DOCUMENTATION PATRIMONIAL - Fiscus.fgov.be

DOCUMENTATION PATRIMONIAL - Fiscus.fgov.be

DOCUMENTATION PATRIMONIAL - Fiscus.fgov.be

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

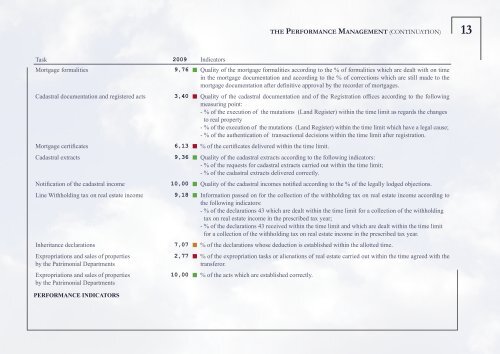

The performance Management (continuation)<br />

13<br />

Task 2009 Indicators<br />

Mortgage formalities<br />

Cadastral documentation and registered acts<br />

Mortgage certificates<br />

Cadastral extracts<br />

Notification of the cadastral income<br />

Line Withholding tax on real estate income<br />

Inheritance declarations<br />

Expropriations and sales of properties<br />

by the Patrimonial Departments<br />

Expropriations and sales of properties<br />

by the Patrimonial Departments<br />

performance indicators<br />

9,76 ■ Quality of the mortgage formalities according to the % of formalities which are dealt with on time<br />

in the mortgage documentation and according to the % of corrections which are still made to the<br />

mortgage documentation after definitive approval by the recorder of mortgages.<br />

3,40 ■ Quality of the cadastral documentation and of the Registration offices according to the following<br />

measuring point:<br />

- % of the execution of the mutations (Land Register) within the time limit as regards the changes<br />

to real property<br />

- % of the execution of the mutations (Land Register) within the time limit which have a legal cause;<br />

- % of the authentication of transactional decisions within the time limit after registration.<br />

6,13 ■ % of the certificates delivered within the time limit.<br />

9,36 ■ Quality of the cadastral extracts according to the following indicators:<br />

- % of the requests for cadastral extracts carried out within the time limit;<br />

- % of the cadastral extracts delivered correctly.<br />

10,00 ■ Quality of the cadastral incomes notified according to the % of the legally lodged objections.<br />

9,18 ■ Information passed on for the collection of the withholding tax on real estate income according to<br />

the following indicators:<br />

- % of the declarations 43 which are dealt within the time limit for a collection of the withholding<br />

tax on real estate income in the prescri<strong>be</strong>d tax year;<br />

- % of the declarations 43 received within the time limit and which are dealt within the time limit<br />

for a collection of the withholding tax on real estate income in the prescri<strong>be</strong>d tax year.<br />

7,07 ■ % of the declarations whose deduction is established within the allotted time.<br />

2,77 ■ % of the expropriation tasks or alienations of real estate carried out within the time agreed with the<br />

transferor.<br />

10,00 ■ % of the acts which are established correctly.