INVESTKREDIT BANK AG - Xetra

INVESTKREDIT BANK AG - Xetra

INVESTKREDIT BANK AG - Xetra

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

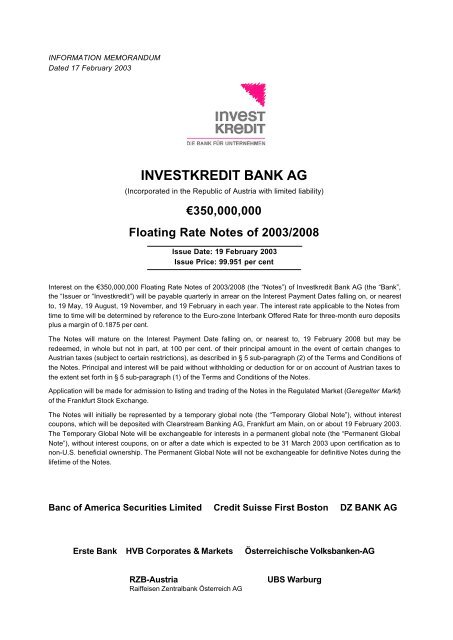

INFORMATION MEMORANDUM<br />

Dated 17 February 2003<br />

<strong>INVESTKREDIT</strong> <strong>BANK</strong> <strong>AG</strong><br />

(Incorporated in the Republic of Austria with limited liability)<br />

€350,000,000<br />

Floating Rate Notes of 2003/2008<br />

Issue Date: 19 February 2003<br />

Issue Price: 99.951 per cent<br />

Interest on the €350,000,000 Floating Rate Notes of 2003/2008 (the “Notes”) of Investkredit Bank <strong>AG</strong> (the “Bank”,<br />

the “Issuer or “Investkredit”) will be payable quarterly in arrear on the Interest Payment Dates falling on, or nearest<br />

to, 19 May, 19 August, 19 November, and 19 February in each year. The interest rate applicable to the Notes from<br />

time to time will be determined by reference to the Euro-zone Interbank Offered Rate for three-month euro deposits<br />

plus a margin of 0.1875 per cent.<br />

The Notes will mature on the Interest Payment Date falling on, or nearest to, 19 February 2008 but may be<br />

redeemed, in whole but not in part, at 100 per cent. of their principal amount in the event of certain changes to<br />

Austrian taxes (subject to certain restrictions), as described in § 5 sub-paragraph (2) of the Terms and Conditions of<br />

the Notes. Principal and interest will be paid without withholding or deduction for or on account of Austrian taxes to<br />

the extent set forth in § 5 sub-paragraph (1) of the Terms and Conditions of the Notes.<br />

Application will be made for admission to listing and trading of the Notes in the Regulated Market (Geregelter Markt)<br />

of the Frankfurt Stock Exchange.<br />

The Notes will initially be represented by a temporary global note (the “Temporary Global Note”), without interest<br />

coupons, which will be deposited with Clearstream Banking <strong>AG</strong>, Frankfurt am Main, on or about 19 February 2003.<br />

The Temporary Global Note will be exchangeable for interests in a permanent global note (the “Permanent Global<br />

Note”), without interest coupons, on or after a date which is expected to be 31 March 2003 upon certification as to<br />

non-U.S. beneficial ownership. The Permanent Global Note will not be exchangeable for definitive Notes during the<br />

lifetime of the Notes.<br />

Banc of America Securities Limited Credit Suisse First Boston DZ <strong>BANK</strong> <strong>AG</strong><br />

Erste Bank HVB Corporates & Markets<br />

Österreichische Volksbanken-<strong>AG</strong><br />

RZB-Austria<br />

Raiffeisen Zentralbank Österreich <strong>AG</strong><br />

UBS Warburg

The Issuer, having made all reasonable enquiries, confirms that this Information Memorandum contains all<br />

information with respect to the Issuer, the Issuer and its subsidiaries and affiliates taken as a whole (the<br />

“Group” or the “Investkredit Group”) and the Notes which is material in the context of the issue and offering of<br />

the Notes and that the statements contained herein relating to the Issuer, the Group and the Notes are in every<br />

material particular true and accurate and not misleading, the opinions and intentions expressed in this<br />

document with regard to the Issuer and the Group are honestly held, have been reached after considering all<br />

relevant circumstances and are based on reasonable assumptions, there are no other facts in relation thereto<br />

the omission of which would, in the context of the issue and offering of the Notes, make any statement in this<br />

Information Memorandum misleading in any material respect and all reasonable enquiries have been made by<br />

the Issuer to ascertain such facts and to verify the accuracy of all such information and statements. The Issuer<br />

accepts the responsibility for the contents of this Information Memorandum, accordingly.<br />

No person is authorised to give any information or to make any representations not contained in this<br />

Information Memorandum and any information or representations not so contained must not be relied upon as<br />

having been authorised by or on behalf of the Issuer or the Managers (as defined in “Subscription and Sale”<br />

below). The delivery of this Information Memorandum at any time does not imply that the information contained<br />

in it is correct as at any time subsequent to its date.<br />

This Information Memorandum does not constitute an offer of, or an invitation by or on behalf of the Issuer or<br />

the Managers to subscribe for, or purchase, any of the Notes.<br />

The Notes have not been, and will not be, registered under the United States Securities Act of 1933 (the<br />

“Securities Act”) and are subject to U.S. tax law requirements. Subject to certain exceptions, Notes may not be<br />

offered, sold or delivered in the United States or to U.S. persons.<br />

The distribution of this Information Memorandum and the offering of the Notes in certain jurisdictions may be<br />

restricted by law. Persons into whose possession this Information Memorandum comes are required by the<br />

Issuer and the Managers to inform themselves about and to observe any such restrictions. For a description of<br />

certain further restrictions on offers and sales of Notes and distribution of this Information Memorandum, see<br />

“Subscription and Sale” below.<br />

In this Information Memorandum all references to “EUR”, “euro” and “€” are to the lawful currency of the<br />

member states of the European Union that adopted the single currency in accordance with the Treaty<br />

establishing the European Community, as amended by the Treaty on European Union. The Republic of Austria<br />

(“Austria”) is a participating member state of the European economic and monetary union.<br />

In connection with this issue, Credit Suisse First Boston (Europe) Limited or any person acting for him<br />

may over-allot or effect transactions with a view to supporting the market price of the Notes at a level<br />

higher than that which might otherwise prevail for a limited period after the issue date. However, there<br />

may be no obligation on Credit Suisse First Boston (Europe) Limited or any agent of his to do this.<br />

Such stabilising, if commenced, may be discontinued at any time, and must be brought to an end after<br />

a limited period.<br />

2

TABLE OF CONTENTS<br />

Page<br />

TERMS AND CONDITIONS OF THE NOTES (German / English)................................................. 4<br />

USE OF PROCEEDS................................................................................................................16<br />

CAPITALISATION OF THE <strong>BANK</strong> ..............................................................................................17<br />

DESCRIPTION OF THE <strong>BANK</strong>..................................................................................................18<br />

SELECTED FINANCIAL INFORMATION....................................................................................24<br />

TAXATION ...............................................................................................................................26<br />

SUBSCRIPTION AND SALE .....................................................................................................28<br />

GENERAL INFORMATION........................................................................................................31<br />

AUDITED FINANCIAL STATEMENTS 2001 OF THE GROUP.........................................................A1<br />

UNAUDITED INTERIM FINANCIAL STATEMENTS OF THE GROUP as of 30 September 2002...U1<br />

