Twice a Year Scientific Journal

Twice a Year Scientific Journal

Twice a Year Scientific Journal

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

124<br />

Economic Analysis (2010, Vol. 43, No. 1-2, 117-125)<br />

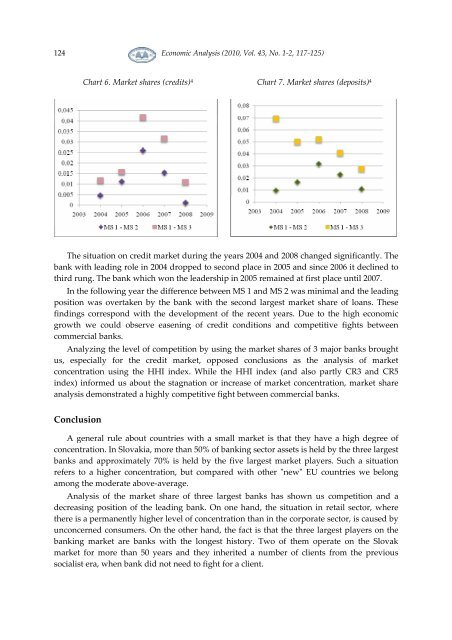

Chart 6. Market shares (credits) 4 Chart 7. Market shares (deposits) 4<br />

The situation on credit market during the years 2004 and 2008 changed significantly. The<br />

bank with leading role in 2004 dropped to second place in 2005 and since 2006 it declined to<br />

third rung. The bank which won the leadership in 2005 remained at first place until 2007.<br />

In the following year the difference between MS 1 and MS 2 was minimal and the leading<br />

position was overtaken by the bank with the second largest market share of loans. These<br />

findings correspond with the development of the recent years. Due to the high economic<br />

growth we could observe easening of credit conditions and competitive fights between<br />

commercial banks.<br />

Analyzing the level of competition by using the market shares of 3 major banks brought<br />

us, especially for the credit market, opposed conclusions as the analysis of market<br />

concentration using the HHI index. While the HHI index (and also partly CR3 and CR5<br />

index) informed us about the stagnation or increase of market concentration, market share<br />

analysis demonstrated a highly competitive fight between commercial banks.<br />

Conclusion<br />

A general rule about countries with a small market is that they have a high degree of<br />

concentration. In Slovakia, more than 50% of banking sector assets is held by the three largest<br />

banks and approximately 70% is held by the five largest market players. Such a situation<br />

refers to a higher concentration, but compared with other ʺnewʺ EU countries we belong<br />

among the moderate above-average.<br />

Analysis of the market share of three largest banks has shown us competition and a<br />

decreasing position of the leading bank. On one hand, the situation in retail sector, where<br />

there is a permanently higher level of concentration than in the corporate sector, is caused by<br />

unconcerned consumers. On the other hand, the fact is that the three largest players on the<br />

banking market are banks with the longest history. Two of them operate on the Slovak<br />

market for more than 50 years and they inherited a number of clients from the previous<br />

socialist era, when bank did not need to fight for a client.