Fiat Group - Consolidated Financial Statements and Notes - Fiat SpA

Fiat Group - Consolidated Financial Statements and Notes - Fiat SpA

Fiat Group - Consolidated Financial Statements and Notes - Fiat SpA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

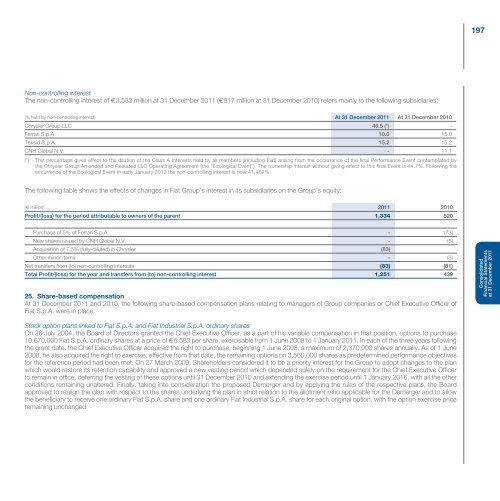

Non-controlling interest<br />

The non-controlling interest of €3,533 million at 31 December 2011 (€917 million at 31 December 2010) refers mainly to the following subsidiaries:<br />

(% held by non-controlling interest) At 31 December 2011 At 31 December 2010<br />

Chrysler <strong>Group</strong> LLC 46.5 (*) -<br />

Ferrari S.p.A. 10.0 15.0<br />

Teksid S.p.A. 15.2 15.2<br />

CNH Global N.V. - 11.1<br />

(*) This percentage gives effect to the dilution of the Class A Interests held by all members (including <strong>Fiat</strong>) arising from the occurrence of the final Performance Event contemplated by<br />

the Chrysler <strong>Group</strong> Amended <strong>and</strong> Restated LLC Operating Agreement (the “Ecological Event”). The ownership interest without giving effect to this final Event is 44.7%. Following the<br />

occurrence of the Ecological Event in early January 2012 the non-controlling interest is now 41.462%.<br />

The following table shows the effects of changes in <strong>Fiat</strong> <strong>Group</strong>’s interest in its subsidiaries on the <strong>Group</strong>’s equity:<br />

(€ million) 2011 2010<br />

Profit/(loss) for the period attributable to owners of the parent 1,334 520<br />

Purchase of 5% of Ferrari S.p.A. - (73)<br />

New shares issued by CNH Global N.V. - (5)<br />

Acquisition of 7.5% (fully-diluted) in Chrysler (83)<br />

Other minor items - (3)<br />

Net transfers from (to) non-controlling interests (83) (81)<br />

Total Profit/(loss) for the year <strong>and</strong> transfers from (to) non-controlling interest 1,251 439<br />

25. Share-based compensation<br />

At 31 December 2011 <strong>and</strong> 2010, the following share-based compensation plans relating to managers of <strong>Group</strong> companies or Chief Executive Officer of<br />

<strong>Fiat</strong> S.p.A. were in place.<br />

Stock option plans linked to <strong>Fiat</strong> S.p.A. <strong>and</strong> <strong>Fiat</strong> Industrial S.p.A. ordinary shares<br />

On 26 July 2004, the Board of Directors granted the Chief Executive Officer, as a part of his variable compensation in that position, options to purchase<br />

10,670,000 <strong>Fiat</strong> S.p.A. ordinary shares at a price of €6.583 per share, exercisable from 1 June 2008 to 1 January 2011. In each of the three years following<br />

the grant date, the Chief Executive Officer acquired the right to purchase, beginning 1 June 2008, a maximum of 2,370,000 shares annually. As of 1 June<br />

2008, he also acquired the right to exercise, effective from that date, the remaining options on 3,560,000 shares as predetermined performance objectives<br />

for the reference period had been met. On 27 March 2009, Shareholders considered it to be a priority interest for the <strong>Group</strong> to adopt changes to the plan<br />

which would restore its retention capability <strong>and</strong> approved a new vesting period which depended solely on the requirement for the Chief Executive Officer<br />

to remain in office, deferring the vesting of these options until 31 December 2010 <strong>and</strong> extending the exercise period until 1 January 2016, with all the other<br />

conditions remaining unaltered. Finally, taking into consideration the proposed Demerger <strong>and</strong> by applying the rules of the respective plans, the Board<br />

approved to realign the plan with respect to the shares underlying the plan in strict relation to the allotment ratio applicable for the Demerger <strong>and</strong> to allow<br />

the beneficiary to receive one ordinary <strong>Fiat</strong> S.p.A. share <strong>and</strong> one ordinary <strong>Fiat</strong> Industrial S.p.A. share for each original option, with the option exercise price<br />

remaining unchanged.<br />

197<br />

<strong>Consolidated</strong><br />

<strong>Financial</strong> <strong>Statements</strong><br />

at 31 December 2011