Twice a Year Scientific Journal

Twice a Year Scientific Journal

Twice a Year Scientific Journal

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Kotlebova, J., Future Stance of Currencies in the IMS, EA (2010, Vol. 43, No, 1-2, 61-69) 67<br />

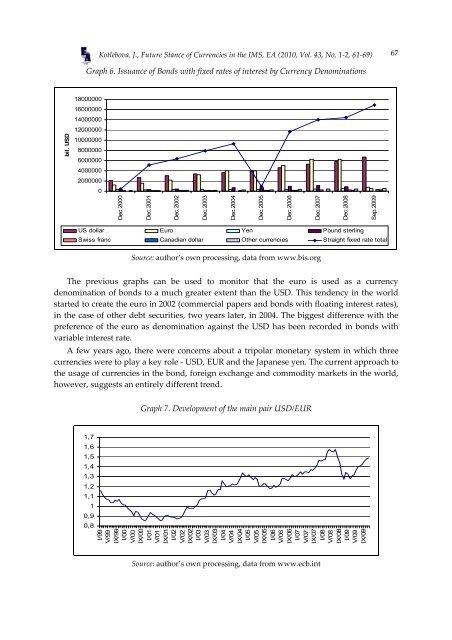

Graph 6. Issuance of Bonds with fixed rates of interest by Currency Denominations<br />

18000000<br />

16000000<br />

14000000<br />

12000000<br />

bil. USD<br />

10000000<br />

8000000<br />

6000000<br />

4000000<br />

2000000<br />

0<br />

Dec.2000<br />

Dec.2001<br />

Dec.2002<br />

Dec.2003<br />

Dec.2004<br />

Dec.2005<br />

Dec.2006<br />

Dec.2007<br />

Dec.2008<br />

Sep.2009<br />

US dollar Euro Yen Pound sterling<br />

Swiss franc Canadian dollar Other currencies Straight fixed rate total<br />

Source: author’s own processing, data from www.bis.org<br />

The previous graphs can be used to monitor that the euro is used as a currency<br />

denomination of bonds to a much greater extent than the USD. This tendency in the world<br />

started to create the euro in 2002 (commercial papers and bonds with floating interest rates),<br />

in the case of other debt securities, two years later, in 2004. The biggest difference with the<br />

preference of the euro as denomination against the USD has been recorded in bonds with<br />

variable interest rate.<br />

A few years ago, there were concerns about a tripolar monetary system in which three<br />

currencies were to play a key role - USD, EUR and the Japanese yen. The current approach to<br />

the usage of currencies in the bond, foreign exchange and commodity markets in the world,<br />

however, suggests an entirely different trend.<br />

Graph 7. Development of the main pair USD/EUR<br />

1,7<br />

1,6<br />

1,5<br />

1,4<br />

1,3<br />

1,2<br />

1,1<br />

1<br />

0,9<br />

0,8<br />

I/99<br />

V/99<br />

IX/99<br />

I/00<br />

V/00<br />

IX/00<br />

I/01<br />

V/01<br />

IX/01<br />

I/02<br />

V/02<br />

IX/02<br />

I/03<br />

V/03<br />

IX/03<br />

I/04<br />

V/04<br />

IX/04<br />

I/05<br />

V/05<br />

IX/05<br />

I/06<br />

V/06<br />

IX/06<br />

I/07<br />

V/07<br />

IX/07<br />

I/08<br />

V/08<br />

IX/08<br />

I/09<br />

V/09<br />

IX/09<br />

Source: author’s own processing, data from www.ecb.int