A Guide to HMDA Reporting - ffiec

A Guide to HMDA Reporting - ffiec

A Guide to HMDA Reporting - ffiec

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Completing<br />

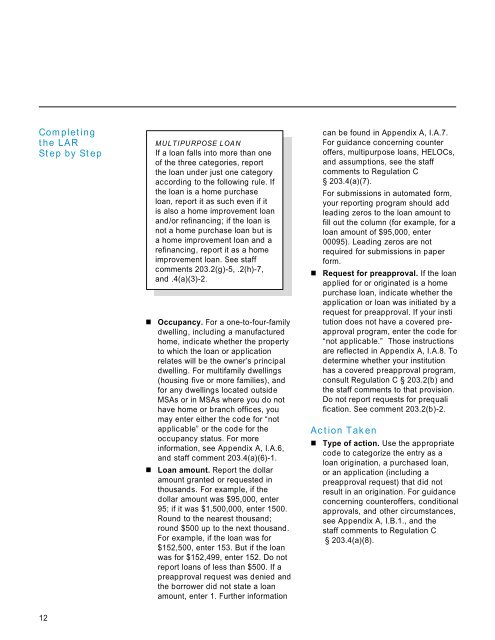

the LAR MULTIPURPOSE LOAN<br />

Step by Step<br />

If a loan falls in<strong>to</strong> more than one<br />

of the three categories, report<br />

the loan under just one category<br />

according <strong>to</strong> the following rule. If<br />

the loan is a home purchase<br />

loan, report it as such even if it<br />

is also a home improvement loan<br />

and/or refinancing; if the loan is<br />

not a home purchase loan but is<br />

a home improvement loan and a<br />

refinancing, report it as a home<br />

improvement loan. See staff<br />

comments 203.2(g)-5, .2(h)-7,<br />

and .4(a)(3)-2.<br />

12<br />

¢ Occupancy. For a one-<strong>to</strong>-four-family<br />

dwelling, including a manufactured<br />

home, indicate whether the property<br />

<strong>to</strong> which the loan or application<br />

relates will be the owner’s principal<br />

dwelling. For multifamily dwellings<br />

(housing five or more families), and<br />

for any dwellings located outside<br />

MSAs or in MSAs where you do not<br />

have home or branch offices, you<br />

may enter either the code for “not<br />

applicable” or the code for the<br />

occupancy status. For more<br />

information, see Appendix A, I.A.6,<br />

and staff comment 203.4(a)(6)-1.<br />

¢ Loan amount. Report the dollar<br />

amount granted or requested in<br />

thousands. For example, if the<br />

dollar amount was $95,000, enter<br />

95; if it was $1,500,000, enter 1500.<br />

Round <strong>to</strong> the nearest thousand;<br />

round $500 up <strong>to</strong> the next thousand.<br />

For example, if the loan was for<br />

$152,500, enter 153. But if the loan<br />

was for $152,499, enter 152. Do not<br />

report loans of less than $500. If a<br />

preapproval request was denied and<br />

the borrower did not state a loan<br />

amount, enter 1. Further information<br />

can be found in Appendix A, I.A.7.<br />

For guidance concerning counteroffers,<br />

multipurpose loans, HELOCs,<br />

and assumptions, see the staff<br />

comments <strong>to</strong> Regulation C<br />

§ 203.4(a)(7).<br />

For submissions in au<strong>to</strong>mated form,<br />

your reporting program should add<br />

leading zeros <strong>to</strong> the loan amount <strong>to</strong><br />

fill out the column (for example, for a<br />

loan amount of $95,000, enter<br />

00095). Leading zeros are not<br />

required for submissions in paper<br />

form.<br />

¢ Request for preapproval. If the loan<br />

applied for or originated is a home<br />

purchase loan, indicate whether the<br />

application or loan was initiated by a<br />

request for preapproval. If your institution<br />

does not have a covered preapproval<br />

program, enter the code for<br />

“not applicable.” Those instructions<br />

are reflected in Appendix A, I.A.8. To<br />

determine whether your institution<br />

has a covered preapproval program,<br />

consult Regulation C § 203.2(b) and<br />

the staff comments <strong>to</strong> that provision.<br />

Do not report requests for prequalification.<br />

See comment 203.2(b)-2.<br />

Action Taken<br />

¢ Type of action. Use the appropriate<br />

code <strong>to</strong> categorize the entry as a<br />

loan origination, a purchased loan,<br />

or an application (including a<br />

preapproval request) that did not<br />

result in an origination. For guidance<br />

concerning counteroffers, conditional<br />

approvals, and other circumstances,<br />

see Appendix A, I.B.1., and the<br />

staff comments <strong>to</strong> Regulation C<br />

§ 203.4(a)(8).