

financial statements represented only 4.9%<br />

(2010: 4.8%) of total assets and 8.6% (2010:<br />

8.7%) of the equity capital.<br />

The Managing Board of A.S. Création believes<br />

that the net asset and financial position of<br />

A.S. Création is robust and sound and will<br />

enable the company to continue its growth<br />

strategy, which provides, among other things,<br />

for the start-up of a wallpaper production<br />

facility in Russia.<br />

Profit appropriation<br />

The Managing Board of A.S Creation<br />

Tapeten <strong>AG</strong> has always pursued a dividend<br />

policy that provides for a high payout ratio<br />

as long as this is permitted by the company’s<br />

financial situation. In the past years, the payout<br />

ratio of A.S. Création settled at a level of<br />

40% to 45%.<br />

In spite of the uncertain environment prevailing<br />

in 2012 and the financing requirements<br />

resulting from the start-up of a wallpaper