Fiat Group - Consolidated Financial Statements and Notes - Fiat SpA

Fiat Group - Consolidated Financial Statements and Notes - Fiat SpA

Fiat Group - Consolidated Financial Statements and Notes - Fiat SpA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

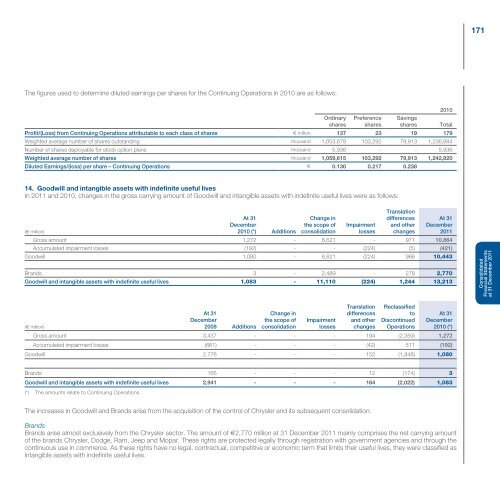

The figures used to determine diluted earnings per shares for the Continuing Operations in 2010 are as follows:<br />

Ordinary<br />

shares<br />

Preference<br />

shares<br />

2010<br />

Savings<br />

shares Total<br />

Profit/(Loss) from Continuing Operations attributable to each class of shares € million 137 23 19 179<br />

Weighted average number of shares outst<strong>and</strong>ing thous<strong>and</strong> 1,053,679 103,292 79,913 1,236,884<br />

Number of shares deployable for stock option plans thous<strong>and</strong> 5,936 - - 5,936<br />

Weighted average number of shares thous<strong>and</strong> 1,059,615 103,292 79,913 1,242,820<br />

Diluted Earnings/(loss) per share – Continuing Operations € 0.130 0.217 0.238<br />

14. Goodwill <strong>and</strong> intangible assets with indefinite useful lives<br />

In 2011 <strong>and</strong> 2010, changes in the gross carrying amount of Goodwill <strong>and</strong> intangible assets with indefinite useful lives were as follows:<br />

(€ million)<br />

At 31<br />

December<br />

2010 (*) Additions<br />

Change in<br />

the scope of<br />

consolidation<br />

Impairment<br />

losses<br />

Translation<br />

differences<br />

<strong>and</strong> other<br />

changes<br />

At 31<br />

December<br />

2011<br />

Gross amount 1,272 - 8,621 - 971 10,864<br />

Accumulated impairment losses (192) - - (224) (5) (421)<br />

Goodwill 1,080 - 8,621 (224) 966 10,443<br />

Br<strong>and</strong>s 3 - 2,489 - 278 2,770<br />

Goodwill <strong>and</strong> intangible assets with indefinite useful lives 1,083 - 11,110 (224) 1,244 13,213<br />

(€ million)<br />

At 31<br />

December<br />

2009 Additions<br />

Change in<br />

the scope of<br />

consolidation<br />

Impairment<br />

losses<br />

Translation<br />

differences<br />

<strong>and</strong> other<br />

changes<br />

Reclassified<br />

to<br />

Discontinued<br />

Operations<br />

At 31<br />

December<br />

2010 (*)<br />

Gross amount 3,437 - - - 194 (2,359) 1,272<br />

Accumulated impairment losses (661) - - - (42) 511 (192)<br />

Goodwill 2,776 - - - 152 (1,848) 1,080<br />

Br<strong>and</strong>s 165 - - - 12 (174) 3<br />

Goodwill <strong>and</strong> intangible assets with indefinite useful lives 2,941 - - - 164 (2,022) 1,083<br />

(*) The amounts relate to Continuing Operations.<br />

The increases in Goodwill <strong>and</strong> Br<strong>and</strong>s arise from the acquisition of the control of Chrysler <strong>and</strong> its subsequent consolidation.<br />

Br<strong>and</strong>s<br />

Br<strong>and</strong>s arise almost exclusively from the Chrysler sector. The amount of €2,770 million at 31 December 2011 mainly comprises the net carrying amount<br />

of the br<strong>and</strong>s Chrysler, Dodge, Ram, Jeep <strong>and</strong> Mopar. These rights are protected legally through registration with government agencies <strong>and</strong> through the<br />

continuous use in commerce. As these rights have no legal, contractual, competitive or economic term that limits their useful lives, they were classified as<br />

intangible assets with indefinite useful lives.<br />

171<br />

<strong>Consolidated</strong><br />

<strong>Financial</strong> <strong>Statements</strong><br />

at 31 December 2011