OES Annual Report 2012 - Ocean Energy Systems

OES Annual Report 2012 - Ocean Energy Systems

OES Annual Report 2012 - Ocean Energy Systems

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

111<br />

05 / DEVELOPMENT OF THE INTERNATIONAL<br />

OCEAN ENERGY INDUSTRY: PERFORMANCE<br />

IMPROVEMENTS AND COST REDUCTIONS<br />

The cumulative effects of moving to larger-scale farms reduce the CoE by approximately 50 percent, without<br />

considering any technology innovations, as illustrated in Table 2. CoE in this case was calculated using a<br />

fixed charge rate (FCR) of 12.4 percent and a project life of 20 years. This is typical for commercial, mature,<br />

utility-scale power projects in the United States. The power-density at the reference deployment location to<br />

compute device performance is 34 kW/m.<br />

PLANT CAPACITY<br />

5 MW 20 MW 50 MW<br />

CAPEX $6,912 $5,035 $4,347<br />

OPEX $438 $239 $162<br />

O&M percent of CAPEX 6.3% 4.7% 3.7%<br />

PERFORMANCE 5 MW 20 MW 50 MW<br />

Capacity factor 30% 30% 30%<br />

Availability 95% 95% 95%<br />

COE (¢/KWH) 5 MW 20 MW 50 MW<br />

CAPEX Contribution 30 22 19<br />

O&M Contribution 22 12 8<br />

Total 52 34 27<br />

TABLE 2: Reference cost and<br />

economic profile from aggregated data<br />

and techno-economic modeling<br />

It is important to point out that the CoE in this study was computed using a utility generator CoE model, with<br />

returns on capital seen typically in utility-scale power plants, hence the study does not consider the impact<br />

on higher capital borrowing costs that are typical for immature technologies. In reality, there would be a risk<br />

premium paid by the developer at smaller-scale plants.<br />

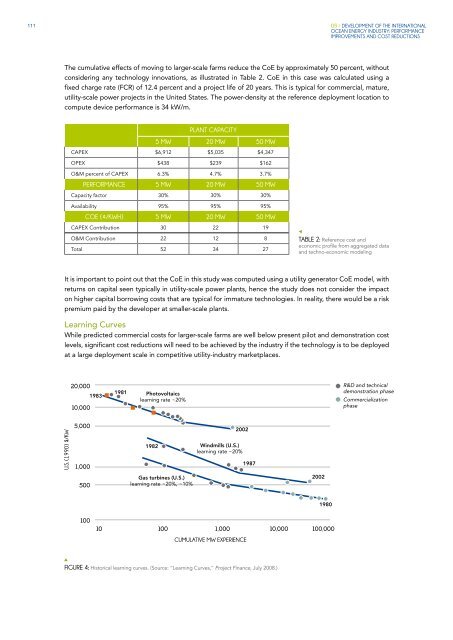

Learning Curves<br />

While predicted commercial costs for larger-scale farms are well below present pilot and demonstration cost<br />

levels, significant cost reductions will need to be achieved by the industry if the technology is to be deployed<br />

at a large deployment scale in competitive utility-industry marketplaces.<br />

20,000<br />

1983<br />

10,000<br />

1981<br />

Photovoltaics<br />

learning rate ~20%<br />

R&D and technical<br />

demonstration phase<br />

Commercialization<br />

phase<br />

U.S. (1990) $/KW<br />

5,000<br />

1,000<br />

1982<br />

2002<br />

Windmills (U.S.)<br />

learning rate ~20%<br />

1987<br />

500<br />

Gas turbines (U.S.)<br />

learning rate ~20%, ~10%<br />

2002<br />

1980<br />

100<br />

10 100<br />

1,000<br />

10,000 100,000<br />

CUMULATIVE MW EXPERIENCE<br />

FIGURE 4: Historical learning curves. (Source: “Learning Curves,” Project Finance, July 2008.)