3

Anleihebedingungen<br />

Terms and Conditions of the Notes<br />

– non-binding translation –<br />

§ 1<br />

Form und Nennbetrag<br />

(1) Die von der Investkredit Bank <strong>AG</strong>, Wien, Republik<br />

Österreich, (nachfolgend die „Emittentin“ genannt)<br />

begebenen variabel verzinslichen Inhaber-Schuldverschreibungen<br />

von 2003/2008 im Gesamtnennbetrag<br />

von<br />

EUR 350.000.000<br />

(in Worten: Euro dreihundertfünfzig Millionen)<br />

sind in untereinander gleichberechtigte, auf den Inhaber<br />

lautende übertragbare Teilschuldverschreibungen zu je<br />

EUR 1.000 (nachfolgend die „Teilschuldverschreibungen“<br />

oder die „Anleihe“ genannt) eingeteilt.<br />

(2) Die Teilschuldverschreibungen werden zunächst<br />

durch eine vorläufige Global-Inhaber-Schuldverschreibung<br />

(die „Vorläufige Global-Schuldverschreibung“)<br />

ohne Zinsscheine verbrieft. Die Vorläufige Global-<br />

Schuldverschreibung kann insgesamt oder teilweise<br />

gegen den Nachweis des Nichtbestehens U.S.-<br />

amerikanischen wirtschaftlichen Eigentums, wie in der<br />

Vorläufigen Global-Schuldverschreibung beschrieben,<br />

kostenfrei für den Inhaber frühestens nach Ablauf von 40<br />

Tagen ab dem Valutierungstag (wie in § 2 Absatz (1) (a)<br />

definiert) in Rechte an einer permanenten Global-<br />

Inhaber-Schuldverschreibung (die „Dauer-Global-<br />

Schuldverschreibung“) ohne Zinsscheine ausgetauscht<br />

werden. Die Vorläufige Global-Schuldverschreibung und<br />

die Dauer-Global-Schuldverschreibung werden bei der<br />

Clearstream Banking <strong>AG</strong>, Frankfurt am Main, hinterlegt;<br />

die Clearstream Banking <strong>AG</strong>, Frankfurt am Main, oder<br />

ihr Rechtsnachfolger werden nachstehend als „Verwahrer“<br />

bezeichnet. So lange die Teilschuldverschreibungen<br />

durch die Vorläufige Global-Schuldverschreibung<br />

verbrieft sind, sind zur Zahlung von Zinsen<br />

gesonderte Nachweise des Nichtbestehens USamerikanischen<br />

wirtschaftlichen Eigentums erforderlich.<br />

Die Vorläufige Global-Schuldverschreibung und die<br />

Dauer-Global-Schuldverschreibung werden nachstehend<br />

jeweils die „Global-Schuldverschreibung“ genannt. Das<br />

Recht der Inhaber von Teilschuldverschreibungen (nachstehend<br />

die „Anleihegläubiger“ genannt) auf Lieferung<br />

von Einzelurkunden ist während der gesamten Laufzeit<br />

ausgeschlossen. Den Anleihegläubigern stehen Miteigentumsanteile<br />

an der Global-Schuldverschreibung zu,<br />

die in Übereinstimmung mit den Bestimmungen und<br />

Regeln des Verwahrers und außerhalb der Bundesrepublik<br />

Deutschland von Euroclear Bank S.A./N.V.,<br />

Brüssel, und Clearstream Banking S.A., Luxemburg,<br />

übertragen werden können. Die Global-Schuldverschreibungen<br />

tragen die eigenhändigen Unterschriften<br />

von zwei zeichnungsberechtigten Vertretern der<br />

Emittentin und die eigenhändige Unterschrift eines<br />

Kontrollbeauftragten der DZ <strong>BANK</strong> <strong>AG</strong> Deutsche<br />

Zentral-Genossenschaftsbank, Frankfurt am Main<br />

(„DZ <strong>BANK</strong>“).<br />

§ 1<br />

Form and Denomination<br />

(1) The issue by Investkredit Bank <strong>AG</strong>, Vienna, Republic<br />

of Austria, (the “Issuer”) of its Floating Rate Notes of<br />

2003/2008 in the aggregate principal amount of<br />

EUR 350,000,000<br />

(in words: Euro three hundred fifty million)<br />

is subdivided into transferable claims to bearer of EUR<br />

1,000 each ranking pari passu with each other (the<br />

“Notes”).<br />

(2) The Notes are initially represented by a temporary<br />

global bearer note (the “Temporary Global Note”) without<br />

coupons. The Temporary Global Note will be<br />

exchangeable, free of charge to the holder, on or after<br />

the day falling after the expiry of 40 days after its Issue<br />

Date (as defined in § 2 subparagraph (1)(a)), in whole or<br />

in part upon certification as to non-U.S. beneficial<br />

ownership in the form set out in the Temporary Global<br />

Note for interests in a permanent global bearer note (the<br />

“Permanent Global Note”) without coupons. The<br />

Temporary Global Note and the Permanent Global Note<br />

will be deposited with Clearstream Banking <strong>AG</strong>,<br />

Frankfurt am Main; Clearstream Banking <strong>AG</strong> or its legal<br />

successor are hereinafter referred to as the “Depositary”.<br />

As long as the Notes are represented by the Temporary<br />

Global Note any interest payments on the Notes require<br />

separate certifications as to non-U.S. beneficial<br />

ownership. The Temporary Global Note and the<br />

Permanent Global Note are each hereinafter referred to<br />

as the “Global Note”. The right of the holders of the<br />

Notes (hereinafter referred to as the “Noteholders”) for<br />

the delivery of individual Notes shall be excluded<br />

throughout the entire lifetime of the Notes. The<br />

Noteholders shall be entitled to co-ownership<br />

participations in the Global Note, which are transferable<br />

in accordance with the rules and regulations of the<br />

Depositary and, outside of the Federal Republic of<br />

Germany, pursuant to the rules and regulations of<br />

Euroclear Bank S.A./N.V., Brussels, and Clearstream<br />

Banking S.A., Luxembourg. The Global Bearer Notes<br />

bear the handwritten signatures of two authorised<br />

representatives of the Issuer and the handwritten<br />

signature of a control officer of DZ <strong>BANK</strong> <strong>AG</strong> Deutsche<br />

