Fiat Group - Consolidated Financial Statements and Notes - Fiat SpA

Fiat Group - Consolidated Financial Statements and Notes - Fiat SpA

Fiat Group - Consolidated Financial Statements and Notes - Fiat SpA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

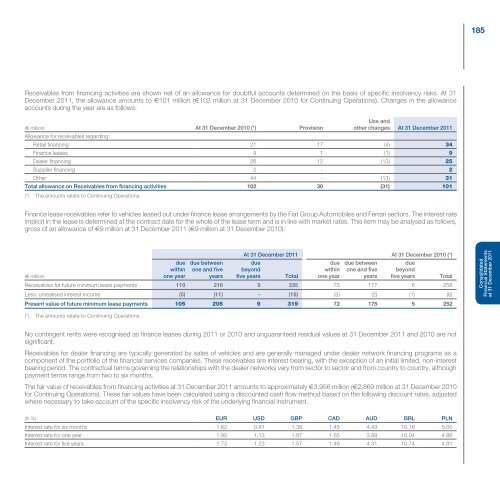

Receivables from financing activities are shown net of an allowance for doubtful accounts determined on the basis of specific insolvency risks. At 31<br />

December 2011, the allowance amounts to €101 million (€102 million at 31 December 2010 for Continuing Operations). Changes in the allowance<br />

accounts during the year are as follows:<br />

(€ million)<br />

Allowance for receivables regarding:<br />

At 31 December 2010 (*) Provision<br />

Use <strong>and</strong><br />

other changes At 31 December 2011<br />

Retail financing 21 17 (4) 34<br />

Finance leases 9 1 (1) 9<br />

Dealer financing 26 12 (13) 25<br />

Supplier financing 2 - - 2<br />

Other 44 - (13) 31<br />

Total allowance on Receivables from financing activities<br />

(*) The amounts relate to Continuing Operations.<br />

102 30 (31) 101<br />

Finance lease receivables refer to vehicles leased out under finance lease arrangements by the <strong>Fiat</strong> <strong>Group</strong> Automobiles <strong>and</strong> Ferrari sectors. The interest rate<br />

implicit in the lease is determined at the contract date for the whole of the lease term <strong>and</strong> is in line with market rates. This item may be analysed as follows,<br />

gross of an allowance of €9 million at 31 December 2011 (€9 million at 31 December 2010):<br />

At 31 December 2011 At 31 December 2010 (*)<br />

due due between<br />

due<br />

due due between<br />

due<br />

within one <strong>and</strong> five beyond<br />

within one <strong>and</strong> five beyond<br />

(€ million)<br />

one year years five years Total one year years five years Total<br />

Receivables for future minimum lease payments 110 216 9 335 75 177 6 258<br />

Less: unrealised interest income (5) (11) - (16) (3) (2) (1) (6)<br />

Present value of future minimum lease payments 105 205 9 319 72 175 5 252<br />

(*) The amounts relate to Continuing Operations.<br />

No contingent rents were recognised as finance leases during 2011 or 2010 <strong>and</strong> unguaranteed residual values at 31 December 2011 <strong>and</strong> 2010 are not<br />

significant.<br />

Receivables for dealer financing are typically generated by sales of vehicles <strong>and</strong> are generally managed under dealer network financing programs as a<br />

component of the portfolio of the financial services companies. These receivables are interest bearing, with the exception of an initial limited, non-interest<br />

bearing period. The contractual terms governing the relationships with the dealer networks vary from sector to sector <strong>and</strong> from country to country, although<br />

payment terms range from two to six months.<br />

The fair value of receivables from financing activities at 31 December 2011 amounts to approximately €3,956 million (€2,869 million at 31 December 2010<br />

for Continuing Operations). These fair values have been calculated using a discounted cash flow method based on the following discount rates, adjusted<br />

where necessary to take account of the specific insolvency risk of the underlying financial instrument.<br />

(In %) EUR USD GBP CAD AUD BRL PLN<br />

Interest rate for six months 1.62 0.81 1.38 1.45 4.43 10.16 5.00<br />

Interest rate for one year 1.95 1.13 1.87 1.65 3.88 10.04 4.88<br />

Interest rate for five years 1.73 1.23 1.57 1.46 4.31 10.74 4.81<br />

185<br />

<strong>Consolidated</strong><br />

<strong>Financial</strong> <strong>Statements</strong><br />

at 31 December 2011