AUTO TITLE MANUAL - Franklin County, Ohio

AUTO TITLE MANUAL - Franklin County, Ohio

AUTO TITLE MANUAL - Franklin County, Ohio

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

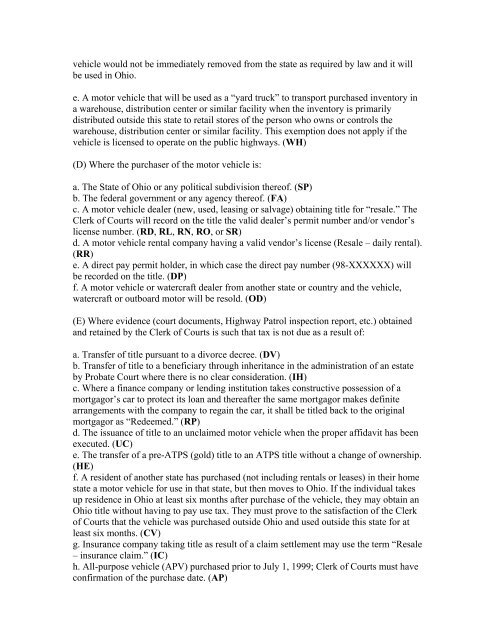

vehicle would not be immediately removed from the state as required by law and it will<br />

be used in <strong>Ohio</strong>.<br />

e. A motor vehicle that will be used as a “yard truck” to transport purchased inventory in<br />

a warehouse, distribution center or similar facility when the inventory is primarily<br />

distributed outside this state to retail stores of the person who owns or controls the<br />

warehouse, distribution center or similar facility. This exemption does not apply if the<br />

vehicle is licensed to operate on the public highways. (WH)<br />

(D) Where the purchaser of the motor vehicle is:<br />

a. The State of <strong>Ohio</strong> or any political subdivision thereof. (SP)<br />

b. The federal government or any agency thereof. (FA)<br />

c. A motor vehicle dealer (new, used, leasing or salvage) obtaining title for “resale.” The<br />

Clerk of Courts will record on the title the valid dealer’s permit number and/or vendor’s<br />

license number. (RD, RL, RN, RO, or SR)<br />

d. A motor vehicle rental company having a valid vendor’s license (Resale – daily rental).<br />

(RR)<br />

e. A direct pay permit holder, in which case the direct pay number (98-XXXXXX) will<br />

be recorded on the title. (DP)<br />

f. A motor vehicle or watercraft dealer from another state or country and the vehicle,<br />

watercraft or outboard motor will be resold. (OD)<br />

(E) Where evidence (court documents, Highway Patrol inspection report, etc.) obtained<br />

and retained by the Clerk of Courts is such that tax is not due as a result of:<br />

a. Transfer of title pursuant to a divorce decree. (DV)<br />

b. Transfer of title to a beneficiary through inheritance in the administration of an estate<br />

by Probate Court where there is no clear consideration. (IH)<br />

c. Where a finance company or lending institution takes constructive possession of a<br />

mortgagor’s car to protect its loan and thereafter the same mortgagor makes definite<br />

arrangements with the company to regain the car, it shall be titled back to the original<br />

mortgagor as “Redeemed.” (RP)<br />

d. The issuance of title to an unclaimed motor vehicle when the proper affidavit has been<br />

executed. (UC)<br />

e. The transfer of a pre-ATPS (gold) title to an ATPS title without a change of ownership.<br />

(HE)<br />

f. A resident of another state has purchased (not including rentals or leases) in their home<br />

state a motor vehicle for use in that state, but then moves to <strong>Ohio</strong>. If the individual takes<br />

up residence in <strong>Ohio</strong> at least six months after purchase of the vehicle, they may obtain an<br />

<strong>Ohio</strong> title without having to pay use tax. They must prove to the satisfaction of the Clerk<br />

of Courts that the vehicle was purchased outside <strong>Ohio</strong> and used outside this state for at<br />

least six months. (CV)<br />

g. Insurance company taking title as result of a claim settlement may use the term “Resale<br />

– insurance claim.” (IC)<br />

h. All-purpose vehicle (APV) purchased prior to July 1, 1999; Clerk of Courts must have<br />

confirmation of the purchase date. (AP)