Zentral-Genossenschaftsbank, Frankfurt am Main<br />

(“DZ <strong>BANK</strong>”).<br />

4

§ 2<br />

Zinsen<br />

(1) (a) Die Teilschuldverschreibungen werden ab dem<br />

19. Februar 2003 (der „Valutierungstag“) mit dem<br />

gemäß Absatz (b) festgestellten variablen Zinssatz<br />

verzinst. Die Zinsen werden vierteljährlich nachträglich<br />

an jedem Zinstermin (wie nachstehend<br />

definiert) fällig.<br />

„Zinstermine“ sind der 19. Mai, 19. August, 19.<br />

November und 19. Februar eines jeden Jahres, es<br />

sei denn, der betreffende Tag ist kein Geschäftstag<br />

(wie nachstehend definiert). In diesem Fall ist<br />

Zinstermin der Geschäftstag, der auf den Tag<br />

unmittelbar folgt, an dem die Zinsen sonst zahlbar<br />

gewesen wären, es sei denn, der Zinstermin würde<br />

dadurch in den nächsten Kalendermonat fallen; in<br />

diesem Fall fällt der Zinstermin auf den unmittelbar<br />

vorhergehenden Geschäftstag. Der Zeitraum vom<br />

Valutierungstag (einschließlich) bis zum ersten<br />

Zinstermin (ausschließlich) und jeder nachfolgende<br />

Zeitraum von einem Zinstermin (einschließlich) bis<br />

zum darauffolgenden Zinstermin (ausschließlich)<br />

werden nachfolgend „Zinsperiode“ genannt. Der<br />

letzte Zinstermin ist der 19. Februar 2008.<br />

„Geschäftstag“ im Sinne dieses Absatzes (1)(a) ist<br />

jeder Tag, an dem die Banken und das Abrechnungssystem<br />

des Verwahrers am Erfüllungsort<br />

gemäß § 12 Absatz (2) für Bankgeschäfte geöffnet<br />

sind.<br />

(b) Der für jede Zinsperiode maßgebende variable<br />

Zinssatz der Teilschuldverschreibungen wird von der<br />

DZ <strong>BANK</strong> in ihrer Funktion als Zinsermittlungsbank<br />

(die „Zinsermittlungsbank“) nach den folgenden<br />

Bestimmungen festgestellt:<br />

1. Der variable Zinssatz für die jeweilige Zinsperiode<br />

entspricht der gemäß den Ziffern 2., 3.<br />

oder 4. bestimmten European Interbank Offered<br />

Rate („EURIBOR“) für Drei-Monats-Euro-<br />

Einlagen zuzüglich 0,1875 % p. a..<br />

2. Am zweiten TARGET-Geschäftstag vor dem<br />

Valutierungstag und danach am zweiten<br />

TARGET-Geschäftstag vor jedem Zinstermin (der<br />

„Zinsermittlungstag“) wird die Zinsermittlungsbank<br />

den EURIBOR bestimmen. Dieser Angebotssatz<br />

entspricht demjenigen, welcher auf der<br />

Bildschirmseite, bezeichnet als Moneyline<br />

Telerate Seite 248 (oder die Ersatzseite oder der<br />

Ersatzservice, welche diese Seite ersetzen, um<br />

die Interbanken-Angebotssätze für Euro-Einlagen<br />

der führenden Banken in der Eurozone anzuzeigen),<br />

um 11.00 Uhr (Brüsseler Zeit) für Drei-<br />

Monats-Euro-Einlagen für die dem jeweiligen<br />

Zinsermittlungstag folgende Zinsperiode angezeigt<br />

wird.<br />

3. Falls an einem Zinsermittlungstag ein solcher<br />

Angebotssatz nicht angezeigt wird oder falls die<br />

relevante Seite nicht erreichbar ist, wird die<br />

Zinsermittlungsbank an dem Zinsermittlungstag<br />

bei fünf führenden Mitgliedsbanken imEURIBOR-<br />

Panel (die „Referenzbanken“) die Quotierung des<br />

EURIBOR für Drei-Monats-Euro-Einlagen ein-<br />

§ 2<br />

Interest<br />

(1) (a) The Notes shall bear interest from 19 February<br />

2003 (the “Issue Date”) at the floating rate<br />

determined in accordance with sub-paragraph (b).<br />

Interest shall be due quarterly in arrear on each<br />

Interest Payment Date (as defined below).<br />

“Interest Payment Dates” are 19 May, 19 August, 19<br />

November and 19 February of each year unless such<br />

day is not a Business Day (as defined below). In this<br />

case the Interest Payment Date shall be the<br />

Business Day immediately succeeding the day, on<br />

which interest would have been payable, unless the<br />

Interest Payment Date would fall within the next<br />

month; in this case the Interest Payment Date falls<br />

on the immediately preceding Business Day. The<br />

period from and including the Issue Date to but<br />

excluding the first Interest Payment Date and each<br />

successive period from and including an Interest<br />

Payment Date to but excluding the next succeeding<br />

Interest Payment Date is called an “Interest Period”.<br />

The last Interest Payment Date is 19 February 2008.<br />

“Business Day” in the meaning of this sub-paragraph<br />

(1)(a) is each day, on which banks and the clearing<br />

system of the Depositary at the place of performance<br />

in accordance with § 12 sub-paragraph (2) are open<br />

for business.<br />

(b) For each Interest Period the relevant floating rate<br />

of interest on the Notes will be determined by<br />

DZ <strong>BANK</strong> in its capacity as interest determination<br />

agent (the “Interest Determination Agent”) pursuant<br />

to the following conditions:<br />

1. The floating rate of interest for the respective<br />

Interest Period equals the European Interbank<br />

Offered Rate (“EURIBOR”) for three-months-<br />

Euro-deposits plus 0.1875 % p.a. determined in<br />

accordance with item 2, 3 or 4.<br />

2. On the second TARGET Business Day<br />

preceding the Issue Date and thereafter on the<br />

second TARGET Business Day preceding each<br />

Interest Payment Date (the “Interest<br />

Determination Date”) the Interest Determination<br />

Agent will determine the EURIBOR. Such offered<br />

rate will be that which appears on the display<br />

designated as Moneyline Telerate page 248 (or<br />

such other page or service as may replace it for<br />

the purpose of displaying Euro-zone interbank<br />

offered rates of major banks for euro deposits) -<br />

at 11:00 a.m. (Brussels time) for the respective<br />

Interest Determination Date of the succeeding<br />

Interest Period.<br />

3. If on any Interest Determination Date such<br />

offered rate does not so appear, or if the relevant<br />

page is unavailable, the Interest Determination<br />

Agent will ask five leading member banks of the<br />

EURIBOR-panel (the “Reference Banks”) for<br />

quotes of an EURIBOR-rate offered to leading<br />

banks in the Euro-zone interbank market for<br />

5

holen, der führenden Banken im Interbankenmarkt<br />

der Eurozone angeboten wird. Der EURIBOR für<br />

die betreffende Zinsperiode ist das von der<br />

Zinsermittlungsbank errechnete arithmetische<br />

Mittel (gegebenenfalls gerundet auf das nächste<br />

eintausendstel eines Prozentpunktes, ab 0,0005<br />

wird aufgerundet) der ihr genannten Zinssätze.<br />

4. Wenn an einem Zinsermittlungstag lediglich<br />

eine oder keine der Referenzbanken eine solche<br />

Quotierung abgibt, entspricht der variable<br />

Zinssatz für die folgende Zinsperiode dem Satz<br />

p.a., welcher von der Zinsermittlungsbank als die<br />

Summe von 0,1875 % und dem arithmetische<br />

Mittel (gegebenenfalls gerundet auf das nächste<br />

eintausendstel eines Prozentpunktes, ab 0,0005<br />

wird aufgerundet) des Euro-Darlehenssatzes<br />

festgelegt wird, welcher von führenden, von der<br />

Zinsermittlungsbank bestimmten, Banken in der<br />

Eurozone führenden europäische Banken für<br />

eine 3-Monats-Periode angeboten wird. Wenn die<br />

so von der Zinsermittlungsbank bestimmten<br />

Banken nicht, wie beschrieben, solche Quotierungen<br />

abgeben, entspricht der variable Zinssatz<br />

dem variablen Zinssatz, der für die letzte<br />

Zinsperiode gegolten hat, bezüglich welcher einer<br />

der vorgenannten Unterparagraphen dieses<br />

Paragraphen (b) Anwendung gefunden hat.<br />

„TARGET-Geschäftstag“ ist jeder Tag, an dem das<br />

Europäische Zahlungsverkehrssystem TARGET<br />

(Trans-European Automated Real-time Gross<br />

Settlement Express Transfer System) in Betrieb ist.<br />

(c) Die Zinsermittlungsbank wird an jedem Zinsermittlungstag<br />

oder unverzüglich danach den<br />

variablen Zinssatz sowie den für die fragliche<br />

Zinsperiode zu zahlenden Zinsbetrag festsetzen. Die<br />

auf die Teilschuldverschreibungen entfallenden<br />

Zinsen werden errechnet, indem der auf den<br />

Nennbetrag einer Teilschuldverschreibung nach dem<br />

anwendbaren variablen Zinssatz zu zahlende Betrag<br />

p.a. ermittelt wird. Dieses Ergebnis wird mit der Zahl<br />

der tatsächlichen Tage der fraglichen Zinsperiode<br />

multipliziert und durch 360 geteilt. Das Ergebnis wird<br />

auf den nächsten Eurocent auf- oder abgerundet,<br />

wobei 0,5 Eurocents aufgerundet werden.<br />

(d) Der Zinslauf der Teilschuldverschreibungen endet<br />

mit dem Ablauf des Tages, der dem Tag vorausgeht,<br />

an dem sie zur Rückzahlung fällig werden. Falls die<br />

Emittentin, gleich aus welchem Grunde, die<br />

Teilschuldverschreibungen bei Fälligkeit nicht einlöst,<br />

erfolgt die Verzinsung des ausstehenden Nennbetrages<br />

der Teilschuldverschreibungen vom Tag<br />

der Fälligkeit bis zum Ablauf des Tages, der dem<br />

Tag der tatsächlichen Rückzahlung vorangeht, in<br />

Höhe des gesetzlich festgelegten Satzes für<br />

Verzugszinsen, mindestens jedoch in Höhe des<br />

variablen Zinssatzes, welcher auf die Teilschuldverschreibungen<br />

für diese Zinsperiode gemäß<br />

diesen Anleihebedingungen zahlbar ist.<br />

(e) Die Zinsermittlungsbank veranlasst die Bekanntmachung<br />

des für die entsprechende Zinsperiode<br />

ermittelten variablen Zinssatzes, des auf den<br />

three-months-Euro-deposits. The EURIBOR-rate<br />

for the respective Interest Period is the arithmetic<br />

mean calculated by the Interest Determination<br />

Agent (rounded, if necessary to the nearest one<br />

thousandth of a percentage point, 0.0005 being<br />

rounded upwards) of the EURIBOR-quotes.<br />

4. If on any Interest Determination Date one only<br />

or none of the Reference Banks provides such<br />

