AUTO TITLE MANUAL - Franklin County, Ohio

AUTO TITLE MANUAL - Franklin County, Ohio

AUTO TITLE MANUAL - Franklin County, Ohio

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

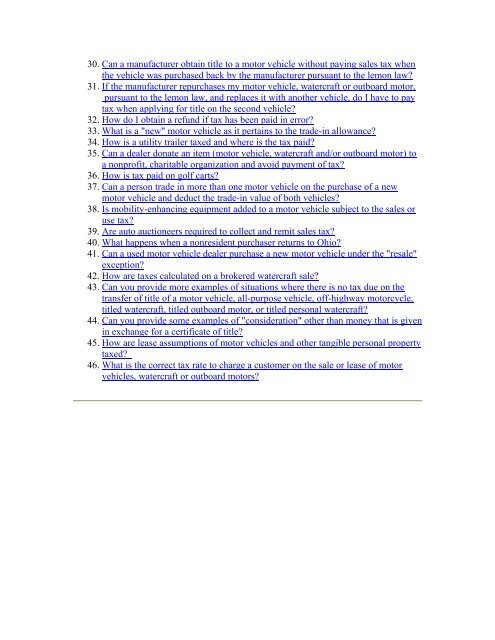

30. Can a manufacturer obtain title to a motor vehicle without paying sales tax when<br />

the vehicle was purchased back by the manufacturer pursuant to the lemon law?<br />

31. If the manufacturer repurchases my motor vehicle, watercraft or outboard motor,<br />

pursuant to the lemon law, and replaces it with another vehicle, do I have to pay<br />

tax when applying for title on the second vehicle?<br />

32. How do I obtain a refund if tax has been paid in error?<br />

33. What is a "new" motor vehicle as it pertains to the trade-in allowance?<br />

34. How is a utility trailer taxed and where is the tax paid?<br />

35. Can a dealer donate an item (motor vehicle, watercraft and/or outboard motor) to<br />

a nonprofit, charitable organization and avoid payment of tax?<br />

36. How is tax paid on golf carts?<br />

37. Can a person trade in more than one motor vehicle on the purchase of a new<br />

motor vehicle and deduct the trade-in value of both vehicles?<br />

38. Is mobility-enhancing equipment added to a motor vehicle subject to the sales or<br />

use tax?<br />

39. Are auto auctioneers required to collect and remit sales tax?<br />

40. What happens when a nonresident purchaser returns to <strong>Ohio</strong>?<br />

41. Can a used motor vehicle dealer purchase a new motor vehicle under the "resale"<br />

exception?<br />

42. How are taxes calculated on a brokered watercraft sale?<br />

43. Can you provide more examples of situations where there is no tax due on the<br />

transfer of title of a motor vehicle, all-purpose vehicle, off-highway motorcycle,<br />

titled watercraft, titled outboard motor, or titled personal watercraft?<br />

44. Can you provide some examples of "consideration" other than money that is given<br />

in exchange for a certificate of title?<br />

45. How are lease assumptions of motor vehicles and other tangible personal property<br />

taxed?<br />

46. What is the correct tax rate to charge a customer on the sale or lease of motor<br />

vehicles, watercraft or outboard motors?