Fiat Group - Consolidated Financial Statements and Notes - Fiat SpA

Fiat Group - Consolidated Financial Statements and Notes - Fiat SpA

Fiat Group - Consolidated Financial Statements and Notes - Fiat SpA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

186<br />

<strong>Consolidated</strong><br />

<strong>Financial</strong><br />

<strong>Statements</strong><br />

at 31 December<br />

2011<br />

<strong>Notes</strong><br />

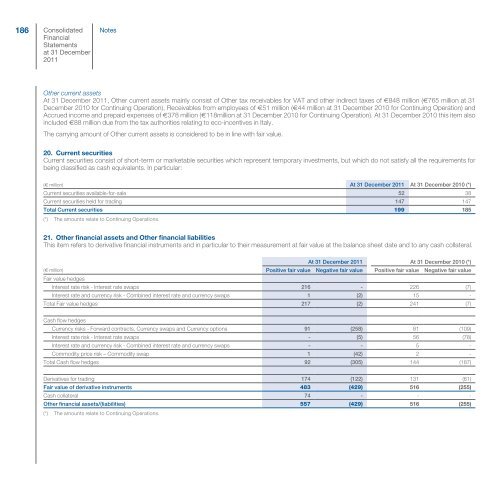

Other current assets<br />

At 31 December 2011, Other current assets mainly consist of Other tax receivables for VAT <strong>and</strong> other indirect taxes of €848 million (€765 million at 31<br />

December 2010 for Continuing Operation), Receivables from employees of €51 million (€44 million at 31 December 2010 for Continuing Operation) <strong>and</strong><br />

Accrued income <strong>and</strong> prepaid expenses of €378 million (€118million at 31 December 2010 for Continuing Operation). At 31 December 2010 this item also<br />

included €88 million due from the tax authorities relating to eco-incentives in Italy.<br />

The carrying amount of Other current assets is considered to be in line with fair value.<br />

20. Current securities<br />

Current securities consist of short-term or marketable securities which represent temporary investments, but which do not satisfy all the requirements for<br />

being classified as cash equivalents. In particular:<br />

(€ million) At 31 December 2011 At 31 December 2010 (*)<br />

Current securities available-for-sale 52 38<br />

Current securities held for trading 147 147<br />

Total Current securities<br />

(*) The amounts relate to Continuing Operations.<br />

199 185<br />

21. Other financial assets <strong>and</strong> Other financial liabilities<br />

This item refers to derivative financial instruments <strong>and</strong> in particular to their measurement at fair value at the balance sheet date <strong>and</strong> to any cash collateral.<br />

At 31 December 2011 At 31 December 2010 (*)<br />

(€ million)<br />

Fair value hedges<br />

Positive fair value Negative fair value Positive fair value Negative fair value<br />

Interest rate risk - Interest rate swaps 216 - 226 (7)<br />

Interest rate <strong>and</strong> currency risk - Combined interest rate <strong>and</strong> currency swaps 1 (2) 15 -<br />

Total Fair value hedges 217 (2) 241 (7)<br />

Cash flow hedges<br />

Currency risks - Forward contracts, Currency swaps <strong>and</strong> Currency options 91 (258) 81 (109)<br />

Interest rate risk - Interest rate swaps - (5) 56 (78)<br />

Interest rate <strong>and</strong> currency risk - Combined interest rate <strong>and</strong> currency swaps - - 5 -<br />

Commodity price risk – Commodity swap 1 (42) 2 -<br />

Total Cash flow hedges 92 (305) 144 (187)<br />

Derivatives for trading 174 (122) 131 (61)<br />

Fair value of derivative instruments 483 (429) 516 (255)<br />

Cash collateral 74 - - -<br />

Other financial assets/(liabilities)<br />

(*) The amounts relate to Continuing Operations.<br />

557 (429) 516 (255)