quotation, the floating rate of interest for the<br />

succeeding Interest Period shall be the rate per<br />

annum which the Interest Determination Agent<br />

determ ines to be the aggregate of 0.1875 % per<br />

annum and the arithmetic mean (rounded, if<br />

necessary, to the nearest one thousandth of a<br />

percentage point, 0.0005 being rounded<br />

upwards) of the euro lending rates which leading<br />

banks in the Euro-zone selected by the Interest<br />

Determination Agent are quoting, on the relevant<br />

Interest Determination Date, for a period of three<br />

months, to leading European banks, except that,<br />

if the banks so selected by the Interest<br />

Determination Agent are not quoting as<br />

mentioned above, the floating rate of interest<br />

shall be the floating rate of interest in effect for<br />

the last preceding Interest Period to which one of<br />

the preceding sub-paragraphs of this paragraph<br />

(b) shall have applied.<br />

“TARGET Business Day” means each day on which<br />

the European payment transfer system TARGET<br />

(Trans-European Automated Real-time Gross<br />

Settlement Express Transfer System) is operating.<br />

(c) The Interest Determination Agent shall determine<br />

the floating rate of interest on each Interest<br />

Determination Date or thereafter, without undue<br />

delay, as well as determine the interest amount<br />

payable for the respective Interest Period. The<br />

interest amount on each Note shall be calculated by<br />

applying the rate of interest applicable for the<br />

respective Interest Period to the principal amount of<br />

such Note p.a. This result shall be multiplied by the<br />

actual number of days of the respective Interest<br />

Period and shall be divided by 360. The resultant<br />

amount shall be rounded upwards or downwards to<br />

the nearest Eurocent (0.5 Eurocent being rounded<br />

upwards).<br />

(d) The Notes will cease to bear interest as of the<br />

end of the day preceding the respective due date.<br />

Should the Issuer for any reason whatsover fail to<br />

redeem the Notes when due, interest on the principal<br />

amount of the Notes outstanding shall continue to<br />

accrue until the end of the day preceding the day of<br />

actual payment at the higher of the default rate of<br />

interest established by law and the floating rate of<br />

interest payable on the Notes for that Interest Period<br />

in accordance with these Terms and Conditions.<br />

(e) The Interest Determination Agent shall without<br />

undue delay arrange for the publication in accordance<br />

with § 10 of the respective interest rate<br />

6

Nennbetrag jeder Teilschuldverschreibung entfallenden<br />

Zinsbetrages und des Zinstermins unverzüglich<br />

gemäß § 10. Im Falle einer Verlängerung<br />

oder einer Verkürzung der Zinsperiode können von<br />

der Zinsermittlungsbank der zahlbare Zinsbetrag<br />

sowie der Zinstermin nachträglich berichtigt oder<br />

andere geeignete Anpassungsregelungen getroffen<br />

werden, ohne dass es dafür einer Bekanntmachung<br />

bedarf. Im übrigen ist (sofern kein offensichtlicher<br />

Fehler vorliegt) die Ermittlung der variablen<br />

Zinssätze und der jeweils zahlbare Zinsbetrag<br />

endgültig und für alle Beteiligten bindend. Den<br />

Anleihegläubigern stehen gegen die Zinsermittlungsbank<br />

keine Ansprüche wegen der Art der<br />

Wahrnehmung oder der Nichtwahrnehmung der sich<br />

aus diesem § 2 ergebenden Rechte, Pflichten oder<br />

Ermessensbefugnisse zu.<br />

(2) Die Emittentin wird dafür Sorge tragen, dass für die<br />

gesamte Dauer, für die Zinsen auf die Teilschuldverschreibungen<br />

anfallen, jederzeit eine Zinsermittlungsbank<br />

bestellt ist.<br />

(3) Kann oder will die DZ <strong>BANK</strong> – gleich aus welchem<br />

Grund – ihr Amt als Zinsermittlungsbank nicht mehr<br />

ausüben, ist sie berechtigt, nach Unterrichtung der<br />

Emittentin eine andere Bank von internationalem<br />

Ansehen als Zinsermittlungsbank mit den in diesen<br />

Anleihebedingungen festgelegten Rechten und Pflichten<br />

zu bestellen. Ist der DZ <strong>BANK</strong> die Bestellung einer<br />

anderen Zinsermittlungsbank nicht möglich, so obliegt<br />

diese Bestellung der Emittentin. Die Übertragung des<br />

Amtes der Zinsermittlungsbank ist von der DZ <strong>BANK</strong><br />

oder der Emittentin, falls dieser die Bestellung obliegt,<br />

unverzüglich gemäß § 10 oder, wenn dies nicht möglich<br />

sein sollte, in anderer geeigneter Art und Weise auf<br />

Kosten der Emittentin öffentlich bekannt zu machen.<br />

(4) Die Zinsermittlungsbank als solche ist ausschließlich<br />

Beauftragte der Emittentin. Zwischen der Zinsermittlungsbank<br />

und den Anleihegläubigern besteht kein<br />

Auftrags- oder Treuhandverhältnis.<br />

(5) Die Zinsermittlungsbank ist von den Beschränkungen<br />

des § 181 des Bürgerlichen Gesetzbuches und<br />

entsprechenden Beschränkungen in anderen Rechtsordnungen,<br />

soweit gesetzlich zulässig, befreit.<br />

(6) Unbeschadet der Bestimmungen der Absätze (1)<br />

und (4) haftet die Zinsermittlungsbank dafür, dass sie<br />

Erklärungen abgibt, nicht abgibt, entgegennimmt oder<br />

Handlungen vornimmt oder unterlässt nur, wenn und<br />

soweit sie dabei die Sorgfalt eines ordentlichen<br />

Kaufmanns verletzt hat.<br />

determined for the respective Interest Period, the<br />

interest payable on the principal amount of each<br />

Note and the Interest Payment Date. In the event of<br />

an extension or shortening of the Interest Period, the<br />

amount of interest payable and the Interest Payment<br />

Date may subsequently be corrected, or appropriate<br />

alternative arrangements may be made by way of<br />

adjustment by the Interest Determination Agent<br />

without a publication being necessary with regard<br />

thereto. In all other respects, the determination of the<br />

rates of interest and the amounts of interest payable<br />

in each instance shall (in the absence of manifest<br />

error) be final and binding upon all parties. The Noteholders<br />

do not have any claims against the Interest<br />

Determination Agent regarding the way of handling<br />

or not handling its rights, duties and discretionary<br />

decisions resulting out of this § 2.<br />

(2) The Issuer shall procure that for the time, where<br />

interest is accruing on the Notes, there is at all times an<br />

Interest Determination Agent.<br />

(3) If DZ <strong>BANK</strong> – for any reason whatsoever – is unable<br />

or unwilling to act as Interest Determination Agent, it<br />

shall be entitled, after informing the Issuer, to appoint<br />

another bank of international standing as Interest<br />

Determination Agent with the rights and obligations as<br />

set forth in these Terms and Conditions of the Notes.<br />

Should DZ <strong>BANK</strong> be unable to make such appointment,<br />

then the Issuer shall have to appoint the successor<br />

Interest Determination Agent. The transfer of the office<br />

of Interest Determination Agent shall be published by DZ<br />

<strong>BANK</strong> or, if the Issuer is obliged to make the<br />

appointment, the Issuer, without undue delay pursuant to<br />

§ 10 or, if this should not be possible, in another<br />

appropriate manner at the cost of the Issuer.<br />

(4) The Interest Determination Agent is, in its function as<br />

such, exclusively mandated by the Issuer. No mandate<br />

or fiduciary relationship (Treuhandverhältnis) exists<br />

between the Interest Determination Agent and the<br />

Noteholders.<br />

(5) The Interest Determination Agent is released from<br />

the restrictions of § 181 German Civil Code<br />

(Bürgerliches Gesetzbuch) and similar restrictions of<br />

other applicable laws.<br />

(6) Irrespective of the conditions of sub-paragraphs (1)<br />

and (4) the Interest Determination Agent in making,<br />

omitting, or acceping declarations, in acting or failing to<br />

act shall only be liable in so far as it has violated the due<br />

care of a proper merchant (Sorgfalt eines ordentlichen<br />

Kaufmanns).<br />

§ 3<br />

Rückzahlung<br />

(1) Die Emittentin verpflichtet sich, die Teilschuldverschreibungen<br />

am 19. Februar 2008 zum Nennbetrag<br />

zurückzuzahlen. Die Emittentin kann die Teilschuldverschreibungen,<br />

unbeschadet ihrer Rechte in den in § 5<br />

Absatz (2) genannten Fällen, nicht kündigen. Abgesehen<br />

vom dem Kündigungsrecht gemäß § 8 sind die<br />

Anleihegläubiger nicht berechtigt, die Rückzahlung<br />

der Teilschuldverschreibungen vor Endfälligkeit zu verlangen.<br />

§ 3<br />

Redemption<br />

(1) The Issuer undertakes to redeem the Notes at their<br />

principal amount on 19 February 2008. The Issuer is not<br />

entitled to call the Notes, without prejudice to its rights in<br />

the events mentioned in § 5 sub-paragraph (2). The<br />

Noteholders are not entitled to require the Issuer to<br />

redeem the Notes prior to maturity except as provided in<br />

§ 8.<br />

7

(2) Die Emittentin ist berechtigt, jederzeit Teilschuldverschreibungen<br />

am Markt oder auf sonstige Weise zu<br />

erwerben.<br />

(3) Derart zurückgezahlte oder rückerworbene Teilschuldverschreibungen<br />

(mit Ausnahme von Teilschuldverschreibungen,<br />

die innerhalb des üblichen Wertpapierhandelsgeschäfts<br />

erworben wurden) werden<br />

entwertet und dürfen nicht wieder ausgegeben oder<br />

wieder veräußert werden.<br />

(2) The Issuer is entitled at any time to purchase Notes<br />

in the open market or other-wise.<br />

(3) Notes so redeemed or purchased (other than any<br />

Notes purchased in the ordinary course of a business of<br />

dealing in securities) will be cancelled and may not be<br />

