Fiat Group - Consolidated Financial Statements and Notes - Fiat SpA

Fiat Group - Consolidated Financial Statements and Notes - Fiat SpA

Fiat Group - Consolidated Financial Statements and Notes - Fiat SpA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

208<br />

<strong>Consolidated</strong><br />

<strong>Financial</strong><br />

<strong>Statements</strong><br />

at 31 December<br />

2011<br />

<strong>Notes</strong><br />

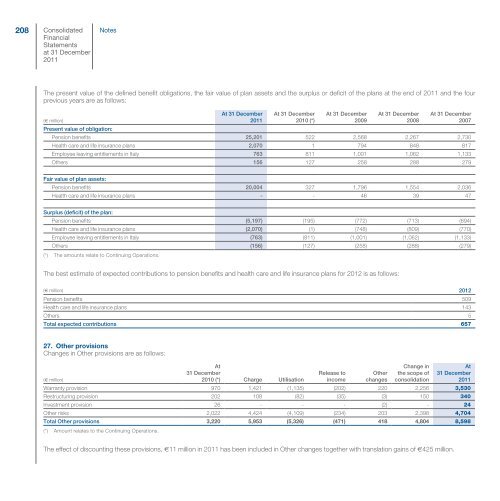

The present value of the defined benefit obligations, the fair value of plan assets <strong>and</strong> the surplus or deficit of the plans at the end of 2011 <strong>and</strong> the four<br />

previous years are as follows:<br />

At 31 December At 31 December At 31 December At 31 December At 31 December<br />

(€ million)<br />

Present value of obligation:<br />

2011<br />

2010 (*)<br />

2009<br />

2008<br />

2007<br />

Pension benefits 25,201 522 2,568 2,267 2,730<br />

Health care <strong>and</strong> life insurance plans 2,070 1 794 848 817<br />

Employee leaving entitlements in Italy 763 811 1,001 1,062 1,133<br />

Others 156 127 258 288 279<br />

Fair value of plan assets:<br />

Pension benefits 20,004 327 1,796 1,554 2,036<br />

Health care <strong>and</strong> life insurance plans - - 46 39 47<br />

Surplus (deficit) of the plan:<br />

Pension benefits (5,197) (195) (772) (713) (694)<br />

Health care <strong>and</strong> life insurance plans (2,070) (1) (748) (809) (770)<br />

Employee leaving entitlements in Italy (763) (811) (1,001) (1,062) (1,133)<br />

Others<br />

(*) The amounts relate to Continuing Operations.<br />

(156) (127) (258) (288) (279)<br />

The best estimate of expected contributions to pension benefits <strong>and</strong> health care <strong>and</strong> life insurance plans for 2012 is as follows:<br />

(€ million) 2012<br />

Pension benefits 509<br />

Health care <strong>and</strong> life insurance plans 143<br />

Others 5<br />

Total expected contributions 657<br />

27. Other provisions<br />

Changes in Other provisions are as follows:<br />

At<br />

Change in<br />

At<br />

31 December<br />

Release to Other the scope of 31 December<br />

(€ million)<br />

2010 (*) Charge Utilisation income changes consolidation<br />

2011<br />

Warranty provision 970 1,421 (1,135) (202) 220 2,256 3,530<br />

Restructuring provision 202 108 (82) (35) (3) 150 340<br />

Investment provision 26 - - - (2) - 24<br />

Other risks 2,022 4,424 (4,109) (234) 203 2,398 4,704<br />

Total Other provisions 3,220 5,953 (5,326) (471) 418 4,804 8,598<br />

(*) Amount relates to the Continuing Operations.<br />

The effect of discounting these provisions, €11 million in 2011 has been included in Other changes together with translation gains of €425 million.