AUTO TITLE MANUAL - Franklin County, Ohio

AUTO TITLE MANUAL - Franklin County, Ohio

AUTO TITLE MANUAL - Franklin County, Ohio

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

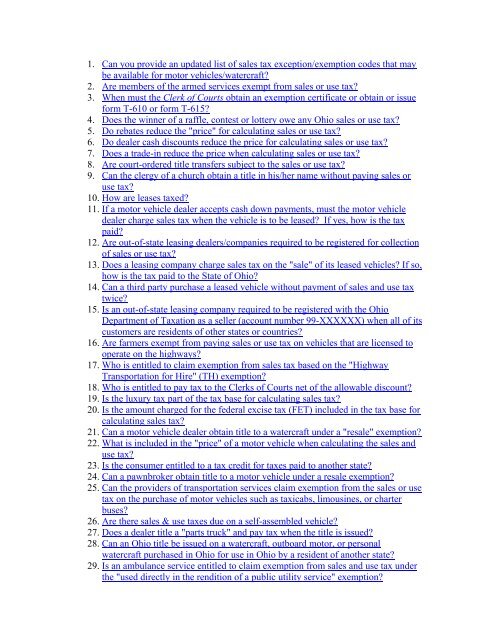

1. Can you provide an updated list of sales tax exception/exemption codes that may<br />

be available for motor vehicles/watercraft?<br />

2. Are members of the armed services exempt from sales or use tax?<br />

3. When must the Clerk of Courts obtain an exemption certificate or obtain or issue<br />

form T-610 or form T-615?<br />

4. Does the winner of a raffle, contest or lottery owe any <strong>Ohio</strong> sales or use tax?<br />

5. Do rebates reduce the "price" for calculating sales or use tax?<br />

6. Do dealer cash discounts reduce the price for calculating sales or use tax?<br />

7. Does a trade-in reduce the price when calculating sales or use tax?<br />

8. Are court-ordered title transfers subject to the sales or use tax?<br />

9. Can the clergy of a church obtain a title in his/her name without paying sales or<br />

use tax?<br />

10. How are leases taxed?<br />

11. If a motor vehicle dealer accepts cash down payments, must the motor vehicle<br />

dealer charge sales tax when the vehicle is to be leased? If yes, how is the tax<br />

paid?<br />

12. Are out-of-state leasing dealers/companies required to be registered for collection<br />

of sales or use tax?<br />

13. Does a leasing company charge sales tax on the "sale" of its leased vehicles? If so,<br />

how is the tax paid to the State of <strong>Ohio</strong>?<br />

14. Can a third party purchase a leased vehicle without payment of sales and use tax<br />

twice?<br />

15. Is an out-of-state leasing company required to be registered with the <strong>Ohio</strong><br />

Department of Taxation as a seller (account number 99-XXXXXX) when all of its<br />

customers are residents of other states or countries?<br />

16. Are farmers exempt from paying sales or use tax on vehicles that are licensed to<br />

operate on the highways?<br />

17. Who is entitled to claim exemption from sales tax based on the "Highway<br />

Transportation for Hire" (TH) exemption?<br />

18. Who is entitled to pay tax to the Clerks of Courts net of the allowable discount?<br />

19. Is the luxury tax part of the tax base for calculating sales tax?<br />

20. Is the amount charged for the federal excise tax (FET) included in the tax base for<br />

calculating sales tax?<br />

21. Can a motor vehicle dealer obtain title to a watercraft under a "resale" exemption?<br />

22. What is included in the "price" of a motor vehicle when calculating the sales and<br />

use tax?<br />

23. Is the consumer entitled to a tax credit for taxes paid to another state?<br />

24. Can a pawnbroker obtain title to a motor vehicle under a resale exemption?<br />

25. Can the providers of transportation services claim exemption from the sales or use<br />

tax on the purchase of motor vehicles such as taxicabs, limousines, or charter<br />

buses?<br />

26. Are there sales & use taxes due on a self-assembled vehicle?<br />

27. Does a dealer title a "parts truck" and pay tax when the title is issued?<br />

28. Can an <strong>Ohio</strong> title be issued on a watercraft, outboard motor, or personal<br />

watercraft purchased in <strong>Ohio</strong> for use in <strong>Ohio</strong> by a resident of another state?<br />

29. Is an ambulance service entitled to claim exemption from sales and use tax under<br />

the "used directly in the rendition of a public utility service" exemption?