re-issued or resold.<br />

§ 4<br />

Zahlungen / Zahlstelle / Zahlstellenwechsel<br />

(1) Die Em ittentin verpflichtet sich unwiderruflich, Kapital<br />

und/oder Zinsen bei Fälligkeit in Euro zu zahlen. Diese<br />

Verpflichtung umfasst den rechtzeitigen Transfer der<br />

fälligen Beträge an die DZ <strong>BANK</strong> in ihrer Funktion als<br />

Zahlstelle (die „Zahlstelle“) unter allen Umständen und<br />

ohne Rücksicht auf die Staatsangehörigkeit, den<br />

Wohnsitz und den gewöhnlichen Aufenthaltsort der<br />

Anleihegläubiger. Die Zahlung von Kapital und/oder<br />

Zinsen an die Anleihegläubiger erfolgt, ohne dass die<br />

Ausfertigung eines Affidavits oder die Erfüllung<br />

irgendeiner sonstigen Förmlichkeit verlangt werden darf,<br />

abgesehen von der Beachtung etwaiger am Zahlungsort<br />

geltender Steuer-, Devisen- oder sonstiger Gesetze oder<br />

Vorschriften.<br />

(2) Von der Emittentin erhaltene Zahlungen von Kapital<br />

und/oder Zinsen auf die Teilschuldverschreibungen sind<br />

seitens der Zahlstelle durch Überweisung an den<br />

Verwahrer zwecks Gutschrift auf den Konten der<br />

jeweiligen Depotbanken unverzüglich an die Anleihegläubiger<br />

weiterzuleiten. Die Emittentin wird durch die<br />

Zahlung an den Verwahrer oder dessen Order von ihrer<br />

Zahlungspflicht gegenüber den Anleihegläubigern<br />

befreit.<br />

(3) Kann oder will die DZ <strong>BANK</strong> – gleich aus welchem<br />

Grund – ihr Amt als Zahlstelle nicht mehr ausüben,<br />

ist sie berechtigt, nach Unterrichtung der Emittentin<br />

eine andere Bank von internationalem Ansehen als<br />

Zahlstelle mit den in diesen Anleihebedingungen<br />

festgelegten Rechten und Pflichten zu bestellen. Ist der<br />

DZ <strong>BANK</strong> die Bestellung einer anderen Zahlstelle nicht<br />

möglich, so obliegt diese Bestellung der Emittentin. Die<br />

Übertragung des Amtes der Zahlstelle ist von der<br />

DZ <strong>BANK</strong> oder der Emittentin, falls dieser die Bestellung<br />

obliegt, unverzüglich gemäß § 10 oder, wenn dies<br />

nicht möglich sein sollte, in anderer geeigneter Art<br />

und Weise auf Kosten der Emittentin öffentlich bekannt<br />

zu machen.<br />

(4) Die Zahlstelle als solche ist ausschließlich Beauftragte<br />

der Emittentin. Zwischen der Zahlstelle und den<br />

Anleihegläubigern besteht kein Auftrags- oder Treuhandverhältnis.<br />

(5) Unbeschadet der Bestimmungen des Absatzes (4)<br />

haftet die Zahlstelle in dieser Eigenschaft dafür, dass sie<br />

Erklärungen abgibt, nicht abgibt, entgegennimmt oder<br />

Handlungen vornimmt oder unterlässt nur, wenn und<br />

soweit sie dabei die Sorgfalt eines ordentlichen Kaufmanns<br />

verletzt hat. Die Zahlstelle ist von den<br />

Beschränkungen des § 181 Bürgerliches Gesetzbuch<br />

und entsprechenden Bestimmungen in anderen Rechtsordnungen<br />

befreit.<br />

§ 4<br />

Payments / Paying Agent / Substitution of Paying Agent<br />

(1) The Issuer irrevocably undertakes to transfer, as and<br />

when due, principal and/or interest in Euro. This<br />

undertaking covers the transfer to DZ <strong>BANK</strong> in its<br />

function as paying agent (the “Paying Agent”) to be<br />

made when due, under any and all circumstances<br />

regardless of the nationality, domicile or residence of the<br />

Noteholders. The payment of principal and/or interest<br />

shall be made to the Noteholders without it being<br />

permissible to require the execution of an affidavit or<br />

compliance with any other formality whatsoever, save as<br />

may be required for the compliance with relevant tax,<br />

foreign exchange or other laws or regulations applicable<br />

in the place where payment is to be made.<br />

(2) Payments of principal and/or interest on the Notes<br />

received from the Issuer shall be promptly made by the<br />

Paying Agent by way of transfer through the Depositary<br />

for credit to the accounts of the depositary banks in<br />

favour of the Noteholders. The Issuer shall be<br />

discharged from its payment obligations towards the<br />

Noteholders by payments to the Depositary or to the<br />

order of the Depositary.<br />

(3) If DZ <strong>BANK</strong> – for any reason whatsoever - is unable<br />

or unwilling to act as Paying Agent, it shall be entitled,<br />

after informing the Issuer, to appoint another bank of<br />

international standing as Paying Agent with the rights<br />

and obligations as set forth in these Terms and<br />

Conditions of the Notes. Should DZ <strong>BANK</strong> be unable to<br />

make such appointment, then the Issuer shall have to<br />

appoint the successor Paying Agent. The transfer of the<br />

office of Paying Agent shall be published by DZ <strong>BANK</strong><br />

or, if the Issuer is obliged to make the appointment, the<br />

Issuer, without undue delay pursuant to § 10 or, if this<br />

should not be possible, in another appropriate manner at<br />

the cost of the Issuer.<br />

(4) The Paying Agent is, in its function as such,<br />

exclusively mandated by the Issuer. No mandate or<br />

fiduciary relationship (Treuhandverhältnis) exists<br />

between the Paying Agent and the Noteholders.<br />

(5) Irrespective to the conditions of sub-paragraph (4)<br />

the Paying Agent shall, in such capacity, be liable for<br />

declarations made, omitted, received or actions taken or<br />

omitted or declarations of the Noteholders forwarded or<br />

omitted to be forwarded, only if and to the extent that it<br />

does not act with the due care of a proper merchant<br />

(Sorgfalt eines ordentlichen Kaufmanns). The Paying<br />

Agent is released from the restrictions of § 181 German<br />

Civil Code (Bürgerliches Gesetzbuch) and similar<br />

restrictions of other applicable laws.<br />

8

§ 5<br />

Steuern / Kündigung aus Steuergründen<br />

(1) Alle Zahlungen von Kapital und/oder Zinsen auf die<br />

Teilschuldverschreibungen sind unbelastet, ohne Abzug<br />

oder Einbehalt jedweder Art von Steuern, Abgaben,<br />

Veranlagungen oder Gebühren zu leisten, die von oder<br />

in der Republik Österreich oder von einer dort zur<br />

Steuererhebung ermächtigten Behörde auferlegt,<br />

erhoben, eingezogen oder zurückbehalten werden, es<br />

sei denn, ein solcher Einbehalt oder Abzug ist gesetzlich<br />

vorgeschrieben. In einem solchen Fall wird die<br />

Emittentin solche zusätzlichen Beträge zahlen, die<br />

erforderlich sind, damit die den Anleihegläubigern<br />

zufließenden Beträge jeweils den Beträgen an Kapital<br />

und/oder Zinsen entsprechen, die den Anleihegläubigern<br />

zugeflossen wären, wenn ein solcher Einbehalt oder<br />

Abzug nicht erforderlich gewesen wäre. Solche zusätzlichen<br />

Beträge sind jedoch von der Zahlung auf die<br />

Teilschuldverschreibungen ausgenommen, wenn sie<br />

aufgrund von Steuern, Abgaben, Veranlagungen oder<br />

Gebühren<br />

(a) durch jedwede im Namen des Anleihegläubigers<br />

als Depotbank oder Verwahrstelle tätige Person oder<br />

auf sonstige Weise zu leisten sind, die keinen Abzug<br />

oder Einbehalt durch die Emittentin auf von ihr<br />

getätigte Zahlungen von Kapital und/oder Zinsen<br />

darstellen, oder<br />

(b) wegen gegenwärtiger oder früherer persönlicher<br />

oder geschäftlicher Beziehungen des Anleihegläubigers<br />

zur Republik Österreich zu zahlen sind<br />

und nicht allein aufgrund der Tatsache, dass<br />

Zahlungen auf die Teilschuldverschreibungen aus<br />

der Republik Österreich stammen oder für steuerliche<br />

Zwecke als solche anzusehen sind. Dabei ist<br />

die deutsche Zinsabschlagsteuer und der darauf<br />

entfallende Solidaritätszuschlag sowie die österreichische<br />

Kapitalertragsteuer, wie sie jeweils zum<br />

Zeitpunkt der Begebung der Teilschuldverschreibungen<br />

erhoben werden, als Steuer anzusehen, die<br />

unter diesen Unterabsatz (b) fällt und in Bezug auf<br />

die demgemäss keine zusätzlichen Beträge zu<br />

zahlen sind, oder<br />

(c) aufgrund oder infolge (i) einer Richtlinie oder<br />

Verordnung der Europäischen Union hinsichtlich der<br />

Besteuerung von Zinserträgen oder (ii) eines<br />

internationalen Vertrages oder Abkommens hinsichtlich<br />

einer solchen Besteuerung, unter dem die<br />

Republik Österreich oder die Europäische Union eine<br />

Partei ist, oder (iii) einer Gesetzesregelung zur<br />

Durchführung oder Erfüllung oder Umsetzung<br />

solcher Richtlinien, Verordnungen, Verträge oder<br />

Abkommen abgezogen oder einbehalten werden,<br />

oder<br />

(d) aufgrund einer Gesetzesänderung zu zahlen<br />

sind, die später als 30 Tage nach der betreffenden<br />

Fälligkeit einer Zahlung oder, falls diese Zahlung<br />

später erfolgt, nach der gemäss § 10 angekündigten<br />

Leistung der Zahlung in Kraft tritt.<br />

Jede Bezugnahme in diesen Anleihebedingungen<br />

auf Kapital und/oder Zinsen gilt auch als Bezugnahme<br />

auf jedwede sonstigen zusätzlichen Beträge,<br />

die unter diesem Absatz (1) zahlbar sein können.<br />

§ 5<br />

Taxes / Redemption for Tax Reasons<br />

(1) All payments of principal and/or interest in respect of<br />

the Notes shall be made free and clear of, and without<br />

withholding or deduction for, any taxes, duties,<br />

assessments or governmental charges of whatever<br />

nature imposed, levied, collected, withheld or assessed<br />

by or within the Republic of Austria or any authority<br />

therein or thereof having power to tax, unless such<br />

withholding or deduction is required by law. In that event<br />

the Issuer shall pay such additional amounts as will<br />

result in receipt by the Noteholders of such amounts as<br />

would have been received by them had no such<br />

