A quantitative approach to carbon price risk modeling - CiteSeerX

A quantitative approach to carbon price risk modeling - CiteSeerX

A quantitative approach to carbon price risk modeling - CiteSeerX

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

350<br />

300<br />

250<br />

40<br />

35<br />

30<br />

25<br />

EUA Intraday<br />

Switch Coal-Gas<br />

Euro/t CO2<br />

200<br />

150<br />

20<br />

15<br />

10<br />

5<br />

01/04 01/05 01/06 01/07 01/08 01/09 01/10<br />

100<br />

50<br />

0<br />

01/05/05 01/07/05 01/09/05 01/11/05 01/01/06 01/03/06<br />

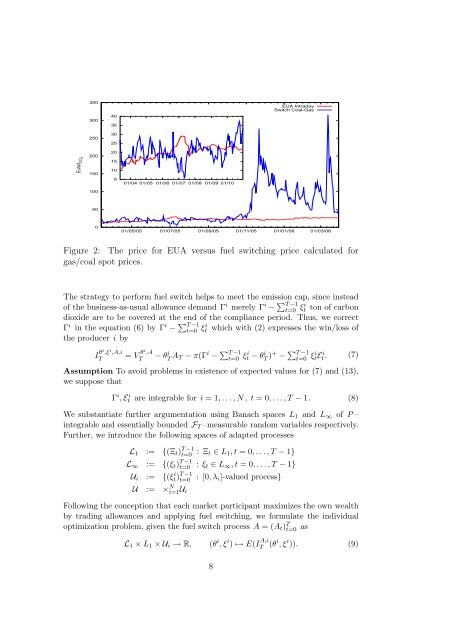

Figure 2: The <strong>price</strong> for EUA versus fuel switching <strong>price</strong> calculated for<br />

gas/coal spot <strong>price</strong>s.<br />

The strategy <strong>to</strong> perform fuel switch helps <strong>to</strong> meet the emission cap, since instead<br />

of the business-as-usual allowance demand Γ i merely Γ i − ∑ T −1<br />

t=0 ξi t <strong>to</strong>n of <strong>carbon</strong><br />

dioxide are <strong>to</strong> be covered at the end of the compliance period. Thus, we correct<br />

Γ i in the equation (6) by Γ i − ∑ T −1<br />

t=0 ξi t which with (2) expresses the win/loss of<br />

the producer i by<br />

I θi ,ξ i ,A,i<br />

T<br />

= V θi ,A<br />

T<br />

− θT i A T − π(Γ i − ∑ T −1<br />

t=0 ξi t − θT i )+ − ∑ T −1<br />

t=0 ξi tEt. i (7)<br />

Assumption To avoid problems in existence of expected values for (7) and (13),<br />

we suppose that<br />

Γ i , E i t are integrable for i = 1, . . . , N , t = 0, . . . , T − 1. (8)<br />

We substantiate further argumentation using Banach spaces L 1 and L ∞ of P –<br />

integrable and essentially bounded F T –measurable random variables respectively.<br />

Further, we introduce the following spaces of adapted processes<br />

L 1 := {(Ξ t ) T t=0 −1 t ∈ L 1 , t = 0, . . . , T − 1}<br />

L ∞ := {(ξ t ) T t=0 −1 t ∈ L ∞ , t = 0, . . . , T − 1}<br />

U i := {(ξt) i T t=0 −1 i]-valued process}<br />

U := × N i=1U i<br />

Following the conception that each market participant maximizes the own wealth<br />

by trading allowances and applying fuel switching, we formulate the individual<br />

optimization problem, given the fuel switch process A = (A t ) T t=0 as<br />

L 1 × L 1 × U i → R,<br />

(θ i , ξ i ) ↦→ E(I A,i<br />

T (θi , ξ i )). (9)<br />

8