Estimation in Financial Models - RiskLab

Estimation in Financial Models - RiskLab

Estimation in Financial Models - RiskLab

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

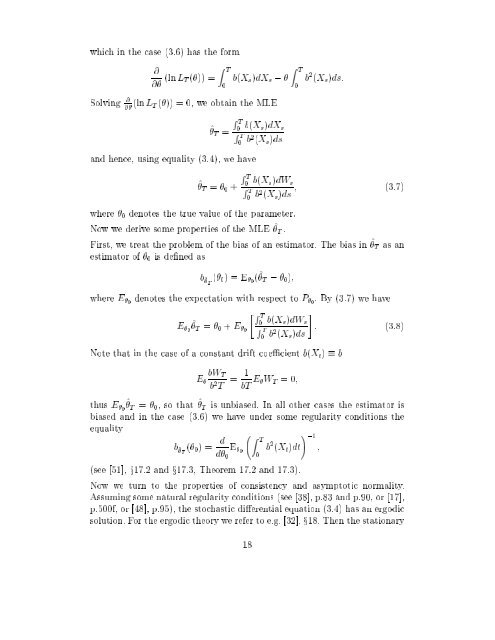

which <strong>in</strong> the case (3.6) has the form<br />

@<br />

@ (ln L T ()) =<br />

Z T<br />

0<br />

b(X s )dX s , <br />

Solv<strong>in</strong>g @ @ (ln L T ()) = 0, we obta<strong>in</strong> the MLE<br />

Z T<br />

0<br />

b 2 (X s )ds:<br />

^ T =<br />

R T<br />

R<br />

0<br />

T<br />

0<br />

b(X s )dX s<br />

b 2 (X s )ds<br />

and hence, us<strong>in</strong>g equality (3.4), we have<br />

^ T = 0 +<br />

where 0 denotes the true value of the parameter.<br />

Now we derive some properties of the MLE ^ T .<br />

R T<br />

0<br />

b(X s )dW R<br />

s<br />

T<br />

0<br />

b 2 (X s )ds ; (3.7)<br />

First, we treat the problem of the bias of an estimator. The bias <strong>in</strong> ^ T as an<br />

estimator of 0 is dened as<br />

b^ T<br />

( 0 )=E 0 (^ T , 0 );<br />

where E 0<br />

denotes the expectation with respect to P 0 . By (3.7) we have<br />

"R T<br />

#<br />

0<br />

b(X s )dW s<br />

E 0<br />

^T = 0 + E 0 : (3.8)<br />

b 2 (X s )ds<br />

R T<br />

0<br />

Note that <strong>in</strong> the case of a constant drift coecient b(X t ) b<br />

E <br />

bW T<br />

b 2 T = 1<br />

bT E W T =0;<br />

thus E 0<br />

^T = 0 , so that ^ T is unbiased. In all other cases the estimator is<br />

biased and <strong>in</strong> the case (3.6) we have under some regularity conditions the<br />

equality<br />

b^ T<br />

( 0 )=<br />

d Z T<br />

,1<br />

E 0 b 2 (X t )dt!<br />

;<br />

d 0 0<br />

(see [51], x17.2 and x17.3, Theorem 17.2 and 17.3).<br />

Now we turn to the properties of consistency and asymptotic normality.<br />

Assum<strong>in</strong>g some natural regularity conditions (see [38], p.83 and p.90, or [17],<br />

p.500f, or [48], p.95), the stochastic dierential equation (3.4) has an ergodic<br />

solution. For the ergodic theory we refer to e.g. [32], x18. Then the stationary<br />

18