withholding or deduction been required, except that no<br />

such additional amounts shall be payable in respect of<br />

the Notes on account of any taxes, duties assessments<br />

or governmental charges, which<br />

(a) are payable by any person acting as custodian<br />

bank or collecting agent on behalf of the<br />

Noteholders, or otherwise in any manner which does<br />

not constitute a deduction or withholding by the<br />

Issuer from payments of principal and/or interest<br />

made by it, or<br />

(b) are payable by reason of the Noteholder having<br />

or having had, some personal or business<br />

connection with the Republic of Austria and not<br />

merely by reason of the fact that payments in respect<br />

of the Notes are, or for purposes of taxation are<br />

deemed to be, derived from sources in the Republic<br />

of Austria; it being understood that the German<br />

“Zinsabschlagsteuer” (advanced interest income tax)<br />

and the solidarity surcharge thereon as well as the<br />

Austrian “Kapitalertragsteuer” (capital-yields tax),<br />

each as in effect at the time of the issue of the Notes,<br />

is a tax falling under this sub-paragraph (b) and with<br />

respect to which, accordingly, no additional amounts<br />

will be payable, or<br />

(c) are deducted or withheld pursuant to, or in the<br />

consequence of, or as a result of, (i) any European<br />

Union Directive or Regulation concerning the<br />

taxation of interest income, or (ii) any international<br />

treaty or understanding relating to such taxation and<br />

to which the Republic of Austria or the European<br />

Union is a party, or (iii) any provision of law<br />

implementing, or complying with, or introduced to<br />

conform with, such Directive, Regulation, treaty or<br />

understanding, or<br />

(d) are payable by reason of a change in law that<br />

becomes effective more than 30 days after the<br />

relevant payment becomes due, or is provided for<br />

and notice thereof is published in accordance with<br />

§ 10, whichever occurs later.<br />

Any reference in these Terms and Conditions of the<br />

Notes to interest and/or principal shall be deemed<br />

also to refer to any additional amounts which may be<br />

payable under this sub-paragraph (1).<br />

9

(2) Falls (i) die Emittentin zur Zahlung zusätzlicher<br />

Beträge gemäß Absatz (1) infolge einer am oder nach<br />

dem 19. Februar 2003 in Kraft tretenden Änderung oder<br />

Ergänzung von Gesetzen oder Verordnungen der<br />

Republik Österreich oder einer Gebietskörperschaft oder<br />

einer von einer dort zur Steuererhebung ermächtigten<br />

Behörde oder einer geänderten Anwendung oder<br />

amtlichen Auslegung solcher Gesetze oder Verordnungen<br />

verpflichtet ist oder wird und (ii) die Emittentin<br />

diese Verpflichtung nicht durch ihr zur Verfügung<br />

stehende geeignete Maßnahmen vermeiden kann, ist<br />

die Emittentin berechtigt, nach ihrer Wahl zu jedem<br />

Zinstermin durch (unwiderrufliche) Kündigung mit einer<br />

Kündigungsfrist von wenigstens 30 Tagen und<br />

höchstens 60 Tagen gegenüber den Anleihegläubigern<br />

die Teilschuldverschreibungen insgesamt (aber nicht<br />

teilweise) zum Nennbetrag zurückzuzahlen, vorausgesetzt,<br />

dass eine solche Kündigung nicht eher als 90<br />

Tage vor dem frühestmöglichen Termin erfolgen darf,<br />

von dem an die Emittentin zur Zahlung zusätzlicher<br />

Beträge bei einer Fälligkeit einer Zahlung auf die<br />

Teilschuldverschreibungen verpflichtet wäre. Vor<br />

Bekanntmachung einer Kündigung gemäß diesem<br />

Absatz hat die Emittentin der Zahlstelle eine von zwei<br />

Vorstandsmitgliedern der Emittentin unterzeichnete<br />

Bestätigung vorzulegen, die belegt, dass die Emittentin<br />

zu dieser Kündigung berechtigt ist, und der eine<br />

Faktendarstellung beigefügt ist, aus der hervorgeht,<br />

dass die Voraussetzungen zur Ausübung des<br />

Kündigungsrechts der Emittentin vorliegen. Ferner hat<br />

die Emittentin eine Stellungnahme unabhängiger<br />

Rechtsberater anerkannter Reputation als Nachweis<br />

vorzulegen, dass die Emittentin infolge einer solchen<br />

Änderung oder Ergänzung zur Zahlung zusätzlicher<br />

Beträge verpflichtet ist oder wird.<br />

(3) Eine solche Kündigung erfolgt durch Bekanntmachung<br />

gemäß § 10.<br />

(2) The Notes may be redeemed at the option of the<br />

Issuer in whole, but not in part, on any Interest Payment<br />

Date, on giving not less than 30 nor more than 60 days’<br />

notice to the Noteholders (which notice shall be<br />

irrevocable), at their principal amount, if (i) the Issuer<br />

has or will become obliged to pay additional amounts as<br />

provided or referred to in sub-paragraph (1) above as a<br />

result of any change in, or amendment to, the laws or<br />

regulations of the Republic of Austria or any political<br />

subdivision or any authority thereof or therein having<br />

power to tax, or any change in the application or official<br />

interpretation of such laws or regulations, which change<br />

or amendment becomes effective on or after 19<br />

February 2003, and (ii) such obligation cannot be<br />

avoided by the Issuer taking reasonable measures<br />

available to it, provided that no such notice of<br />

redemption shall be given earlier than 90 days prior to<br />

the earliest date on which the Issuer would be obliged to<br />

pay such additional amounts were a payment in respect<br />

of the Notes then due. Prior to the publication of any<br />

notice of redemption pursuant to this sub-paragraph, the<br />

Issuer shall deliver to the Paying Agent a certificate<br />

signed by two Directors of the Issuer stating that the<br />

Issuer is entitled to effect such redemption and setting<br />

forth a statement of facts showing that the conditions<br />

precedent to the right of the Issuer so to redeem have<br />

occurred, and an opinion of independent legal advisers<br />

of recognised standing to the effect that the Issuer has<br />

or will become obliged to pay such additional amounts<br />

as a result of such change or amendment.<br />

(3) Any such notice of redemption shall be given by<br />

publication in accordance with § 10.<br />

§ 6<br />

Vorlegungsfrist<br />

Die Vorlegungsfrist gemäß § 801 Absatz (1) Satz 1 BGB<br />

für fällige Teilschuldverschreibungen wird auf 10 Jahre<br />

abgekürzt. Die Vorlegung der Teilschuldverschreibungen<br />

erfolgt durch Übertragung der jeweiligen Miteigentumsanteile<br />

an der Global-Schuldverschreibung auf das<br />

Konto der Zahlstelle beim Verwahrer.<br />

§ 6<br />

Presentation Period<br />

The period for presentation of Notes due (§ 801 subparagraph<br />

(1) sentence 1 BGB (German Civil Code))<br />

shall be reduced to 10 years. The Notes shall be<br />

presented by transfer of the co-ownership participations<br />

in the Global Bearer Note to the account of the Paying<br />

Agent with the Depositary.<br />

§ 7<br />

Status / Negativverpflichtung<br />

(1) Die Verpflichtungen aus den Teilschuldverschreibungen<br />

stellen (vorbehaltlich nachstehendem Absatz<br />

(2)) jederzeit untereinander gleichberechtigte und nicht<br />

dinglich besicherte Verpflichtungen der Emittentin dar.<br />

Die Zahlungsverpflichtungen der Emittentin aus den<br />

Teilschuldverschreibungen stehen, abgesehen von etwa<br />

gesetzlich bedingten Ausnahmen und von nachstehendem<br />

Absatz (2), jederzeit mindestens im gleichen<br />

Rang mit allen anderen gegenwärtigen oder künftigen<br />

nicht dinglich besicherten und nicht nachrangigen<br />

Verbindlichkeiten der Emittentin, einschließlich der<br />

Verbindlichkeiten aus Einlagen.<br />

§ 7<br />

Status / Negative Pledge<br />

(1) The Notes constitute (subject to sub-paragraph (2)<br />

below) unsecured obligations of the Issuer and shall at<br />

all times rank pari passu and without any preference<br />

among themselves. The payment obligations of the<br />

Issuer under the Notes shall, save for such exceptions<br />

as may be provided by applicable legislation and subject<br />

to sub-paragraph (2) below, at all times rank at least<br />

equally with all its other present and future unsecured<br />

and unsubordinated obligations including liabilities in<br />

respect of deposits.<br />

10

(2) Solange irgendwelche Teilschuldverschreibungen<br />

ausstehen, wird die Emittentin keine Grund- oder<br />

Mobiliarpfandrechte noch sonstige dingliche<br />

Belastungen oder Sicherungsrechte („Sicherheiten“) an<br />

ihrem gegenwärtigen oder künftigen Betrieb, Vermögen<br />

oder ihren Einnahmen, weder insgesamt noch teilweise,<br />

zur Besicherung von Relevanten Verbindlichkeiten (wie<br />

nachstehend definiert) noch für Garantien oder Bürgschaften<br />

in Bezug auf jedwede Relevanten Verbindlichkeiten<br />

bestellen oder deren Fortbestehen gestatten,<br />

ohne gleichzeitig oder vorher die Verbindlichkeiten der<br />

Emittentin aus den Teilschuldverschreibungen im<br />

gleichen Rang anteilig zu im wesentlichen gleichen<br />

Bedingungen zu besichern. Im Sinne dieser Anleihebedingungen<br />

bedeutet „ausstehen“, im Zusammenhang<br />

mit dieser Anleihe, alle begebenen Teilschuldverschreibungen,<br />

ausgenommen diejenigen, (a) die gemäß<br />

den Anleihebedingungen zurückgezahlt wurden, (b) für<br />

die der Rückzahlungstag erreicht wurde und für welche<br />

die Rückzahlungsmittel (einschließlich sämtlicher bis<br />

zum Rückzahlungstag darauf aufgelaufener Zinsansprüche<br />

sowie sämtlicher gemäß den Anleihebedingungen<br />

zahlbarer Zinsbeträge nach diesem Tag) gemäß<br />

diesen Anleihebedingungen an die Zahlstelle transferiert<br />

wurden, (c) auf welche die Ansprüche verfallen sind, (d)<br />

die gemäß diesen Anleihebedingungen zurückgekauft<br />

