Fiat Group - Consolidated Financial Statements and Notes - Fiat SpA

Fiat Group - Consolidated Financial Statements and Notes - Fiat SpA

Fiat Group - Consolidated Financial Statements and Notes - Fiat SpA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

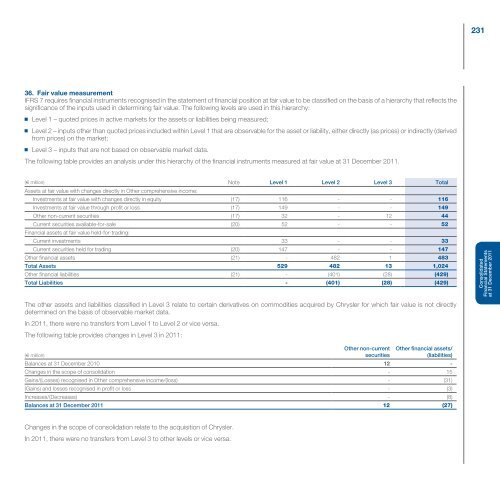

36. Fair value measurement<br />

IFRS 7 requires financial instruments recognised in the statement of financial position at fair value to be classified on the basis of a hierarchy that reflects the<br />

significance of the inputs used in determining fair value. The following levels are used in this hierarchy:<br />

Level 1 – quoted prices in active markets for the assets or liabilities being measured;<br />

Level 2 – inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly (as prices) or indirectly (derived<br />

from prices) on the market;<br />

Level 3 – inputs that are not based on observable market data.<br />

The following table provides an analysis under this hierarchy of the financial instruments measured at fair value at 31 December 2011.<br />

(€ million)<br />

Assets at fair value with changes directly in Other comprehensive income:<br />

Note Level 1 Level 2 Level 3 Total<br />

Investments at fair value with changes directly in equity (17) 116 - - 116<br />

Investments at fair value through profit or loss (17) 149 - - 149<br />

Other non-current securities (17) 32 - 12 44<br />

Current securities available-for-sale<br />

<strong>Financial</strong> assets at fair value held-for-trading:<br />

(20) 52 - - 52<br />

Current investments 33 - - 33<br />

Current securities held for trading (20) 147 - - 147<br />

Other financial assets (21) - 482 1 483<br />

Total Assets 529 482 13 1,024<br />

Other financial liabilities (21) - (401) (28) (429)<br />

Total Liabilities - (401) (28) (429)<br />

The other assets <strong>and</strong> liabilities classified in Level 3 relate to certain derivatives on commodities acquired by Chrysler for which fair value is not directly<br />

determined on the basis of observable market data.<br />

In 2011, there were no transfers from Level 1 to Level 2 or vice versa.<br />

The following table provides changes in Level 3 in 2011:<br />

Other non-current Other financial assets/<br />

(€ million)<br />

securities<br />

(liabilities)<br />

Balances at 31 December 2010 12 -<br />

Changes in the scope of consolidation - 15<br />

Gains/(Losses) recognised in Other comprehensive income/(loss) - (31)<br />

(Gains) <strong>and</strong> losses recognised in profit or loss - (3)<br />

Increases/(Decreases) - (8)<br />

Balances at 31 December 2011 12 (27)<br />

Changes in the scope of consolidation relate to the acquisition of Chrysler.<br />

In 2011, there were no transfers from Level 3 to other levels or vice versa.<br />

231<br />

<strong>Consolidated</strong><br />

<strong>Financial</strong> <strong>Statements</strong><br />

at 31 December 2011