und entwertet wurden und (e) die Vorläufige Global-<br />

Schuldverschreibung, sofern diese bedingungsgemäß<br />

gegen die Dauer-Global-Schuldverschreibung ausgetauscht<br />

wurde.<br />

(3) Im Sinne dieser Anleihebedingungen bedeutet<br />

„Relevante Verbindlichkeiten“ jede gegenwärtige oder<br />

künftige Verbindlichkeit, und zwar (i) in Form von oder<br />

verkörpert durch Schuldverschreibungen oder andere<br />

Wertpapiere, die derzeit an einer Wertpapierbörse,<br />

einem Freiverkehrs- oder sonstigen Wertpapiermarkt<br />

notiert werden, zugelassen sind oder gehandelt werden<br />

oder dafür geeignet sind, oder (ii) in Form von Darlehen,<br />

jedoch mit Ausnahme aller Darlehen der Europäischen<br />

Investitionsbank.<br />

(2) So long as any Note remains outstanding the Issuer<br />

will not create or permit to subsist any mortgage, charge,<br />

pledge, lien or other form of encumbrance or security<br />

interest (“Security”) upon the whole or any part of its<br />

undertaking, assets or revenues present or future to<br />

secure any Relevant Debt (as defined below), or any<br />

guarantee of or indemnity in respect of any Relevant<br />

Debt unless, at the same time or prior thereto, the<br />

Issuer’s obligations under the Notes are secured equally<br />

and rateably therewith in substantially identical terms<br />

thereto. For the purposes of the Terms and Conditions of<br />

the Notes “outstanding” means, in relation to the Notes,<br />

all the Notes issued except (a) those which have been<br />

redeemed in accordance with the Terms and Conditions<br />

of the Notes, (b) those in respect of which the date for<br />

redemption has occurred and the redemption moneys<br />

(including all interest accrued on such Notes to the date<br />

for such redemption and any interest payable under the<br />

Terms and Conditions of the Notes after such date) have<br />

been duly paid to the Paying Agent as provided in these<br />

Terms and Conditions of the Notes, (c) those in respect<br />

of which claims have become void, (d) those which have<br />

been purchased and cancelled as provided in these<br />

Terms and Conditions of the Notes, and (e) the<br />

Temporary Global Note to the extent that it shall have<br />

been exchanged for the Permanent Global Note<br />

pursuant to its provisions.<br />

(3) For the purposes of these Terms and Conditions,<br />

“Relevant Debt” means any present or future<br />

indebtedness (i) in the form of, or represented by, bonds,<br />

notes, debentures, loan stock or other securities which<br />

are for the time being, or are capable of being, quoted,<br />

listed or ordinarily dealt in on any stock exchange, overthe-counter<br />

or other securities market, or (ii) in the form<br />

of loans, other than any loans from the European<br />

Investment Bank.<br />

§ 8<br />

Kündigung durch die Anleihegläubiger<br />

(1) Jeder Anleihegläubiger ist berechtigt, seine<br />

Teilschuldverschreibungen zu kündigen und deren<br />

sofortige Rückzahlung zum Nennbetrag zuzüglich<br />

aufgelaufener Zinsen zu verlangen, falls eines der<br />

folgenden Ereignisse eintritt und fortdauert:<br />

(a) die Emittentin ist mit der Zahlung von Kapital<br />

und/oder Zinsen auf die Teilschuldverschreibungen<br />

in Verzug, und dieses Versäumnis erstreckt sich auf<br />

einen Zeitraum von mehr als 15 Tagen nach dem<br />

betreffenden Fälligkeitstag, oder<br />

(b) die Emittentin versäumt es, einer oder mehreren<br />

anderen Verpflichtungen unter den Teilschuldverschreibungen<br />

nachzukommen oder diese zu<br />

erfüllen, und diesem Verzug kann nicht Abhilfe<br />

geschaffen werden oder, falls Abhilfe geschaffen<br />

wird, erfolgt diese nicht innerhalb von 45 Tagen nach<br />

einer Benachrichtigung durch den Anleihegläubiger<br />

an die Emittentin, oder<br />

§ 8<br />

Events of Default<br />

(1) Each Noteholder shall be entitled to declare his<br />

Notes due and demand immediate redemption thereof at<br />

their principal amount plus accrued interest, if any of the<br />

following events occurs and is continuing:<br />

(a) the Issuer fails to pay any principal of and/or<br />

interest on the Notes when due and such failure<br />

continues for a period of more than 15 days or<br />

(b) the Issuer does not perform or comply with any<br />

one or more of its other obligations under the Notes<br />

which default is incapable of remedy or, if capable of<br />

remedy, is not remedied within 45 days after notice<br />

of such default shall have been given to the Issuer by<br />

any Noteholder or<br />

11

(c) (i) eine andere gegenwärtige oder künftige<br />

Verbindlichkeit der Emittentin oder einer ihrer<br />

Tochtergesellschaften (wie nachstehend<br />

definiert) aus oder in Zusammenhang mit<br />

Geldaufnahmen wird vor ihrem vereinbarten<br />

Endfälligkeitstermin aufgrund jedweden tatsächlichen<br />

oder potentiellen Verzugs, Kündigungsgrund<br />

oder dergleichen (wie auch immer<br />

beschrieben) vorzeitig fällig (oder kann für fällig<br />

erklärt werden), oder<br />

(ii) eine solche Verbindlichkeit wird bei Fälligkeit<br />

oder innerhalb einer etwa vereinbarten Nachfrist<br />

nicht bezahlt, oder<br />

(iii) die Emittentin oder eine ihrer Tochtergesellschaften<br />

ist mit der Zahlung aufgrund einer<br />

gegenwärtigen oder künftigen Garantie oder<br />

Bürgschaft, die für Verbindlichkeiten aus Geldaufnahmen<br />

Dritter gegeben wurde, in Verzug,<br />

vorausgesetzt, dass der Gesamtbetrag der<br />

betreffenden Verpflichtungen, Garantien und<br />

Bürgschaften, in Bezug auf die einer oder<br />

mehrere der in diesem Absatz (c) aufgeführten<br />

Tatbestände eingetreten sind, über dem Betrag<br />

von EUR 15.000.000,-- oder dessen Gegenwert<br />

liegt, oder<br />

(d) eine Beschlagnahme, Pfändung, Zwangsvollstreckung<br />

oder andere Rechtsverfahren werden auf<br />

oder gegen jedwede Teile an Eigentum, Vermögen<br />

und Erlösen der Emittentin oder einer ihrer<br />

Tochtergesellschaften durchgesetzt, vollzogen oder<br />

eingeklagt, oder<br />

(e) die Emittentin oder eine ihrer Tochtergesellschaften<br />

ist insolvent oder in Konkurs gegangen<br />

(oder wird oder könnte gesetzlich oder gerichtlich so<br />

betrachtet werden) oder kann ihre Zahlungspflichten<br />

aus Verbindlichkeiten nicht erfüllen oder stellt ihre<br />

Zahlungen auf alle oder einen wesentlichen Teil<br />

(oder eine bestimmte Art) ihrer Verbindlichkeiten ein<br />

oder droht dies an oder bietet eine allgemeine<br />

Abtretung oder eine Vereinbarung oder einen<br />

Vergleich bezüglich aller solcher Verbindlichkeiten<br />

an oder führt eine(n) solche(n) durch oder vereinbart<br />

oder erklärt ein Moratorium bezüglich aller oder<br />

jedweder Teile (oder einer bestimmten Art) von<br />

Verbindlichkeiten der Emittentin oder einer ihrer<br />

Tochtergesellschaften, oder<br />

(f) die Liquidation oder Auflösung der Emittentin wird<br />

verfügt oder beschlossen, oder ein zuständiges<br />

Gericht oder eine zuständige Verwaltungsbehörde<br />

verfügt oder die Emittentin beschließt den Antrag auf<br />

gerichtliche Bestellung eines amtlichen Aufsehers<br />

zur Überwachung der Geschäftsleitung der<br />

Emittentin mit bindender Kraft und der Wirkung eines<br />

zeitweiligen Moratoriums (Geschäftsaufsicht) für die<br />

Emittentin oder einen wesentlichen Teil ihres<br />

Vermögens oder eine ihrer Tochtergesellschaften;<br />

oder die Emittentin stellt alle oder einen wesentlichen<br />

Teil ihrer Geschäftstätigkeiten ein oder droht dies an,<br />

mit Ausnahme der Tätigkeiten im Sinne und zur<br />

Durchführung ihrer Sanierung, Reorganisation,<br />

Verschmelzung oder Konsolidierung oder einer<br />

anderen Form des Zusammenschlusses mit einer<br />

anderen Gesellschaft, sofern diese andere<br />

(c) (i) any other present or future indebtedness of<br />

the Issuer or any of its Subsidiaries (as defined<br />

below) for or in respect of moneys borrowed or<br />

raised becomes (or becomes capable of being<br />

declared) due and payable prior to its stated<br />

maturity by reason of any actual or potential<br />

default, event of default or the like (howsoever<br />

described), or<br />

(ii) any such indebtedness is not paid when due<br />

or, as the case may be, within any applicable<br />

grace period, or<br />

(iii) the Issuer or any of its Subsidiaries fails to<br />

pay when due any amount payable by it under<br />

any present or future guarantee for, or indemnity<br />

in respect of, any moneys borrowed or raised by<br />

others, provided that the aggregate amount of the<br />

relevant indebtedness, guarantees and<br />

indemnities in respect of which one or more of<br />

the events mentioned above in this subparagraph<br />

(c) have occurred exceeds EUR<br />

15,000,000 or its equivalent or<br />

(d) a distress, attachment, execution or other legal<br />

process is levied, enforced or sued out on or against<br />

any part of the property, assets or revenues of the<br />

Issuer or any of its Subsidiaries or<br />

(e) the Issuer or any of its Subsidiaries is (or is, or<br />

could be, deemed by law or a court to be) insolvent<br />

or bankrupt or unable to pay its debts, stops,<br />

suspends or threatens to stop or suspend payment<br />

of all or a material part of (or of a particular type of)<br />

its debts, proposes or makes a general assignment<br />

or an arrangement or composition with or for the<br />

benefit of the relevant creditors in respect of any of<br />

such debts or a moratorium is agreed or declared in<br />

respect of or affecting all or any part of (or of a<br />

particular type of) the debts of the Issuer or any of its<br />

Subsidiaries or<br />

(f) an order is made or an effective resolution<br />

passed for the winding-up or dissolution of the Issuer<br />

or any order is made by any competent court or<br />

administrative agency for, or any resolution being<br />

passed by the Issuer to apply for, the judicial<br />

appointment of the Official Controller to supervise the<br />

management of the Issuer with binding authority with<br />

the effect of a temporary moratorium<br />

(Geschäftsaufsicht) in relation to the Issuer or a<br />

substantial part of its assets, or any of its<br />

Subsidiaries, or the Issuer ceases or threatens to<br />

cease to carry on all or a material part of its business<br />

or operations, except for the purpose of and followed<br />

by a reconstruction, reorganisation, merger or<br />

consolidation or other form of amalgamation with<br />

another company, provided such company assumes<br />

all obligations entered into by the Issuer in<br />

12

Gesellschaft alle Verpflichtungen übernimmt, welche<br />

die Emittentin im Zusammenhang mit dieser Anleihe<br />

eingegangen ist, oder im Falle einer Tochtergesellschaft,<br />

wodurch der Betrieb und das Vermögen<br />

der Tochtergesellschaft auf die Emittentin oder eine<br />

andere Tochtergesellschaft übertragen oder auf<br />

andere Weise eingebracht werden.<br />

In diesen Anleihebedingungen wird eine Gesellschaft<br />

als „Tochtergesellschaft“ bezeichnet, sofern die<br />

Emittentin<br />

(i) an ihr eine Stimmrechtsmehrheit hält, oder<br />

(ii) an ihr kapitalbeteiligt und zur Bestellung oder<br />

Abberufung der Mehrheit der Mitglieder ihres<br />

Vorstandes berechtigt ist, oder<br />

(iii) an ihr kapitalbeteiligt ist und gemäß vertraglicher<br />

Regelung mit anderen Aktionären oder<br />

Kapitalbeteiligten die Stimmrechtsmehrheit an ihr<br />

allein kontrolliert, oder falls es sich dabei um eine<br />

Gesellschaft im Mehrheitsbesitz eines Unternehmens<br />

handelt, das selbst eine Tochtergesellschaft<br />

der Emittentin ist.<br />

Das Recht, die Teilschuldverschreibungen zur Rückzahlung<br />

zu kündigen, erlischt, falls der Kündigungsgrund<br />

vor Ausübung dieses Rechts geheilt wurde.<br />

(2) Die Kündigung von Teilschuldverschreibungen hat in<br />

der Weise zu erfolgen, dass der Anleihegläubiger der<br />

Emittentin eine schriftliche Kündigungserklärung übergibt<br />

oder durch eingeschriebenen Brief sendet, die einen<br />

die Emittentin zufriedenstellenden Eigentumsnachweis<br />

enthält und in welcher der Nennbetrag der fällig<br />

gestellten Teilschuldverschreibungen und der Kündigungsgrund<br />

anzugeben sind. Eine solche Kündigung<br />

wird mit Zugang der Kündigungserklärung bei der<br />

Emittentin wirksam.<br />

connection with these Notes, or in the case of a<br />

Subsidiary, whereby the undertaking and assets of<br />

the Subsidiary are transferred to or otherwise vested<br />

in the Issuer or another of its Subsidiaries.<br />

In these Terms and Conditions of the Notes, a<br />

company is a “Subsidiary”, if the Issuer<br />

(i) holds a majority of the voting rights in it, or<br />

(ii) is a member of it and has the right to appoint<br />

or remove a majority of its board of directors, or<br />

(iii) is a member of it and controls alone, pursuant<br />

to an agreement with other shareholders or<br />

members, a majority of the voting rights in it, or if<br />

it is a subsidiary of a company which is itself a<br />

Subsidiary of the Issuer.<br />

The right to declare Notes due shall terminate if the<br />

situation giving rise to it has been cured before such<br />

right is exercised.<br />

(2) Any notice declaring Notes due shall be made by<br />

means of a written declaration delivered by hand or<br />

registered mail to the Issuer, giving a proof of ownership<br />

satisfactory to the Issuer and stating the principal<br />

amount of Notes declared due and stating the event of<br />

default. Any such notice declaring Notes due shall<br />

become effective upon receipt of such notice by the<br />

Issuer.<br />

§ 9<br />

Schuldnerwechsel<br />

(1) Die Emittentin ist jederzeit berechtigt, ohne Zustimmung<br />

der Anleihegläubiger eine andere Gesellschaft<br />

(„Neue Emittentin“), deren Anteile die Emittentin direkt<br />

oder indirekt zu mehr als 90 % hält, zu jeder Zeit bis zur<br />

vollständigen Zahlung aller Verbindlichkeiten aus den<br />

Teilschuldverschreibungen, als Hauptschuldnerin für alle<br />

Verpflichtungen aus und im Zusammenhang mit diesen<br />

Teilschuldverschreibungen an die Stelle der Emittentin<br />

zu setzen. Voraussetzung dafür ist, dass:<br />

(a) die Neue Emittentin rechtlich in der Lage ist,<br />

sämtliche sich aus und im Zusammenhang mit<br />

diesen Teilschuldverschreibungen ergebenden Verpflichtungen<br />

zu erfüllen und insbesondere die hierzu<br />

erforderlichen Beträge ohne Beschränkungen in<br />

Euro an die Zahlstelle zu transferieren und<br />

(b) die Neue Emittentin alle etwa notwendigen<br />

Genehmigungen der Behörden des Landes, in dem<br />

sie ihren Sitz hat, erhalten hat und<br />

§ 9<br />

Substitution of the Issuer<br />

(1) The Issuer shall be entitled at any time without the<br />

consent of the Noteholders to substitute in place of the<br />

Issuer another company (“New Issuer”), at least 90 % of<br />

the shares of which are directly or indirectly held by the<br />

Issuer, as principal debtor for all obligations under and in<br />

connection with the Issue, provided that<br />

(a) the New Issuer can perform all obligations under<br />

and in connection with this Issue and, in particular, is<br />

able to transfer to the Paying Agent all amounts<br />

necessary therefore without restrictions in Euro, and<br />

(b) the New Issuer has been granted all necessary<br />

consents from the authorities of the country in which<br />

it has its seat, and<br />

13

(c) die Neue Emittentin in geeigneter Form nachweist,<br />

dass sie alle Beträge, die zur Erfüllung der<br />

Zahlungsverpflichtungen aus oder in Zusammenhang<br />

mit diesen Teilschuldverschreibungen erforderlich<br />

sind, ohne die Notwendigkeit einer Einbehaltung<br />

von irgendwelchen Steuern oder Abgaben an der<br />

Quelle an die Zahlstelle transferieren darf und<br />

(d) die Emittentin (für diesen Fall auch „Garantin“<br />

genannt) unbedingt und unwiderruflich die Verpflichtungen<br />

der Neuen Emittentin aus diesen<br />

Anleihebedingungen gegenüber den Anleihegläubigern<br />

garantiert und folglich zur Zahlung<br />

anstelle der Neuen Emittentin auf erstes Anfordern<br />

verpflichtet ist.<br />

(2) Ein solcher Schuldnerwechsel ist gemäß § 10 zu<br />

veröffentlichen.<br />

(3) Im Falle eines solchen Schuldnerwechsels gilt (i)<br />

jede Nennung der Emittentin in diesen Anleihebedingungen<br />

als auf die Neue Emittentin bezogen und<br />

(ii) soll das Recht der Anleihegläubiger, entsprechend<br />

§ 8 ihre Teilschuldverschreibungen zur sofortigen Rückzahlung<br />

zum Nennbetrag zuzüglich aufgelaufener<br />

Zinsen zu kündigen, auch gegeben sein, wenn eines der<br />

in § 8 Absatz (1)(c) bis (f) genannten Ereignisse in<br />

bezug auf die Garantin eintritt.<br />

(c) the New Issuer establishes in a suitable manner<br />

that it is permitted to transfer to the Paying Agent all<br />

amounts necessary for the performance of the<br />

payment obligations under or in connection with this<br />

Issue without having to withhold any taxes or<br />

governmental charges at source, and<br />

(d) the Issuer (in such case also referred to as<br />

“Guarantor”) irrevocably and unconditionally<br />

guarantees such obligations of the New Issuer under<br />

these Terms and Conditions of the Notes.<br />

(2) Such a debtor substitution shall be published in<br />

accordance with § 10.<br />

(3) In the event of such a debtor substitution, (i) every<br />

reference in these Terms and Conditions of the Notes to<br />

the Issuer shall be deemed to refer to the New Issuer,<br />

and (ii) the right of the Noteholders pursuant to § 8 to<br />

declare their Notes due for immediate redemption of the<br />

nominal amount plus accrued interest shall also apply if<br />

any of the events referred to in § 8 sub-paragraph (1) (c)<br />

through (f) occurs in relation to the Guarantor.<br />

§ 10<br />

Bekanntmachungen<br />

Alle die Teilschuldverschreibungen betreffenden<br />

Bekanntmachungen sind in einem überregionalen<br />

Pflichtblatt der Wertpapierbörsen, an denen die<br />

Teilschuldverschreibungen in die Preisfeststellung des<br />

Geregelten Marktes einbezogen sind, zu veröffentlichen.<br />

§ 10<br />

Notices<br />

All notices concerning the Notes shall be published in<br />

one of the national mandatory newspapers of each<br />

Stock Exchange on which the Notes are listed for trading<br />

in the Regulated Market (Geregelter Markt).<br />

§ 11<br />

Begebung weiterer Schuldverschreibungen<br />

Die Emittentin behält sich vor, von Zeit zu Zeit ohne<br />

Zustimmung der Anleihegläubiger weitere Schuldverschreibungen<br />

mit gleicher Ausstattung (oder mit<br />

gleicher Ausstattung, abgesehen vom Valutierungstag<br />

und/oder Ausgabepreis) in der Weise zu begeben, dass<br />

sie mit den Teilschuldverschreibungen zusammengefasst<br />

werden, eine einheitliche Anleihe mit ihnen<br />

bilden und ihren Gesamtnennbetrag erhöhen. Der<br />

Begriff „Teilschuldverschreibungen“ umfasst im Falle<br />

einer solchen Erhöhung auch solche zusätzlich<br />

begebenen Schuldverschreibungen.<br />

§ 11<br />

Issuance of Additional Notes<br />

The Issuer reserves the right to issue from time to time<br />

without the consent of the Noteholders additional Notes<br />

with identical terms in all respects (or in all respects<br />